Bitcoin (BTC) rose nearly 28% in January 2023, hitting its highest level since early November 2022. Crypto Twitter has plausibly whispered that Coinbase traders were the driving force behind the rise of this cryptocurrency. But the Nasdaq-listed exchange is not the only source of upward pressure on Bitcoin.

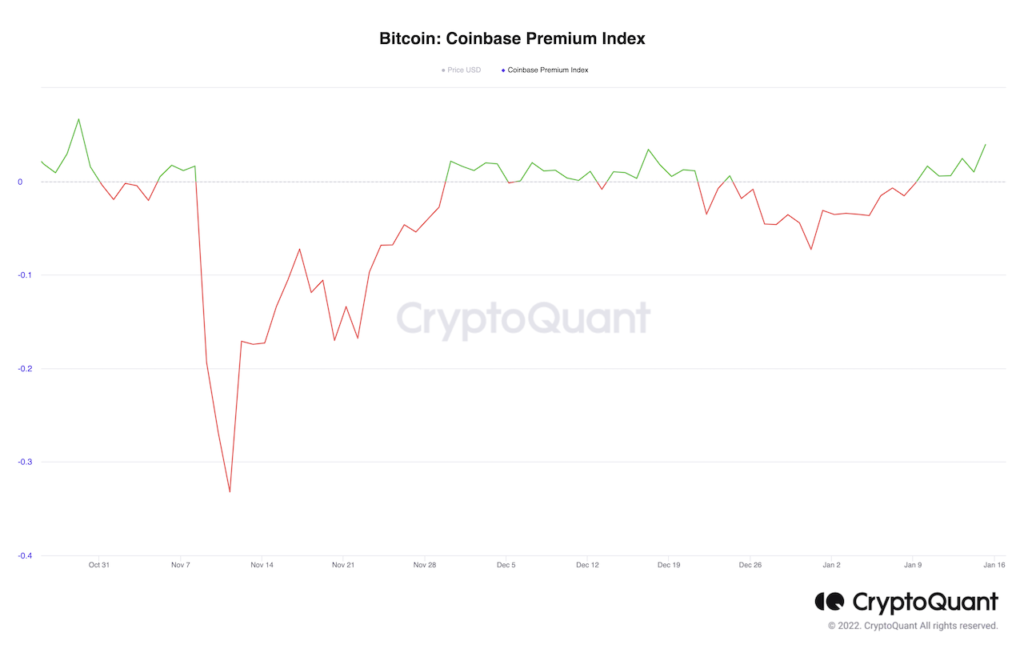

The Coinbase Premium Index, which measures the spread between Coinbase’s BTC/US dollar (USD) pair and Binance’s BTC/Tether (USDT) pair, turned positive last week, according to data from blockchain analytics firm CryptoQuant. It climbed to 0.039 over the weekend, the highest since late October.

In other words, the metric suggests relatively strong buying pressure on Coinbase.

“The price premium between Bitcoin traded on Coinbase and Bitcoin traded on Binance (Coinbase-Binance Premium) remained positive throughout the week, compared to retail investors. It shows that institutional investors are more willing to buy,” André Dragosch, head of Deutsche Digital Assets, wrote in a note to clients.

Bitcoin was trading at a premium on Coinbase compared to Binance. (CryptoQuant)

Bitcoin was trading at a premium on Coinbase compared to Binance. (CryptoQuant)Institutional investors prefer publicly traded Coinbase to offshore entities like Binance, which are viewed as agents for retail investors. Binance is currently taking steps to establish itself as a platform for institutional investors.

However, another measure of net capital inflows into the market, called Cumulative Volume Delta (CVD), is the US dollar, a fiat-backed stablecoin issued by Binance and Paxos, in the perpetual futures market. (BUSD), suggesting that the rally started with a bid for Bitcoin by a Binance-based entity. And then buyers from Coinbase and other exchanges came in later.

If the CVD is rising, it means that there are many buyers, and if it is declining, there are many sellers.

$BTC Spot CVDs

Whole move from 17k to 21k was made by someone on Binance aggressively buying #Bitcoin with BUSD. Other exchanges started to buy around 19.5k with USDT + USD.

