Macroeconomics and financial markets

In the US NY stock market on the 21st, the Dow was 697.1 dollars (2.06%) lower than the previous day, and the Nasdaq was 294.97 dollars (2.5%) lower.

Following the recent U.S. employment statistics and CPI (U.S. consumer price index), the preliminary U.S. Purchasing Managers Index (PMI), which indicates U.S. business sentiment, exceeded market expectations, prompting the Fed to curb inflation. The federal reserve system) has become more wary of the prolonged tightening of monetary policy. The PMI climbed to an eight-month high of 50.5.

In response to this, the VIX (CBOE volatility) index, which shows fear psychology, soared, and government bond yields also surged, and stocks fell to the largest level of decline this year. The poor financial results of major retailers also seem to have pushed down sentiment significantly.

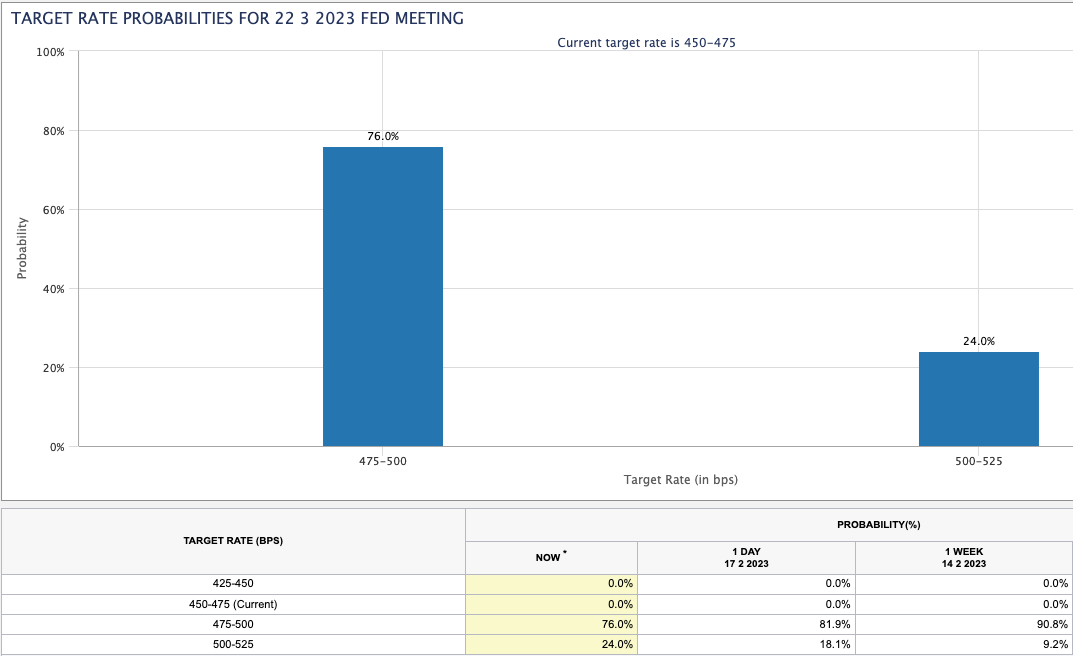

In the interest rate futures market, expectations for an additional rate hike of 0.50% at the US Federal Open Market Committee (FOMC) in March soared from 18.1% to 24%.

CME FedWatch Tool

The minutes of the US Federal Open Market Committee (FOMC) are scheduled to be released today, which will also attract attention.

connection:NY Dow plunges sharply, exceeding coinbase earnings forecast Polygon personnel reduction, etc. | 22nd Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

