The post Could Bitcoin’s Longest Consolidation Lead to a New All-Time High? appeared first on Coinpedia Fintech News

Bitcoin is in its longest consolidation phase since March. This sparks discussions about whether it will break up or down, Expert opinions point to the Wyckoff accumulation phase and broader market strength as indicators of a potential bullish continuation. Here is what you should know.

Bitcoin’s Extended Consolidation Phase and Possible Impact

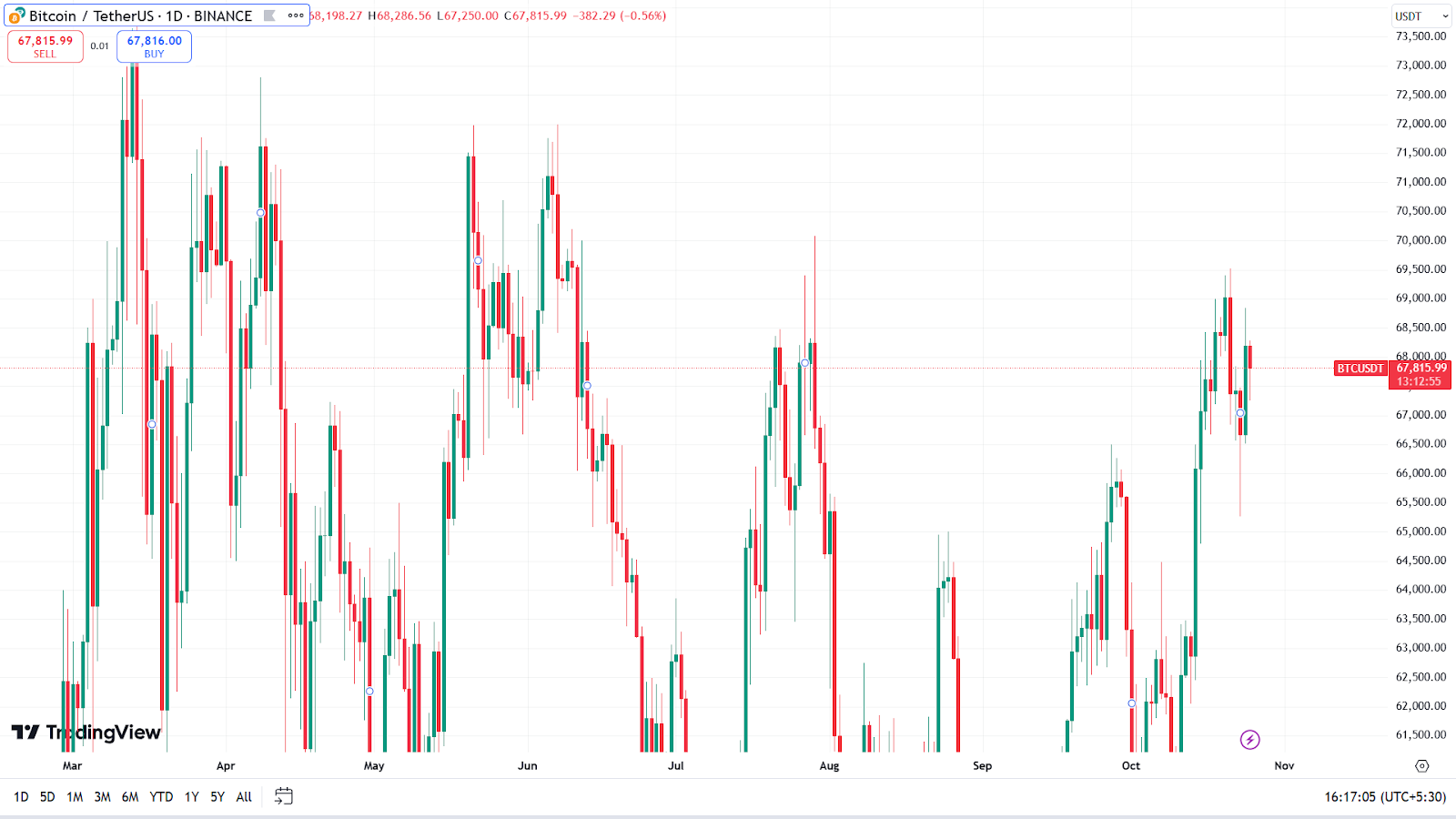

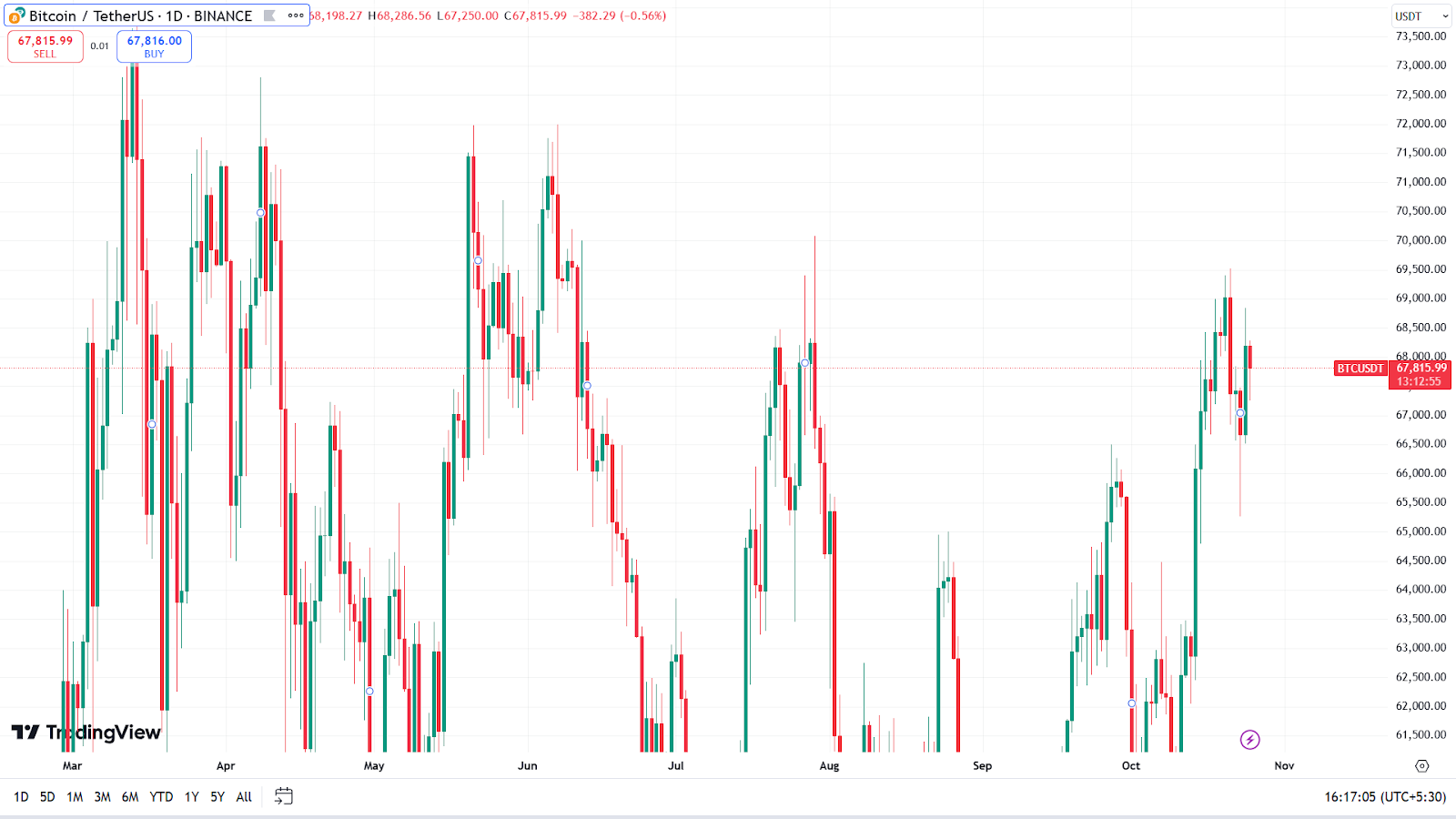

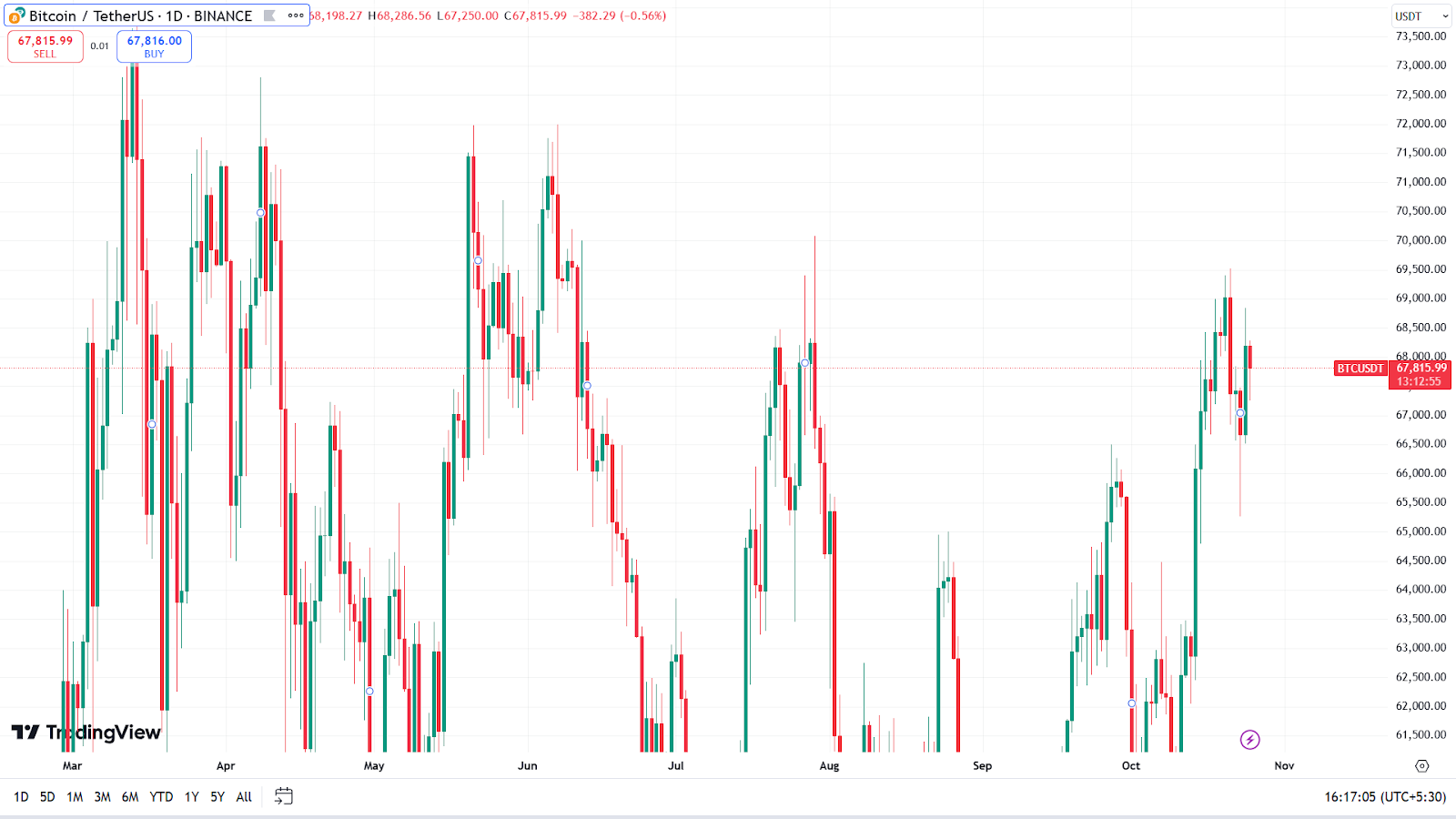

On March 13, the BTC price reached an all-time high of $73,000. Since then, it has hovered between $73,000 and $53,944. Bitcoin has been consolidating since its March all-time high, marking its longest consolidation phase. Extended consolidation often precedes a big move. Therefore, we could expect a big move – either downside or upside.

