Announcement of financial results for 2013

On the 15th, Coinbase, a major US crypto asset (virtual currency) exchange, announced its 4Q (October to December) and full-year financial results for 2023.

He explained that his finances are strong, with 4Q revenue from virtual currency trading increasing 83% from the previous quarter to $520 million (approximately 79 billion yen). The financial results announcement was made after the stock market closed on the 15th, and at the time of writing this article, the company's stock price was up over 12% in after-hours trading.

connection: Nikkei average rises despite entering recession, US stock index hits new high | 16th Financial Tankan

Below is an image summarizing the contents of this presentation. Full-year revenue was $3.1 billion (approximately 464 billion yen), down 3% from the previous year, but adjusted EBITDA remained positive in all quarters.

Source: Financial results announcement (P1)

What is EBITDA?

An abbreviation for “Earnings Before Interest Taxes Depreciation and Amortization,” an indicator used to evaluate corporate value. Refers to profit before deducting interest, taxes, and depreciation.

Virtual currency glossary

Virtual currency glossary

In the 4Q of 2023, the virtual currency market was on an upward trend due to expectations that a Bitcoin (BTC) spot ETF (exchange traded fund) would be approved for the first time in the United States. As a result, analysts had previously expected Coinbase's trading revenue to increase during this period. Net income for the fourth quarter was $270 million (approximately 40.9 billion yen), marking the first quarterly profit in 23 years.

connection: Why analysts at U.S. investment bank Oppenheimer are bullish on Coinbase stock price

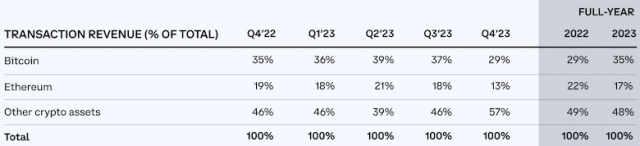

The percentage of trading revenue by stock is as follows. In 4Q 2023, Bitcoin accounted for 29%, Ethereum (ETH) 13%, and other stocks 57%.

Source: Financial results announcement (P5)

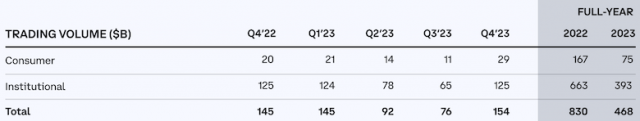

In addition, the trading volume by individual investors and institutional investors is as follows. In Q4 2023, one-third of the top 100 hedge funds by assets under management reported using Coinbase.

Source: Financial results announcement (P5)

With the first Bitcoin ETF approved in the US in January 2024 and financial giants such as BlackRock using Coinbase, performance in the first quarter of this year is expected to improve.

connection: BlackRock's Bitcoin spot ETF holds over 100,000 BTC (770 billion yen)

Other announcements

It is also reported that the company is expanding its business outside of the United States. He explained that over 80% of cryptocurrency transactions take place outside the United States.

connection: Coinbase's virtual currency derivatives trading expands into Europe, with company acquisition in sight

It also states that 8 of the 11 U.S. Bitcoin spot ETFs have Coinbase as their custodian. The U.S. Securities and Exchange Commission's (SEC) approval of a Bitcoin spot ETF in January of this year is promising a turning point in the expansion of the crypto economy.

He also explained that his 24 year business will focus mainly on the following three points. Coinbase said it is on a stronger foundation than it was a year ago and has plenty of capital to take advantage of future opportunities.

- Facilitate trading and earnings from stablecoin “USDC”

- Improving the practicality of virtual currency with payments using USDC and L2 “Base”

- Continue efforts to clarify regulations

connection: Bloomberg Senior Litigation Analyst “Coinbase has the upper hand in lawsuit against SEC, 70% chance of success”

NISA, virtual currency related stocks special feature

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

The post Coinbase results show net profit in the black due to increase in virtual currency trading, stock price rises over 12% after hours appeared first on Our Bitcoin News.

1 year ago

97

1 year ago

97

English (US) ·

English (US) ·