Macroeconomics and financial markets

In the US NY stock market on the 15th, the Dow closed at $280 (0.87%) lower than the previous day and the Nasdaq at $5.9 (0.05%) higher.

Credit Suisse stocks plummeted as financial concerns reignited over Credit Suisse, a major European financial institution, amid a series of bankruptcies in the United States, including the Silicon Valley Bank. Selling swelled mainly in bank-related stocks.

It seems that the decline in stock prices was accelerated by the chairman of the Saudi National Bank, which is the largest shareholder of Credit Suisse, which is suffering from poor performance, and showed a willingness not to accept “additional investment”.

Earlier on the 14th, it announced that there were “significant weaknesses” in the internal control of financial reporting for the past two years. He had a policy in place to correct it.

connection:Swiss central bank makes emergency statement after Credit Suisse’s financial troubles

The Swiss Central Bank and the Swiss Federal Financial Market Supervisory Authority (FINMA) announced that “at the current stage, we meet the above-level capital requirements, but we will provide liquidity to Credit Suisse if necessary.” rebounded.

Credit Suisse is now ready to borrow up to 50 billion Swiss francs ($70 billion).

Due to the unprecedented pace of interest rate hikes by the Federal Reserve (Fed), there is a growing sense of uncertainty about financial risks, such as the view that financial institutions with huge unrealized losses in bond investment are just the tip of the iceberg. We are in an unpredictable situation.

connection:U.S. stocks fluctuate due to slowdown in U.S. PPI and credit uncertainty at Credit Suisse | 16th Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

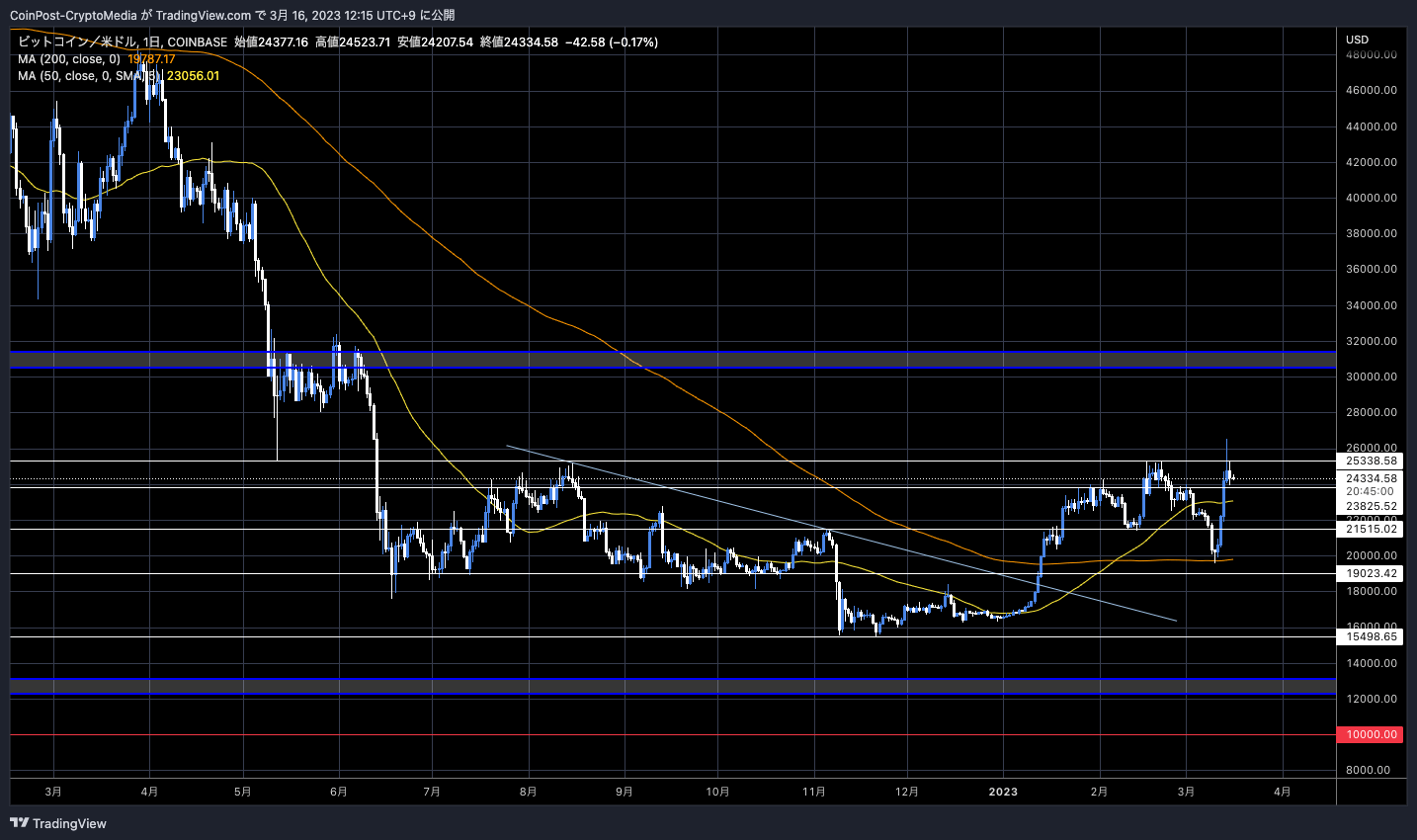

In the crypto asset (virtual currency) market, Bitcoin fell 1.66% from the previous day to $24,351.