Bitcoin Downside Warning: Could a Macro Distribution End the Bull Market?

If the price of BTC stays below the $50,749 level – the lowest point of the order block between February 14 and 25, which drove the price towards a massive upward swing and created an all-time high – it may signal a macro distribution rather than an accumulation. A macro distribution could indicate the bull market is over.

Expert Opinion: Strong Market Correlation Could Support Bitcoin

A crypto expert, identified as Crypto Banter on YouTube, claimed that a downside scenario in the Bitcoin market is unlikely. He cited expected strength in the Nasdaq and S&P 500 as supportive factors. Continued stock strength could bolster Bitcoin’s stability.

Wyckoff Accumulation Phase: Bitcoin’s Position in Phase D

As per Crypto Banter, Bitcoin is currently in the BU/LPS zone of Wyckoff’s Phase D. For Bitcoin to reach the ‘SOS’ zone, a little more strength is needed. A small consolidation may be necessary before a possible markup in Phase E, which would be an extremely bullish phase.

Buying Opportunity: How to Approach Pullbacks

In a bull market, red days create potential buying opportunities. A pullback near the recent range low of $65,860 could allow traders to enter and aim for the range high of $69,017. However, in a sharp market rise, the target could even reach the $80,000 level.

In conclusion, while Bitcoin’s next big move remains uncertain, current patterns hint at a potential buying opportunity for those confident in the bull market’s continuation. Given the current market setup and expert insights, many traders are watching for signs of strength that could signal a breakout. As a result, this consolidation phase could be pivotal in shaping the next Bitcoin price prediction, with the potential to rally if bullish indicators prevail.

Stay tuned to Coinpedia for more updates on Bitcoin’s price momentum.

1 month ago

16

1 month ago

16

English (US) ·

English (US) ·