The post CoinEx Research September 2024 Report: Fed’s Rate Cut Fuels Bitcoin Surge, Turning Recession Concerns into Market Optimism appeared first on Coinpedia Fintech News

CoinEx Research has released its comprehensive report on the cryptocurrency market for September 2024. The crypto market is driven by significant policy shifts and new technological developments. The highlight event was the Federal Reserve’s 50 basis point rate cut, which brought optimism into the markets and inspired a strong rally in risk assets, including cryptocurrencies. This dovish stance, mirrored by similar actions from the European Central Bank (ECB) and the Bank of England (BoE), reversed the market’s earlier downturn, with Bitcoin leading the charge.

Bitcoin’s Bullish Breakout

The month began with Bitcoin on unstable ground, trading as low as $52,700. However, following the Fed’s announcement, Bitcoin surged from the $58,000 level to the recent high at $66,000, rallied sharply to close the month at $63,300 with gain of over 20%. This rebound was mirrored across the broader cryptocurrency market. With Bitcoin now eyeing the critical $70,000 resistance level, the macro outlook for the rest of 2024 appears constructive, particularly as the Fed’s policies continue to take effect.

Recession Risks

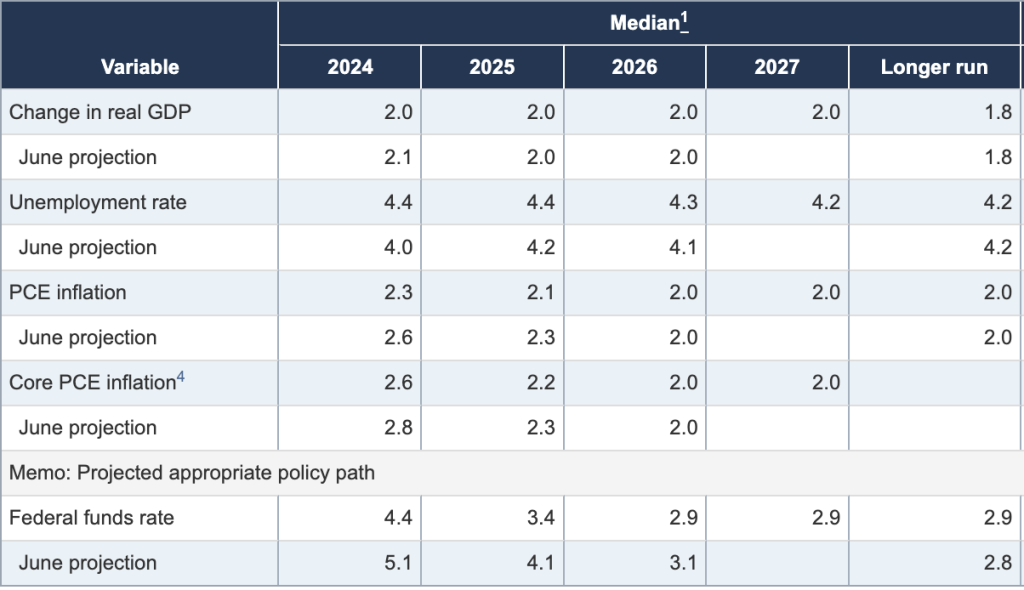

Global markets were closely eyeing central bank policies in September. The Federal Reserve’s recent projections, which kept GDP growth estimates steady at 2% for 2025 and 2026, suggested confidence in economic resilience to withstand the ongoing policy shifts. Meanwhile, the outlook for inflation remained manageable. However, with higher projected unemployment rates, the Fed’s actions reflect labor market conditions may experience some strain.

Source: Federal Reserve

Source: Federal ReserveData as of 18 Sep 2024

USD/JPY – The Key Variable to Watch

However, market participants are closely watching variables like the USD/JPY currency pair, which could influence global liquidity flows if Japan’s central bank continues its rate hike path.