BTC/USD daily

Ethereum (ETH) is down 3.33% from the previous day, XRP is down 3.27%, and Polygon (MATIC) is down 6.91%.

Background of BTC Dominance Rise

As the market fluctuates, “dominance,” which indicates the market share of Bitcoin, is rising.

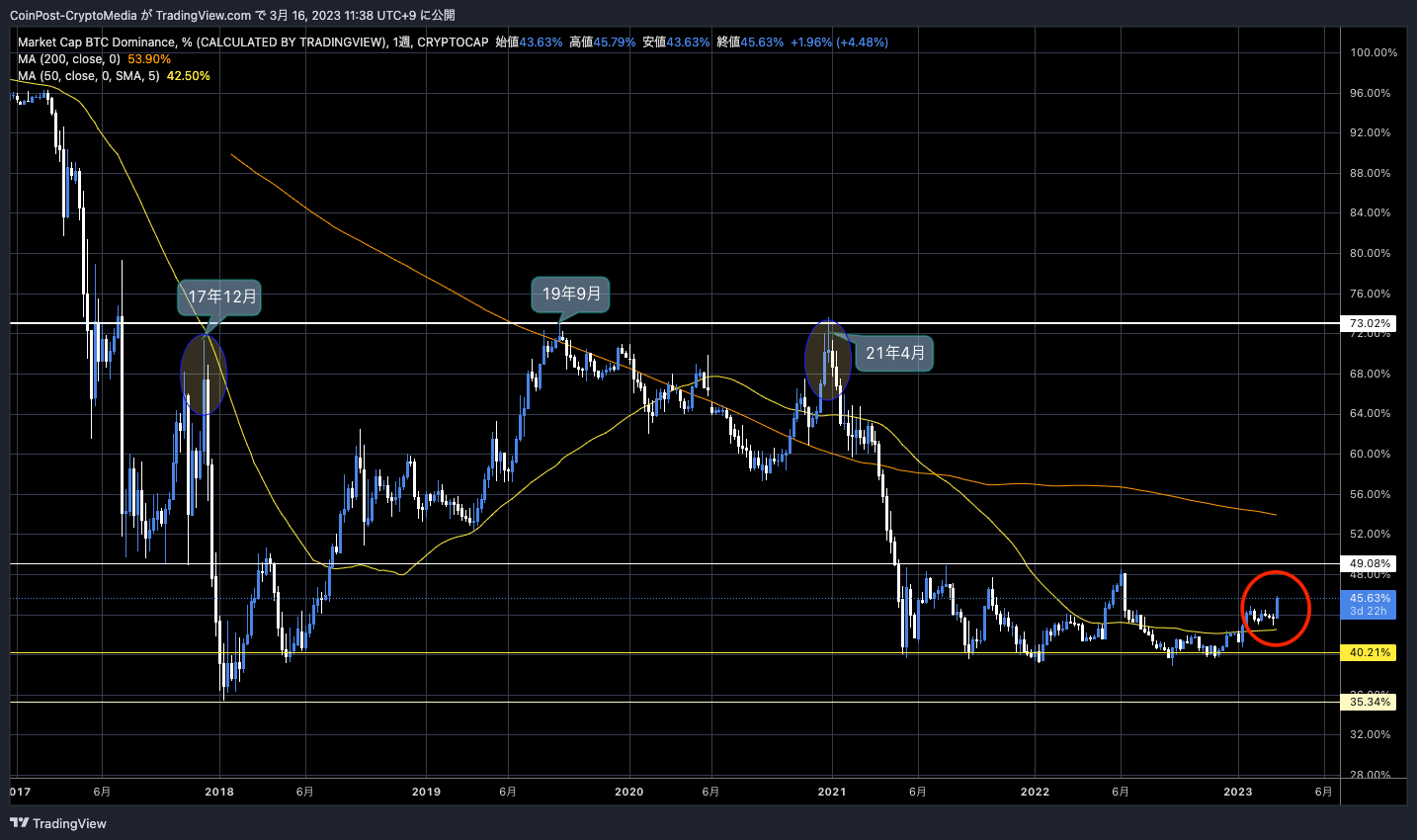

BTC Dominance Weekly

In the rebound phase since the beginning of the year, there were occasions when funds gathered in altcoins more than in bitcoin, but recently, bitcoin has shown firmer price movements than altcoins, with a low rate of decline and a low rate of rise. expensive. BTC dominance increased from 43.6% to 45.6% over the past week.

There are three main reasons for this.

