Flare Network is an EVM (Ethereum Virtual Machine) compatible blockchain that enables the bridging of assets across multiple networks.

Flare Network is currently conducting a governance vote called “FIP.01”, and if this vote is passed, FLR’s wrap delegate (delegation) will acquire a new native token “FLR (Flare token)”. The trend is attracting attention because it needs to be addressed.

FLR is listed on multiple domestic exchanges, but as of February 2023, only “SBIVC Trade” has announced support for the above-mentioned wrap delegate.

Therefore, in this article, we will explain in detail from the overview of FLR to domestic listing trends and the benefits of using SBIVC trade for FLR trading.

table of contents- What is Flare Network’s native token “FLR”?

- FLR airdrop and history of domestic listing

- List of exchanges listing FLR in Japan

- Collaboration with Ripple, what are the strengths of SBIVC trade

- FLR operates smartly with SBIVC trade

- Comparison table of FLR handling status

1. What is Flare Network’s native token “FLR”?

First, let’s give an overview of Flare Network’s native token “FLR (Flare token)”.

1-1. What is Flare Network?

First, let me give you an overview of FLR’s network, the Flare Network.

The Flare Network concept is “Connect everything” and features features focused on promoting interoperability in the Web3 ecosystem.

At the beginning of planning, the purpose of developing Flare Network was to implement smart contracts on XRPL (XRP Ledger), which is the underlying technology of XRP, and expand its functions. However, after that, we changed our policy and steered in the direction of significantly enhancing functions. And in July 2022, it was re-released as a new network that can integrate cross-chain smart contract functions into various chains.

The Flare Network is built around two protocols called ‘State Connector’ and ‘Flare Time Series Oracle (FTSO)’.

State Connector is a system that can reach consensus on information on external networks and the Internet. Build highly interoperable apps to enable secure use of external network and Internet information.

FTSO is a database that securely connects data such as token prices and transaction information to dApps on the Flare Network in real time.

1-2. What is “FLR (Flare Token)”?

FLR is the native token of such Flare Network.

The initial name of the development was “Spark Token”, but it was renamed to “Flare Token” at the time of the above-mentioned re-release.

FLR will be used for transaction fee payments and staking in the network, as well as serving as a governance token within the ecosystem. Users can also wrap FLR and use it as collateral in various DeFi protocols as WFLR.

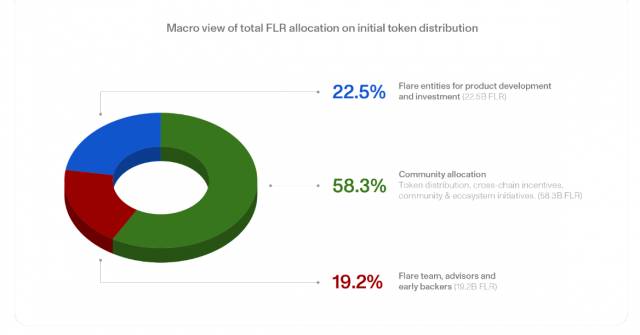

As shown in the figure below, 58.3% of the supplied FLR will be redistributed within the community through incentives and ecosystem support programs to revitalize the community.

1-3. What is FIP.01 (Flare Improvement Proposal 01)?

Regarding FLR, a proposal to improve FLR entitled “FIP.01 (Flare Network Improvement Proposal 01)” has been made, and as of February 2023, a governance vote is being conducted.

FIP.01 aims to improve the economic sustainability of native tokens, strengthen incentives, and improve Tokenomics in general in line with the expansion of functions due to the above-mentioned Flare Network policy change.

As I mentioned at the beginning, if FIP.01 is passed, there will be major changes regarding FLR. In particular, the need for FLR wrapping and delegate support for new FLR acquisitions will have a significant impact on existing networks.

2. History of FLR airdrop and domestic listing

Next, I will explain the outline of the airdrop implemented by FLR and the history of domestic listing.

To commemorate the release of the aforementioned “State Connector” and “Flare Time Series Oracle (FTSO)”, Flare Network will conduct an airdrop of FLR for XRP holders around the world, including exchanges in Japan.

The initial distribution was for 15% of the FLR rights holdings, with December 12, 2020 as a snapshot (date and time of rights vesting), with actual distribution in January 2023. The remaining 85% will also be in phased distribution.

