As younger generations navigate a rapidly changing economic environment, cryptocurrencies and real estate are emerging as top investment choices, according to Bank of America’s (BofA) 2024 Study of Wealthy Americans.

The report highlights a growing generational divide, with Gen Z and millennials favoring digital assets and alternative investments over traditional equities.

Bank of America’s research points to a significant shift in investment strategies driven by the greatest generational wealth transfer in history.

Younger affluent Americans are increasingly turning away from US stocks, a staple for older generations, in favor of cryptocurrencies and real estate.

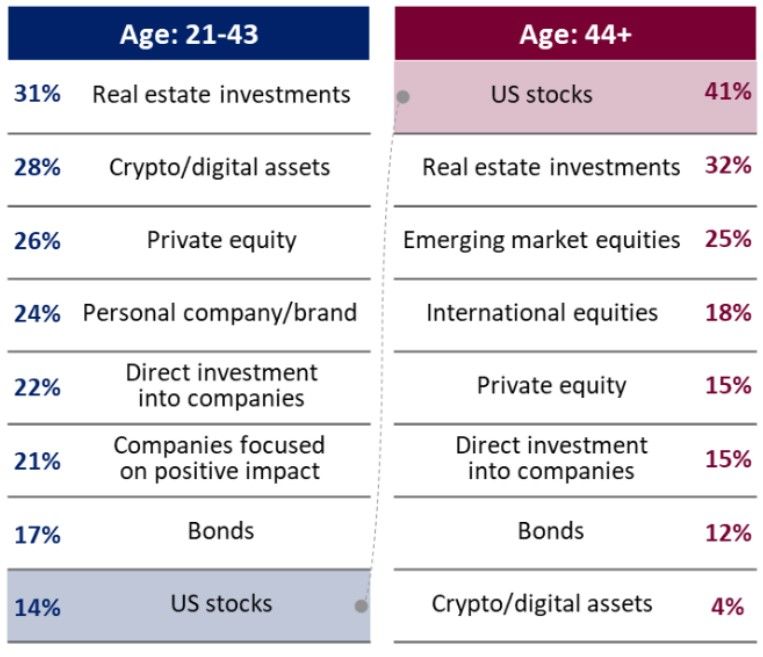

The study reveals that 28% of younger investors now prefer crypto, compared to 41% of older investors who still prioritize US stocks.

Source: Bank of America

Younger investors opt for crypto and real estate

The report underscores the growing appeal of alternative investments for younger Americans.

While 31% of younger investors cite real estate as their top choice, cryptocurrencies follow closely at 28%, and private equity attracts 26% of younger investors.

This marks a departure from older generations, who continue to lean on traditional equities (41%) and real estate (32%).

Real estate’s enduring popularity, especially in major metropolitan areas, is seen as a hedge against inflation and a source of steady appreciation.

Meanwhile, the rise of private equity is linked to younger investors seeking high-growth opportunities in sectors like technology, healthcare, and renewable energy.

Generational wealth transfer

The study also highlights how the largest generational wealth transfer in history is reshaping investment priorities.

As Generation X approaches its 60s, younger investors are increasingly diverging from the traditional portfolios favored by their parents.

This shift reflects broader changes in the global economy, driven by technological advancements and the increasing popularity of digital assets.

Katy Knox, president of BofA Private Bank, notes that this transition is happening against a backdrop of “great social, economic, and technological change,” prompting advisors to rethink their strategies for meeting the evolving needs of younger investors.

Diverging philanthropic values

The report also reveals a generational divide in philanthropic values.

While older generations expect their children to follow their approach to charitable giving, younger investors are favoring more targeted, impact-driven strategies.

This shift reflects a broader trend of younger Americans aiming to make a meaningful difference through social impact investing and other forms of philanthropy.

As wealth increasingly transfers to Gen Z and millennials, financial advisors will need to adapt, offering guidance on alternative investments like cryptocurrencies, private equity, and real estate while also recognizing the unique goals and values of younger investors.

The post Crypto and real estate overtake US stocks as top investment choices for younger Americans: BoFA appeared first on Invezz

English (US) ·

English (US) ·