- Financial crisis risk originating in Europe and the United States

- Stablecoin credit uncertainty

- Altcoin securities problem

First, in response to the largest bankruptcy since the Lehman shock, part of the refuge funds were diverted to alternative assets such as gold and bitcoin due to the benefits of not only US Treasury bonds but also interest rate declines and a weak dollar. There is a point.

New York market gold futures prices skyrocketed. 1 ounce = $1,937 at one point.

XAU/USD Weekly

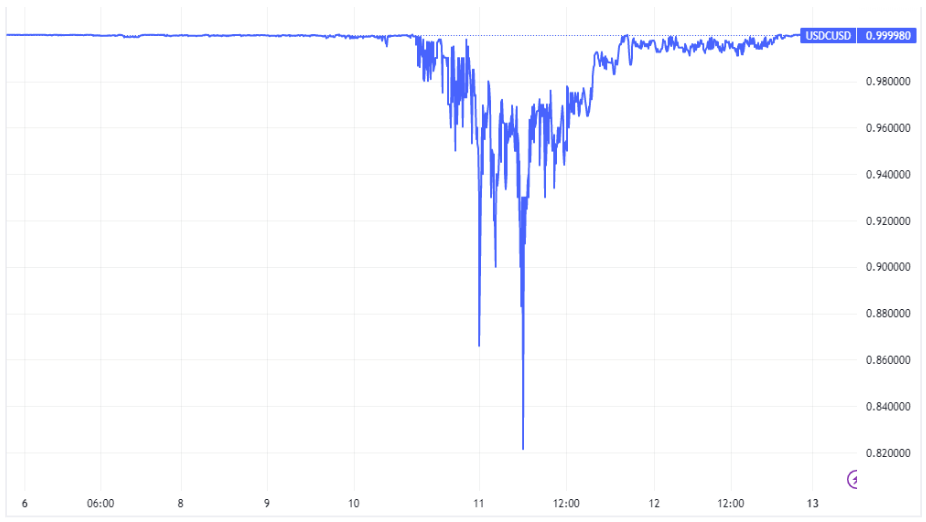

The second is the collapse of the algorithmic stablecoin “UST (TerraUSD)” that occurred last year, and the depeg of the US dollar-linked stablecoin “USD Coin (USDC),” which has been considered highly secure. has shaken the credibility of stablecoins.

USDC’s dipeg is due to the failure of US bank Silicon Valley Bank (SVB) to withdraw 3.3 billion dollars (about 445 billion yen) of the reserve assets of Circle, which issues USDC.

As a result, it became impossible to maintain “1 USDC = 1.0 dollar” and there was a large divergence. It plunged to $0.82 at one point, causing turmoil in the cryptocurrency market.

USDC price history

After that, the US Federal Reserve System and the Treasury Department launched measures to guarantee all deposits, and the USDC peg recovered. Circle’s CEO also commented in a statement that “100% of the USDC reserves are in safe hands. Withdrawals will resume as soon as banks open for business.”

On the other hand, trust in stablecoins, which has come in handy until now, is greatly shaken.

The SEC (U.S. Securities and Exchange Commission) filed a Wells Notice against Binance USD (BUSD), which is issued by Paxos, among the stablecoins that are used as key currencies for exchanges with high market capitalization. In addition, it was forced to end after the New York Financial Services Department (NYDFS) issued an order to stop new issuance.

Redemption is guaranteed until at least February 2024.

Even Tether, which issues the most popular stablecoin “USDT”, has always been skeptical about the backing assets of USDT, which consists of commercial paper (CP), bank deposits, government bonds, etc.

In response, Tether has removed commercial paper from its reserves and replaced it with safer US Treasury securities (US Treasuries), and has announced that it will eliminate secured lending through 2023. He emphasized his stance of striving to ensure transparency by publishing reports from accounting firms.

In February 2011, The Wall Street Journal reported that Cantor Fitzgerald, a major US brokerage firm, was managing a bond portfolio.

The third is the issue of securities.

New York State Attorney General Letitia James sued cryptocurrency exchange Kucoin for violating securities laws.

This is the first time that Ethereum (ETH) has been singled out as an “unregistered security” in court, even though it is a state court rather than a federal court. As for stocks listed on the exchange, Luna (LUNA) and UST (TerraUSD) are also securities, he said.

Ethereum’s hard fork “The Merge” last year changed the consensus algorithm to PoS (Proof of Stake) and made it possible to stake. Regarding this, SEC Chairman Gensler said, “All PoS-based cryptocurrencies that can be profited from staking protocols are likely to be considered securities and are under the jurisdiction of the SEC.” ing.

It has been pointed out that there will be a certain amount of selling pressure due to the ability to withdraw the amount staked so far through the large-scale upgrade Shanghai scheduled for April this year, and there is also a view that this is one of the reasons for the rise in bitcoin dominance.

connection:What is the ETH “Shanghai” upgrade?Summary of each company’s view on staking cancellation and ETH selling pressure

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Credit Suisse Business Uncertainty Brings Prices Down, 3 Reasons for Bitcoin Dominance appeared first on Our Bitcoin News.

2 years ago

142

2 years ago

142

English (US) ·

English (US) ·