Bitcoin (BTC) price action is no longer tied to US stock market sentiment.

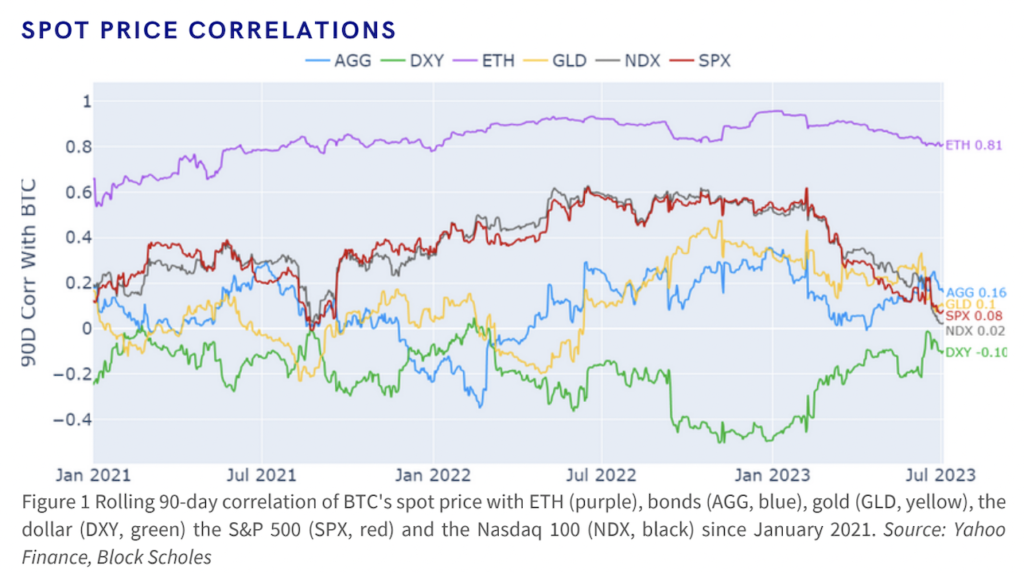

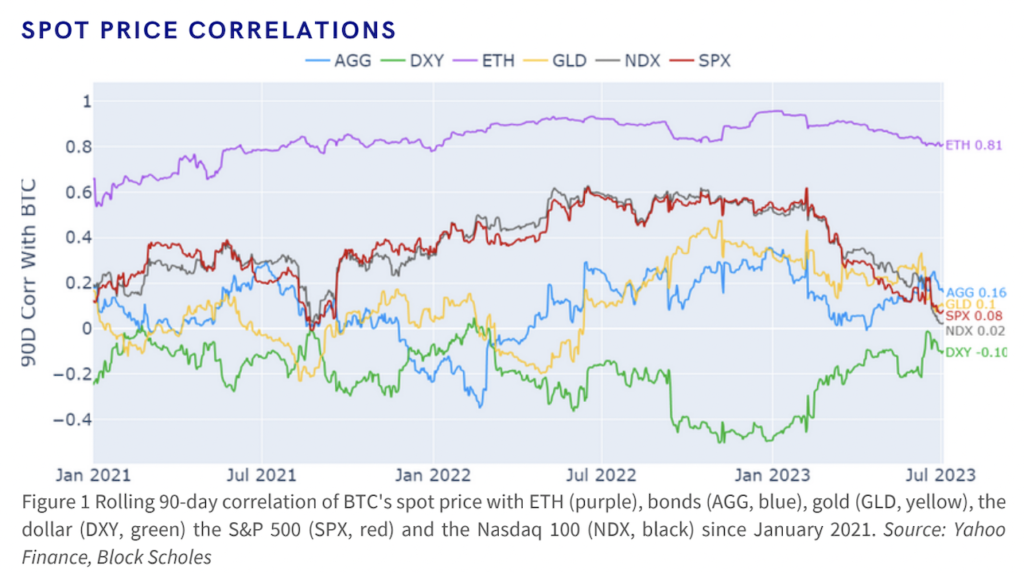

The 90-day rolling correlation between Bitcoin spot price volatility and Wall Street tech stock index Nasdaq and the broader S&P 500 index has dropped to near zero. That’s the lowest value in two years, according to data tracked by crypto derivatives analytics firm Block Scholes.

“Since July 2021, when BTC was between the two peaks of April and November 2021,[thecorrelationhasbeen”It’satthelowestlevel”hesaid

“The decline in correlation occurred as both assets recovered losses incurred through last year’s tightening cycle,” Melville added.

Declining correlations with traditional risk assets means that crypto traders who focus solely on traditional market sentiment and macroeconomic trends may face disappointment.

The statistical relationship between Bitcoin, the Nasdaq and the S&P 500 is near zero. (BlockScholes/Yahoo!)

The statistical relationship between Bitcoin, the Nasdaq and the S&P 500 is near zero. (BlockScholes/Yahoo!)Significant impact of ETF applications

Recent spot Bitcoin exchange-traded fund (ETF) filings by BlackRock, Fidelity, WisdomTree, VanEck, Invesco and others have brought optimism to the crypto market.

Since BlackRock filed on June 15, Bitcoin has returned 25%, ignoring the range of the US stock index.

According to Ilan Solot, co-head of digital assets at Marex Solutions, the ETF story iscan be divided into three parts. Pre-launch, post-launch flows for spot ETFs, and validation of crypto as an asset class.

“The flow of investment products over the next few months could be a touchstone for the second half of the year, so we will be watching closely,” Sorot said.tweeted.

Despite the dismay of the bears, investor interest in listed products has increased since June 15.

In a memo to clients on July 4, Vetle Lunde, a senior analyst at K33 Research, described the impact of the ETF application as “globally, bitcoin exchange-traded financial products ( ETP) experienced an inflow of 13,822 BTC in June, which began after BlackRock’s announcement on June 15. Across national jurisdictions, spot ETPs in Canada and Europe and the US of futures ETFs are all experiencing strong inflows.”

Currently, the ETF scenario is taking the lead, but some macroeconomic factors, such as potential fiat currency liquidity pressures, need attention, analysts tell CoinDesk. .

Bitcoin was trading at $30,830 at the time of writing, according to CoinDesk data.

|Translation: CoinDesk JAPAN

|Editing: Toshihiko Inoue

| Image: BlockScholes/Yahoo

|Original: Bitcoin No Longer Correlated to US Stocks, Crypto Analytics Firm Block Scholes Says

The post Correlation between Bitcoin and US stocks is almost zero ── Lowest in the past two years | CoinDesk JAPAN | CoinDesk Japan appeared first on Our Bitcoin News.

2 years ago

176

2 years ago

176

English (US) ·

English (US) ·