Virtual currency market price this week from 12/30 (Sat) to 1/5 (Fri)

Mr. Hasegawa, an analyst at Bitbank, a major domestic exchange, illustrates this week’s Bitcoin chart and deciphers the future outlook.

table of contents

- Bitcoin on-chain data

- bitbank contribution

Bitcoin on-chain data

Number of BTC transactions

Number of BTC transactions (monthly)

Number of active addresses

Number of active addresses (monthly)

BTC mining pool remittance destination

Exchange/Other services

bitbank analyst analysis (contributed by Tomoya Hasegawa)

Weekly report from 12/30 (Sat) to 1/5 (Fri):

Bitcoin (BTC) vs. yen has been rising this week, although it has fluctuated wildly, and as of noon on the 5th, it is hovering around 6.3 million yen.

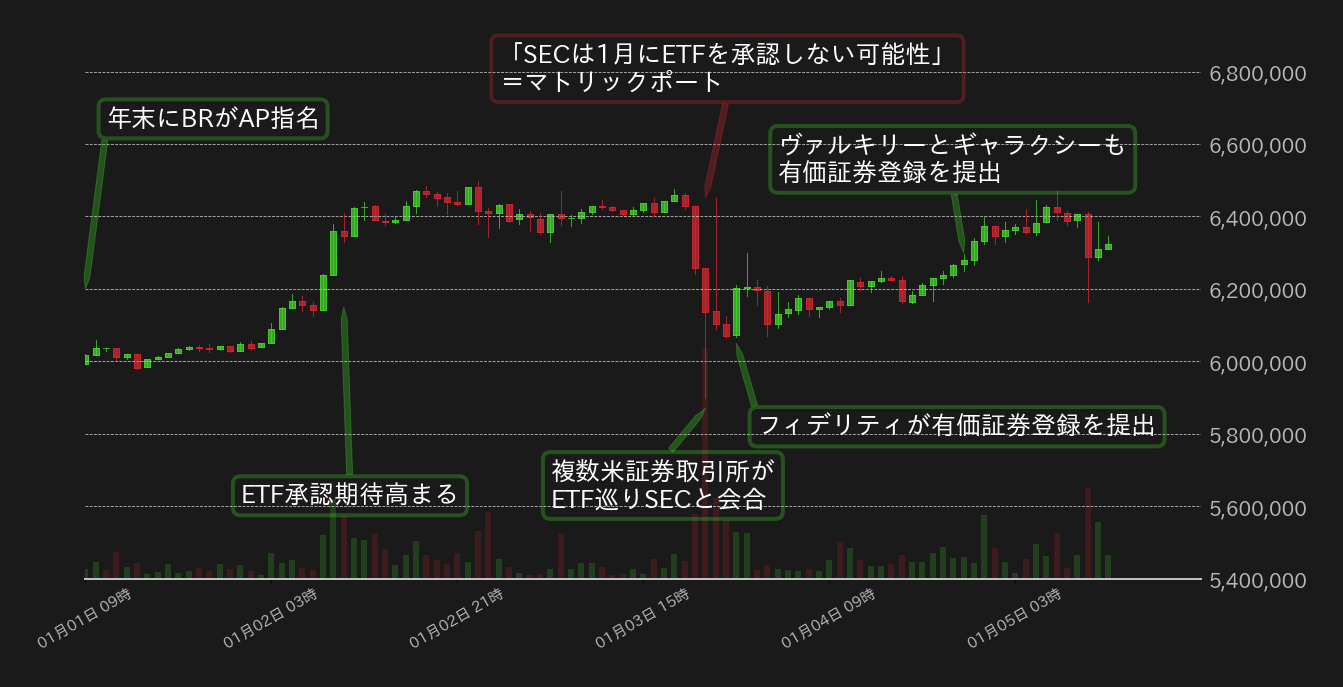

Over the year-end and New Year holidays, BlackRock (BR) named JP Morgan and Jane Street as authorized participants (APs) for a spot-based Bitcoin exchange traded fund (ETF), and Reuters also announced that the U.S. Securities and Exchange Commission As the SEC pointed out that there is a possibility that multiple ETFs may be approved, BTC has been chasing an upward trend since the beginning of the year, and recovered to 6.4 million yen on the 2nd.

Meanwhile, on the 3rd, Matrixport pointed out that “the SEC is likely to postpone ETF approval in January,” and the market price plummeted with long pitches, at one point falling below 6 million yen. .

However, on that day, when Fox News reported that the New York Stock Exchange, Nasdaq, and Chicago Board Options Exchange (Cboe) held a meeting with the SEC regarding a physical Bitcoin ETF, a Bloomberg analyst said, “(ETF) If we’re going to deny or postpone it, we won’t do it at this timing.”And with Fidelity’s filing of ETF securities registration with the SEC, speculation that approval is imminent has resurfaced, and the market price has declined. It has recovered to around 6.2 million yen.

The next day, on the 4th, Valkyrie and Galaxy also submitted their ETF securities registration to the SEC. On this day, US employment-related indicators were strong and US bond yields rose, but BTC recovered to 6.4 million yen.