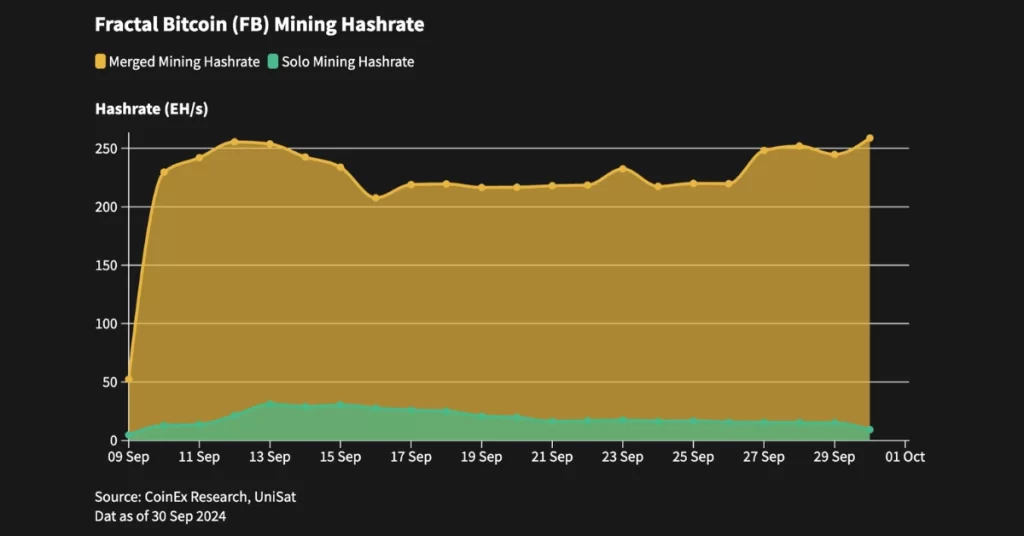

Technological Innovation: Fractal Bitcoin Mainnet

One of the most significant technological developments of the month was the launch of Fractal Bitcoin’s mainnet on September 9th. Fractal Bitcoin, a Layer 2 solution, enhances Bitcoin’s transactional efficiency while preserving compatibility with the main Bitcoin network. It allows for extended features, such as the OP_CAT opcode, enabling developers to test new functionalities without compromising the core system. This innovation has placed Fractal Bitcoin among the top three Proof-of-Work chains by hashrate, supported by ViaBTC mining pool, with CoinEx becoming the first exchange to list its native FB token. For CoinEx’s analysis of Fractal Bitcoin, please refer to “Fractal Bitcoin: The Pioneering Network of Bitcoin – Analysis of Technical Innovation and Challenges”.

Challenges in the Ton Ecosystem

While the crypto market was optimistic, the Ton blockchain faced challenges with its new tokens, CATI and HMSTR. Both tokens underperformed post-launch, with declines of 55% and 35%, respectively. The concerns over the sustainability of the “tap-to-earn” model, as market saturation may limit the appeal of similar projects. The future of the Ton ecosystem will greatly rely on its ability to offer unique value propositions to sustain long-term growth.

