The post Coinbase CLO Slams SEC For Its Response To June Filing, Cites Shortcomings appeared first on Coinpedia Fintech News

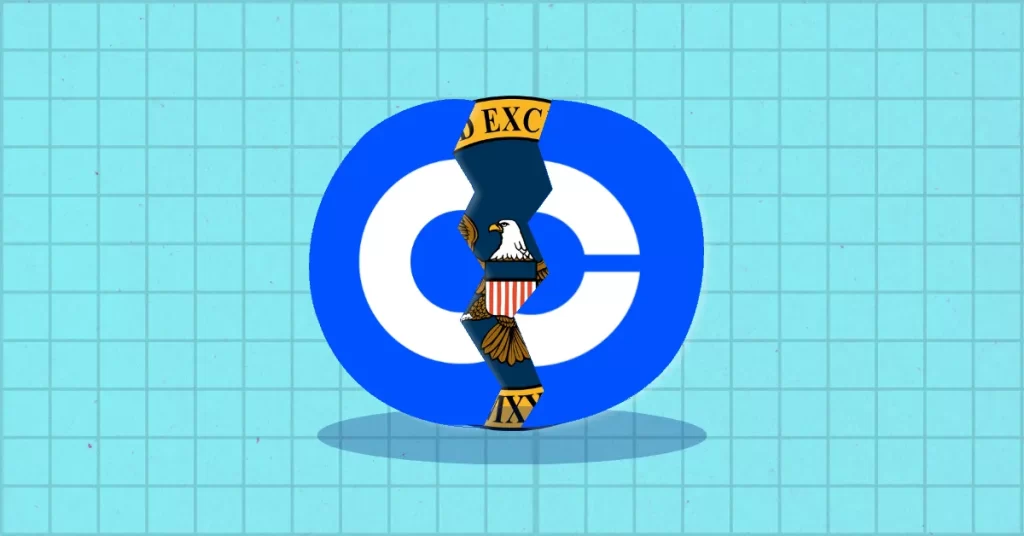

On June 6, the U.S. Securities and Exchange Commission (SEC) filed a lawsuit against Coinbase, accusing the popular cryptocurrency exchange of operating as an unregistered national securities exchange and broker. The SEC further claimed that at least 13 cryptocurrencies offered by Coinbase, including Solana and Cardano’s tokens, should be classified as “crypto asset securities.”

Prior to this lawsuit, Coinbase submitted a filing challenging the SEC’s jurisdictional overreach. The Chief Legal Officer of Coinbase, Paul Grewal, has revealed in a recent tweet that the SEC has provided a response to the filing made by Coinbase in late June.

Coinbase CLO Lashes Out

Grewal voiced his criticism of the regulatory body, highlighting several shortcomings in the SEC’s response. He explained that Coinbase had given the SEC an extension to present reasons for opposing the case after expressing their intention to dismiss it. Unfortunately, Coinbase found the SEC’s response disappointing, as it largely repeated previous arguments without significant changes.

Are Public Interests Being Overlooked?

Paul Grewal pointed out that the SEC overlooked the Supreme Court’s stance on the Howey test, which establishes that an asset must have enforceable rights against the issuer to be classified as an investment contract. Furthermore, Grewal criticized the SEC for failing to consider the public interest in their lawsuit.

According to Coinbase, if the SEC’s allegations were valid, they should not have been allowed to operate for the past two years. Coinbase argues that the agency did not adequately assess the lawsuit’s impact on the public and whether its outcome aligns with the SEC’s commitment to consumer protection standards.

Is SEC Above the Law?

Grewal highlighted that the SEC disregarded statements made by its own Chair during congressional testimony, where it was acknowledged that existing regulatory frameworks did not apply to cryptocurrency exchanges like Coinbase. Additionally, Grewal emphasized that the agency ignored clear warnings from the Supreme Court regarding regulatory overreach in matters that should be determined by Congress.

1 year ago

100

1 year ago

100

English (US) ·

English (US) ·