[Figure 1: BTC vs. Yen chart (1 hour)]Source: Created from bitbank.cc

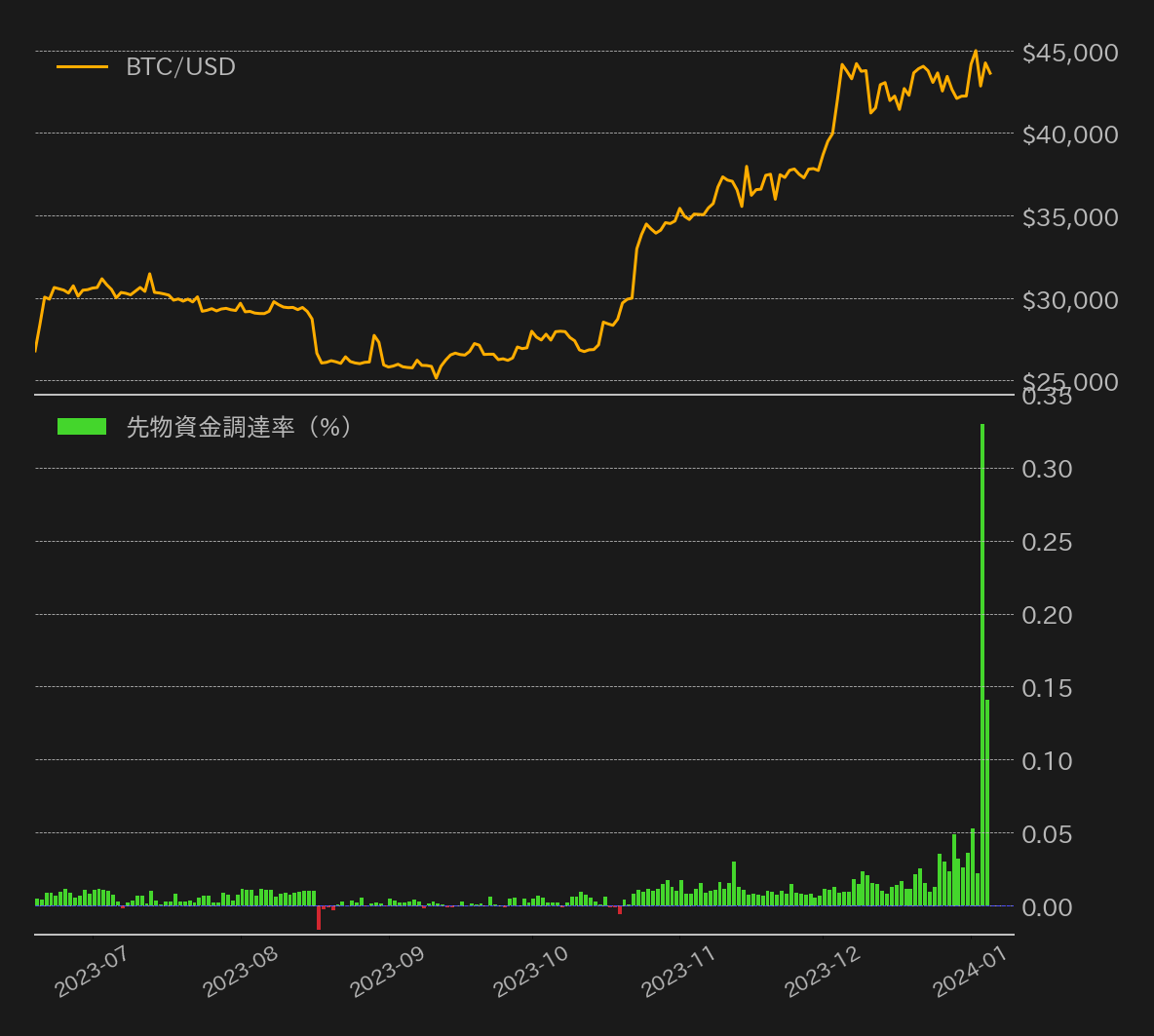

BTC temporarily recovered to $45,000 in dollar terms on the 2nd, but as I pointed out at the end of the year, it was not able to break out cleanly due to a lack of fuel due to the lack of shorts.

Due to the sharp decline in market prices on the 3rd, there were times when the funding rate (fr) in the perpetual futures market temporarily turned negative, but there was immediate buy-in, and as a result, fr reached a record level of 0.3%. It is highly likely that the market position has not improved due to the rise in the market position (Figure 2).

[Figure 2: BTC vs. USD and BTC futures funding rate]Source: Created from bitbank.cc, Glassnode

Although it is surprising that the BTC price is still rising due to ETF-related factors, we believe that the price has been reasonably priced in, and we would like to be careful about “Sell the Fact” in the near term. If the SEC approves a physical Bitcoin ETF, it has been pointed out that it would have until January 10th, which is the deadline for making a final decision on the ETF jointly filed by Ark and 21Shares, so it can be said that the SEC is counting down the days until approval.

In fact, it has been pointed out that if fixed selling occurs and the market pushes down strongly, the chain reaction of unwinding long positions will accelerate the market decline, so it is important to pay close attention to downside risk in the near term.

connection:bitbank_markets official website

Previous report:Even if the futures market is biased, Bitcoin will break out this week.

The post Counting down to Bitcoin ETF approval, beware of downside risk in the near term | Contributed by bitbank analyst appeared first on Our Bitcoin News.

1 year ago

111

1 year ago

111

English (US) ·

English (US) ·