Virtual currency market from 7/1 (Sat) to 7/7 (Fri) this week

Mr. Hasegawa, an analyst at the major domestic exchange bitbank, illustrates this week’s bitcoin chart and analyzes the future outlook.

table of contents

- Bitcoin on-chain data

- Contributed by bitbank

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other Services

bitbank analyst analysis (contribution: Yuya Hasegawa)

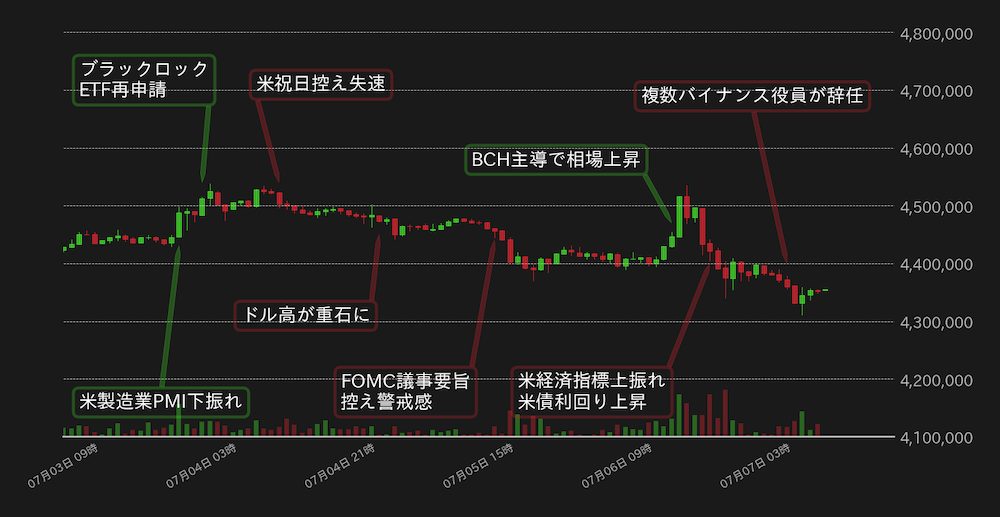

Weekly report from 7/1 (Sat) to 7/7 (Fri):

This week’s bitcoin (BTC) vs. yen exchange rate hit the year-to-date high of 4.53 million yen at the beginning of the week, but the top price is heavy, and as of noon on the 7th, it is pushing to the middle of 4.3 million yen.

Following the downswing of the May US Manufacturing Purchasing Managers Index (PMI) at the beginning of the week and the reapplication by BlackRock for a physical Bitcoin exchange-traded fund (ETF), the BTC market climbed to the 4.5 million yen level. Although the price hit a new high for the year, it then stalled as sales dwindled ahead of the Independence Day of the United States. Furthermore, in the middle of the week, the market fell below 4.4 million yen as a sense of caution spread before the disclosure of the minutes of the US Federal Open Market Committee (FOMC) in June.

On Thursday, Bitcoin Cash (BCH) market recovery led BTC to rise as well. The increase was more than double the market forecast, and the service industry PMI exceeded the market price, completely erasing the increase and falling below 4.4 million yen again.

Recently, reports that Binance executives resigned one after another spread concerns about the company’s management, and BTC fell to around 4.3 million yen at one point.

Figure 1: BTC vs Yen chart (1 hour) Source: Created from bitbank.cc

Last month, the BTC market returned to a two-month high, but it is struggling to clear a clear break above the $31,000 level (approximately 4.45 million yen). While positive news about spot-type bitcoin ETFs has been pointed out to be waning, solid US economic indicators have pushed up US bond yields, weighing on the BTC market.

In addition, the FF interest rate futures market has begun to factor in the possibility that the US Federal Reserve Board (FRB) will decide to raise interest rates in November as well as in July, which can be said to be a difficult market for BTC.

On the chart side, BTC is trying to break below 4,306,000 yen, which is the psychological milestone level of 30,000 dollars in dollars, and whether it fails to maintain the same level will be announced today (7th) in May. can it be said that it depends on the U.S. employment statistics?

The market expects non-farm payrolls to increase by 225,000 in May, a slowdown from April’s increase of 339,000. We should be cautious of downside risks.

On the technical side, BTC has stopped falling at the center line of the Bollinger Bands, but if it breaks the center line in the process of narrowing the band width as it is now, it will tend to adjust to -2σ, and the bottom price will be 3.8 million. It is pointed out that it is around the circle.

Figure 2: BTC vs Yen Bollinger Bands (Daily) Source: bitbank.cc

connection:bitbank_markets official website

Last report:Rise in US bond yields puts pressure on BTC’s top price

The post Concerns about Fed rate hikes are growing, and the price is likely to drop | Contribution by bitbank analyst appeared first on Our Bitcoin News.

2 years ago

134

2 years ago

134

English (US) ·

English (US) ·