GBTC etc. can be liquidated

A Delaware court on Wednesday approved a proposed sale of shares in the Grayscale and Bitwise crypto investment trusts worth a total of $874 million filed by the debtors of the failed cryptocurrency exchange FTX. The proposal was submitted in early November.

connection: FTX Heritage proposes sale of $600 million Bitcoin investment trust, large-scale remittances such as SOL

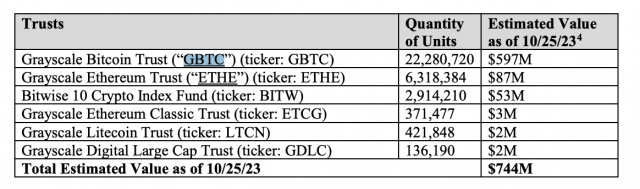

Source: FTX

This offer (valued at the time) consisted of Grayscale Bitcoin Investment Trust (approximately $600 million), Ethereum Investment Trust (approximately $90 million), Bitwise Index Fund ($53 million), and Ethereum Classic Investment Trust (approximately $3 million). The sale involves the sale of seven stocks: Litecoin Investment Trust ($2 million), and Grayscale Large Cap Investment Trust ($2 million). “Or, the transfer would leave the estate ready for dollar-denominated distributions to creditors and allow debtors to act quickly to sell the mutual funds at the appropriate time.”

Recently, attention has been focused on how the discount (negative deviation) rate will affect the GBTC price, which is shrinking.

connection: GBTC’s negative deviation is in single digits, Ark’s Bitcoin strategy is also successful

As for FTX, former CEO Sam Bankman-Fried was found guilty on the 2nd of this month by a New York district court on all seven charges, including wire fraud, commodity fraud, and securities fraud.

connection: Sam, former CEO of virtual currency exchange FTX, found guilty on all seven charges.

CoinPost official app (1.7.15) has been released on iOS and Android

・iOS17 compatible

・Improved display of in-app WebView

・Improved behavior when tapping notifications

Such… pic.twitter.com/Y8dikLRBe7

— CoinPost (virtual currency media) (@coin_post) November 15, 2023

The post Court approves FTX estate to sell $870 million worth of crypto investment trusts appeared first on Our Bitcoin News.

1 year ago

118

1 year ago

118

English (US) ·

English (US) ·