Green CVD includes all exchanges with Binance USDT as well, yellow CVD – only BUSD. pic.twitter.com/1VF34JEQPN

— exitpump (@exitpumpBTC) January 15, 2023

A chart obtained and tweeted from Coinalyze.net by anonymous analyst exitpump (@exitpumpBTC) shows the cumulative volume delta (CVD) of the BTC/BUSD pair listed on Binance (yellow line) and other trades. It compares the CVDs of BTC/USD and BTC/USDT pairs listed on Exchange and Binance.

The yellow line has been trending upwards since January 11th, and the green line started rising three days later. So Bitcoin’s initial rally above $17,000 was largely fueled by strong bidding on Binance’s BTC/BUSD market, with buyers from other exchanges, including Coinbase. came in later.

“From what I’ve seen, mostly because one entity[on Binance]is bidding to absorb the selling pressure, buying more in an attempt to create a breakout market, constantly pushing back the selling force, and still showing no signs of exhaustion. , the short squeeze seems to have pushed the price higher,” exitpump tweeted.

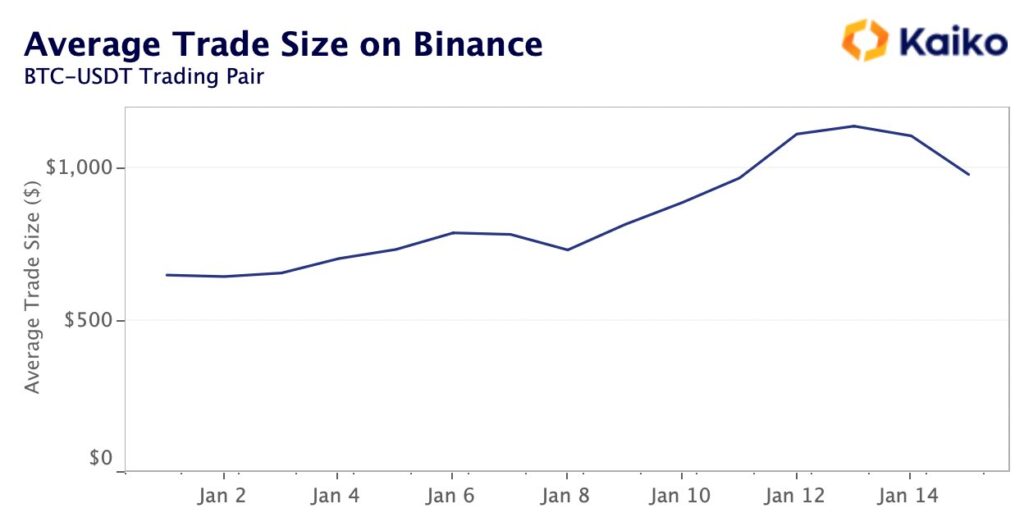

Meanwhile, other indicators, such as average trade size, suggest a lack of clear leadership and an increase in whale activity across the board.

Clara Medalie, research director at Paris-based crypto data firm Kaiko, said in an email to CoinDesk: “In terms of average transaction size, Bitstamp, Kraken ), Bitfinex, LMAX Digital, and most other exchanges, including Binance, have seen modest gains, suggesting whale-driven price movements. suggesting,” he said.

Binance’s average trade size has increased from $700 to $1,100 since January 8.

Bitcoin was up nearly 22% last week, trading at around $21,150 at the time of writing. The rally began with speculation that macroeconomic risks may be a thing of the past.

“Not only has the view that the peak of inflation has passed and interest rates probably won’t rise any further, it has been accepted, but it has also driven most of the sellers out of the market,” said the Crypto Is newsletter. Noelle Acheson, author of Macro Now, explains the price increase.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

|Image: CryptoQuant

|Original: Buyers From Coinbase Powered Bitcoin Higher or Did They?

The post Coinbase Institutional Investors Cause Bitcoin Price Rise? ── Is Binance’s whale related | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

198

2 years ago

198

English (US) ·

English (US) ·