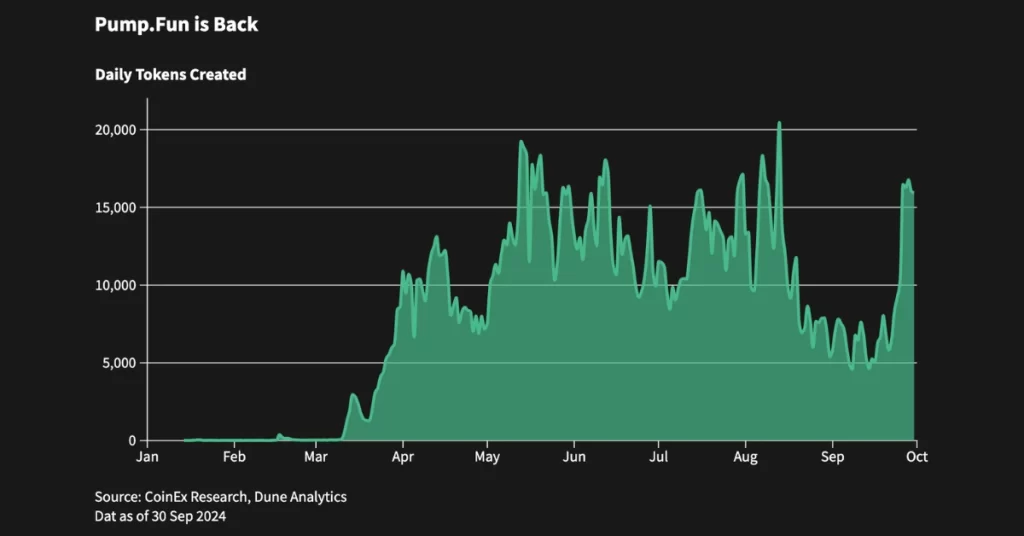

Meme Token Craze Sparked by Social Media

September also saw the revival of meme tokens, driven by viral trends on social media. Animal-themed tokens, such as Moo Deng (a dwarf hippopotamus from Thailand), penguins (PESTO), frogs (OMOCI), spurred speculative interest, particularly on the Solana blockchain. The daily tokens creation level on Pump.Fun has rebounded to the high levels previously seen this year. While meme tokens garnered attention, they are highly volatile, and investors are advised to exercise caution amidst the hype.

Looking Ahead: Economic Data and Market Sentiment

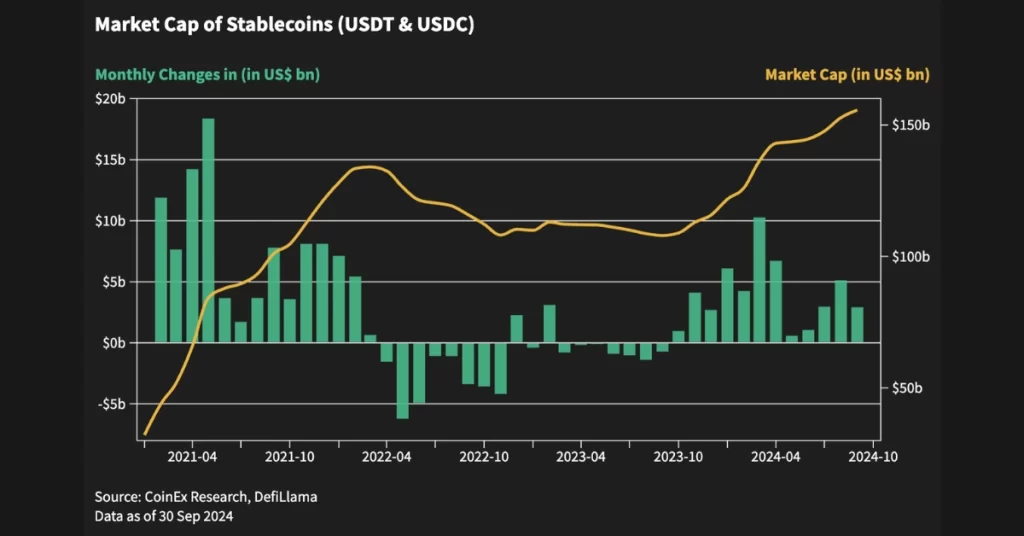

Despite a slowdown in stablecoin inflows, September closed with $2.9 billion, reflecting sustained investor confidence in the market. As October unfolds, market participants will be closely watching economic data and the U.S. elections, which could fuel the next wave of activity in the crypto space.

In conclusion, September 2024 was a pivotal month for cryptocurrencies, with macroeconomic policies, technological innovation, and speculative trends all playing significant roles in shaping the market’s trajectory. With a more accommodative global monetary stance and technological advancements, the outlook remains positive as moving towards 2025.

About CoinEx

Established in 2017, CoinEx is a global cryptocurrency exchange committed to making crypto trading easier. The platform provides a range of services, including spot and futures trading, margin trading, swaps, automated market makers (AMM), and financial management services for over 10 million users across 200+ countries and regions. Since its establishment, CoinEx has steadfastly adhered to a “user-first” service principle. With the sincere intention of nurturing an equitable, respectful, and secure crypto trading environment, CoinEx enables individuals with varying levels of experience to effortlessly access the world of cryptocurrency by offering easy-to-use products.

CoinEx Research remains committed to providing in-depth analyses and insights into the evolving cryptocurrency market, helping investors navigate through the complexities and opportunities that lie ahead.

To learn more about CoinEx, visit:

Website | Twitter | Telegram | LinkedIn | Facebook | Instagram | YouTube

1 month ago

27

1 month ago

27

English (US) ·

English (US) ·