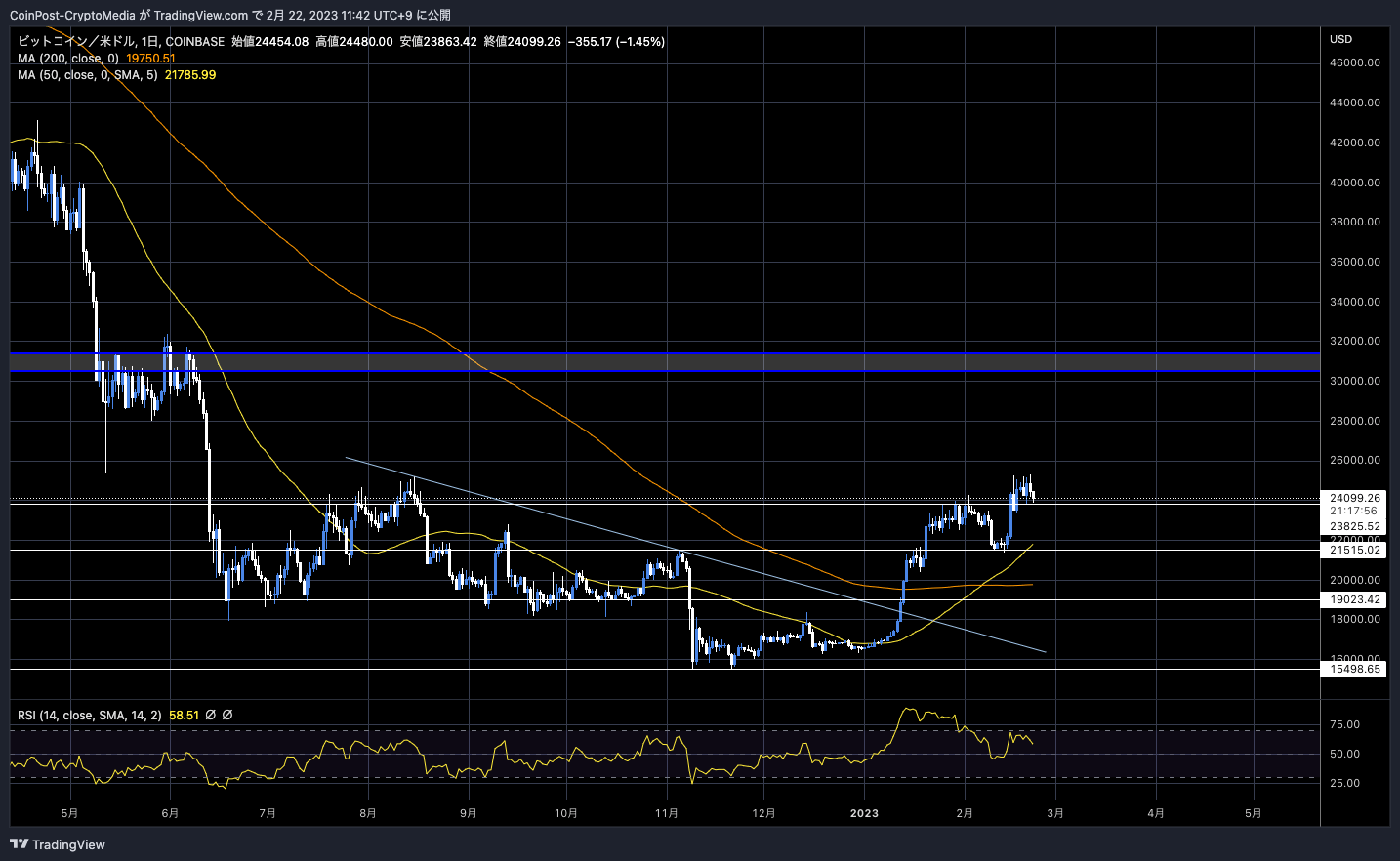

In the crypto asset (virtual currency) market, Bitcoin fell 3.28% from the previous day to $24,079.

BTC/USD daily

Selling took precedence as the three major indexes fell in the US market. The crypto-asset (virtual currency) market was also weak.

The number of whales holding over 1,000 BTC has fallen to its lowest level since August 2019, according to data from crypto analytics firm Glassnode.

glass node

Meanwhile, the number of even larger whale addresses holding more than 10,000 BTC continues to grow, reaching 117.

Situation in China

Cryptocurrency exchange Huobi Global is moving its Asian headquarters from Singapore to Hong Kong after the Securities and Futures Commission (SFC) proposed deregulation in Hong Kong, which aims to become an “international hub” for crypto assets. . Justin Sun, founder of TORON and operator of Huobi, revealed in an interview with Nikkei Asia.

SFC is soliciting public comments until March, and expects to revise the licensing system in June this year.

connection:Hong Kong Authorities Consider Resuming Crypto Trading for Individual Investors

The company expects to increase its Hong Kong staff from 50 to 200 and provide services to institutional investors and high net worth individuals.

In May 2021, the Chinese government announced a complete ban on crypto asset (virtual currency) trading, including the mining business, which had the top share in the world at the time, causing market turmoil. It was reported that Hong Kong, which China positions as a special administrative region, has begun considering the introduction of a bill that allows individual investors to directly invest in crypto assets.

The requirements proposed by the SFC include a due diligence process for cryptocurrency tokens prior to listing.

“Hong Kong is free to pursue ‘one country, two systems’ under the ‘one country, two systems’ formula, as long as it does not threaten China’s financial stability,” said Nick Chan, a member of the National People’s Congress, Bloomberg reported.

Following the collapse of the algorithmic stablecoin “UST (TerraUSD)” last year and the collapse of the major crypto asset (virtual currency) exchange FTX, the U.S. SEC (Securities and Exchange Commission) is tightening regulations, and China is the Web3 market. There is a view that Hong Kong may have taken the opportunity to strengthen its presence in the market, and may have turned to legal development approval for new asset classes first.

In January of this year, China launched a state-owned “NFT platform” with government backing.

It was co-founded by the Huaban Digital Copyright Service Center, a private enterprise based in Beijing, the China Technology Exchange (CTE), which is backed by the Chinese government, and the China Cultural Relics Exchange Center.

altcoin

Among the major alts, the drop in Polygon (MATIC), the 9th largest market capitalization, was 8.06% lower than the previous day.

Ethereum scaling platform Polygon Labs has come under fire for announcing 100 layoffs, up to 20% of its workforce, due to an organizational restructuring.

Polygon has grown exponentially.

To continue on this path of stupendous growth we have crystallized our strategy for the next 5 yrs to drive mass adoption of web3 by scaling Ethereum.

Our treasury remains healthy with a balance of over $250 million and over 1.9 billion MATIC

— Sandeep | Polygon  Top 3 by impact (@sandeepnailwal) February 21, 2023

Top 3 by impact (@sandeepnailwal) February 21, 2023

connection:Polygon cuts 20% of workforce in business unit merger

Regarding financial soundness, he emphasizes that there is no problem with cash balance of more than 250 million dollars and 1.9 million MATIC. Polygon raised $450 million last February from 40 venture capitalists, including Sequoia Capital and SoftBank Vision Fund II.

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Concern about monetary tightening intensifies, US 3 major indexes and virtual currency prices fall appeared first on Our Bitcoin News.

2 years ago

142

2 years ago

142

English (US) ·

English (US) ·