Macroeconomics and financial markets

In the US NY stock market on the 25th, the Dow closed by 9 dollars (0.02%) lower than the previous day and increased for 4 consecutive days. The US Federal Reserve Board (FRB) rate hikes are expected to slow down.

The fact that Tesla’s financial results announcement revealed that it will continue to hold Bitcoin (BTC) has also become a tailwind for the crypto asset (virtual currency) market. The company’s CEO, Elon Musk, also made a splash with his massive acquisition of Twitter.

Tesla reported that it had sold 75% of its large holdings of bitcoin in its earnings announcement in the second quarter of 2022, when the market environment had deteriorated significantly.

Related: Tesla’s financial results revealed continued holding of Bitcoin, China’s first population decline in 60 years | 26th Financial Tankan

Virtual currency market

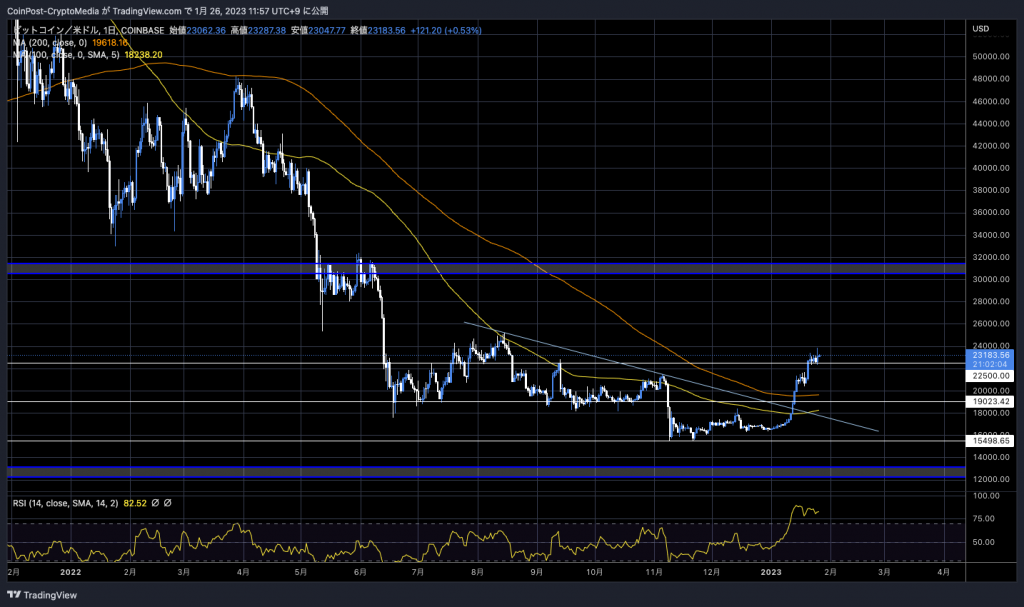

In the crypto asset (virtual currency) market, Bitcoin rose 2.87% from the previous day to $23,187.

BTC/USD daily

Yesterday, there was also a scene where the stock fell temporarily, but as a result, it continued to rise with a shallow dip. In front of the US Federal Open Market Committee (FOMC), the US stock index and the activation of the alt market drove the market.

Bitcoin may have already entered a “tipping point” from a bear market to a bull market in light of past trend cycles.

$BTC #Bitcoin

2015-2017 bull market: 1064 days

2017-2018 bear market: 364 days

2018-2021 bull market: 1064 days

2021-*current* market low: 364 days

Days left until the top if we just carbon copy the cycle timeframe again: 1001 days pic.twitter.com/KoNZxJRuy5

— HornHairs  (@CryptoHornHairs) January 12, 2023

(@CryptoHornHairs) January 12, 2023

- 2015-2017 bull market: 1064 days

- 2017-2018 bear market: 364 days

- 2018-2021: Bull market: 1064 days

- 2021-Present: Bear market: 364 days

Bitcoin’s rise and fall rate since the beginning of the year surpasses financial assets such as the S&P 500 (US stocks) and gold (gold).

Financial giant Goldman Sachs has calculated that Bitcoin’s performance value after 2023 will be 3.1, the highest among major financial assets, in the Sharpe ratio (risk-adjusted return), an index that measures investment efficiency. bottom. Second place is 2.8 of the MSCI Emerging Market Index, a representative stock index for emerging markets.

