Project Mariana interim report

The Bank for International Settlements (BIS) announced in an interim report on the 28th that it is a joint project to explore the development potential of the foreign exchange market (FX) using the tokenized wholesale central bank digital currency (wCBDC). The progress of Project Mariana has been revealed.

The project is being promoted by the BIS Innovation Hub in collaboration with the Banque de France, the Monetary Authority of Singapore and the Swiss National Bank. This is an attempt to validate tokenized FX trading and payment methods for the future of central bank issuing wCBDCs.

According to the report, Project Mariana will apply automated market maker (AMM) technology developed in decentralized finance (DeFi). In particular, it will explore the potential to improve the efficiency, security and transparency of FX trading and payments by adopting Curve Finance’s technology.

It will also use wCBDC, which is based on ERC-20 (Ethereum’s token standard), to improve the liquidity of assets between different blockchain-based networks.

What is AMM

A decentralized trading system built with smart contracts. Utilizing a mathematical formula “bonding curve” that defines the relationship between token price and inventory, and a “liquidity pool” that locks up two types of tokens in a 1:1 ratio to facilitate the automatic exchange of assets.

Cryptocurrency Glossary

Cryptocurrency Glossary

connection:Bank for International Settlements, et al. report on CBDC cross-border settlement experiment

Adopt Curve v2

Project Mariana will facilitate the automatic exchange of tokenized assets by implementing a decentralized trading system powered by AMM. In particular, Curve Finance’s AMM technology “Curve v2 HFMM” has the characteristic of efficiently trading assets with different values while reducing the risk of price fluctuations.

Source: BIS

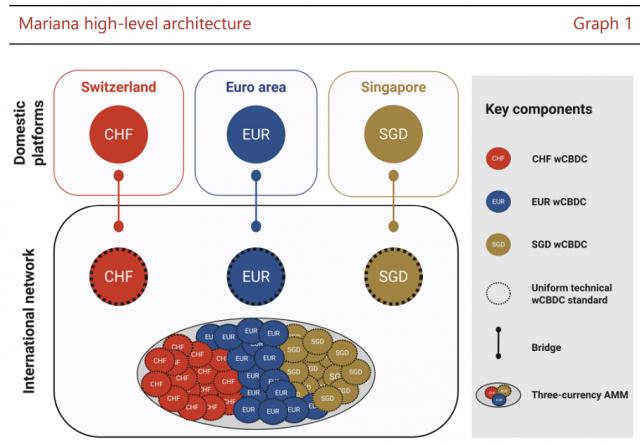

It will also manage and promote the use of wCBDCs in Euro (EUR), Swiss Franc (CHF) and Singapore Dollar (SGD) issued by different central banks on their respective domestic platforms in an international network. This liquidity pool is formed by the commercial banks involved in the project, with access to the trading system controlled by a whitelist maintained by the central bank.

In addition, Project Mariana will set up an international FX interbank marketplace powered by wCBDC on a blockchain-based network. Bridge technology is used to enable mutual linking with domestic platforms in each country.

Commercial banks will be able to obtain wCBDC from domestic platforms and transfer it to international networks (and vice versa). On international networks, commercial banks can use wCBDC to transact with AMM and other banks, enabling decentralized FX trading and settlement.

Project Mariana started last November, and this interim report describes the setup of the proof-of-concept. A final report is due to be published by the end of the year.

connection:Bank for International Settlements analyzes crypto market turmoil and losses for retail investors

The post Convergence of CBDC and DeFi environment Bank for International Settlements verifies the efficiency of the foreign exchange market appeared first on Our Bitcoin News.

2 years ago

105

2 years ago

105

English (US) ·

English (US) ·