₿REAKING: #Bitcoin is the best performing asset in the world this year, according to latest data by Goldman Sachs pic.twitter.com/vh7f7UIloi

—Documenting ₿itcoin  (@DocumentingBTC) January 23, 2023

(@DocumentingBTC) January 23, 2023

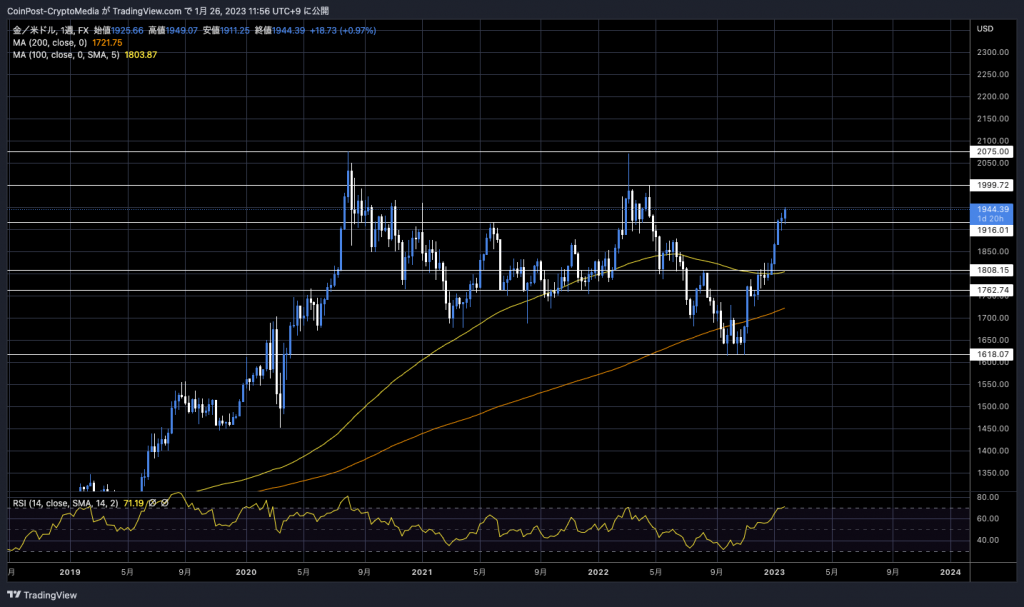

The price of gold has soared due to the weaker dollar in the foreign exchange market, such as the softening of the dollar index (dollar index) and the slowdown in the pace of US interest rate hikes.

In addition to hitting a record high in yen terms, it also rose significantly in dollar terms, reaching $1,945 an ounce. The all-time high was $2,070 in August 2020.

XAU/USD Weekly

altcoin market

Individual stocks of crypto assets are also booming.

Among them, Aptos (APT) recorded a 137% increase from the previous week and a 415% increase from the previous month, setting a record high. APT, which was around $3 on the 6th, reached $19.2 on the 26th, about six times higher.

APTUSD/Daily

According to CoinGecko data, half of APT’s $2 billion in trading volume over the past day came from South Korean won trading pairs on Singapore-based cryptocurrency exchange UpBit.

In addition, UpBit’s APT price is about 3% higher than Binance’s APT price, resulting in a kimchi premium, and arbitrage demand is also believed to have boosted the volume.

Aptos is an L1 blockchain focused on security and scalability, and is also known to have been founded by the former developers of Diem (formerly Libra), which was developed by Meta (formerly Facebook).

It uses the blockchain programming language “Move”, which is superior to Ethereum’s “Solidity” in terms of security and scalability, and its mainnet was launched in October 2010.

Relation:What is the new blockchain “Aptos” developed by former Meta engineers?

The development company Aptos Labs was once valued at $4 billion and has raised a total of over ¥45 billion from major institutional investors in the industry, including Binance Labs, Coinbase Ventures, and Andreesen Horowitz (a16z). .

On the 6th, PancakeSwap, a major BSC-based DEX (distributed exchange), announced support for Aptos and additional projects.

Proposal for PCS farm emission confirmation vote on Aptos

Proposal for PCS farm emission confirmation vote on Aptos

Chefs have been monitoring and optimizing the liquidity levels on Aptos. Based on the initial deployment, we propose to continue our multichain deployment on Aptos

Chefs have been monitoring and optimizing the liquidity levels on Aptos. Based on the initial deployment, we propose to continue our multichain deployment on Aptos

Read the proposal and Vote: https://t.co/l4RK1ZKfug pic.twitter.com/EUEJRbsT5q

Read the proposal and Vote: https://t.co/l4RK1ZKfug pic.twitter.com/EUEJRbsT5q

— PancakeSwap  #Multichain (@PancakeSwap) January 6, 2023

#Multichain (@PancakeSwap) January 6, 2023

Relation:For more information on newly listed Aptos (APT) and Tokenomics, please visit

On the 20th, Binance Liquid Swap, an AMM-type DEX (decentralized exchange), started offering APT/Tether (USDT) and APT/BTC liquidity pools. In addition to receiving a portion of the commission income from transactions, you can earn rewards for BNB yield farming.

Click here for a list of market reports published in the past

The post Continued growth without Bitcoin adjustment, APT surged 137% from the previous week appeared first on Our Bitcoin News.

2 years ago

134

2 years ago

134

English (US) ·

English (US) ·