Although this airdrop caused a significant drop in the price of FLR, it attracted a lot of attention as the largest airdrop ever, sending over 4 billion FLR to millions of addresses and centralized exchanges. .

Since this airdrop has led to the distribution of FLR to cryptocurrency exchanges around the world, FLR has been actively listed in Japan as well.

As a first example, bitbank announced the first domestic listing of FLR on January 11, 2023. At the same time, SBIVC Trade also announced that it will distribute FLR to customers eligible for airdrops.

3. List of exchanges listing FLR in Japan

As of February 10, 2023, the following eight domestic crypto asset exchanges have listed FLR, including SBI VC Trade.

- SBI VC Trade

- bitbank

- coin check

- bitFlyer

- GMO coin

- DMMBitcoin

- BITPoint

- Huobi

Seven companies announced their handling in a short period of time. Since the airdrop was for XRP holders with a high percentage of Japanese investors, we can see high expectations for Flare Network.

At the time of writing (February 15, 2023), Flare Network is in the process of voting for FIP.01. If the proposal is passed, it will have a significant impact as it will not be possible to acquire additional FLR through exchanges unless they support wrap delegates.

As of February 2023, SBIVC Trade is the only domestic exchange that has announced that it will handle wraps and delegates on its behalf. If FIP.01 is passed, future FLR operations will benefit greatly from using SBIVC trades.

4. Collaboration with Ripple, what are the strengths of SBIVC Trade?

“SBIVC Trade” is a domestic crypto asset exchange under the umbrella of SBI Holdings, which engages in securities, banking, and crypto asset-related businesses.

4-1. Relationship between SBIVC Trade and Ripple

SBI Holdings is a partner company with Ripple, which developed XRP in the United States, so it is known in Japan for its extensive XRP-related services.

For example, in July 2021, SBI Remit, a group company of SBI Holdings, which operates an international remittance business, Ripple, and Coins.ph, which operates a crypto asset exchange business in the Philippines, announced the launch of a joint project.

We have announced the launch of ODL (on-demand liquidity) service for RippleNet, a software that streamlines international remittances for financial institutions. As a result, international remittances from Japan to the Philippines can be made much faster and at a lower cost than before.

In addition, “SBI Ripple Asia”, a joint venture between Ripple and SBI Holdings, has also been launched, providing a blockchain platform to financial institutions in the Asian region.

In this way, SBIVC Trade under the umbrella of SBI Holdings, which collaborates closely with Ripple, can be said to be the best exchange to enjoy the benefits of Ripple’s related products.

4-2. Immediate support for FLR updates with SBIVC trade

SBIVC Trade is the only domestic exchange that has indicated that it will be able to wrap and delegate FLR if FIP.01 is passed. (*As of February 15, 2023)

If you want to participate in FLR trading as soon as the proposal is approved, having an account with SBIVC Trade can be an advantage.

In order to apply for wrap delegate correspondence, it is a condition that you open an SBIVC trade account and lend all the FLRs you own. By lending FLR, SBIVC Trade can act on behalf of the wrap delegate and obtain additional FLR as a lending reward.

The lending period at the current stage is assumed to be about 3 years, and it was announced that it is a policy to accept mid-term cancellation.

Five. FLR operates smartly with SBIVC trade

After rebranding and renaming tokens, Flare Network is being developed as a more versatile solution. Its native token, FLR, is also attracting a lot of attention from investors.

If FIP.01 is passed, major updates will bring further interoperability improvements and advanced tokenomics. On the other hand, you need to choose carefully which exchanges you trade FLR on, as new token acquisitions require wrap delegates.

As of February 2023, the SBIVC trade, which is the only one that has expressed support for wrap delegates when FIP.01 is passed, and has a deep relationship with Ripple, can be said to be the leading candidate.

FLR handling comparison table:

| SBI VC Trade | ○ | × | Receipt: Coming soon Delivery: 2 times in the past |

○ (confirmed) |

| DMM Bitcoin | ○ | × | × | × |

| coin check | ○ | × | Delivery: Scheduled to be available from the end of March | × |

| GMO coin | ○ | × | Available only for delivery | × |

| bitFlyer | ○ | sales office only | Receipt: Coming soon Delivery: Coming soon |

× |

| BITPoint | ○ | sales office only | × | × |

| bitbank | ○ | exchange only | Available only for delivery | × |

| huobi | ○ | × | × | × |

*As of February 15, 2023

The post Crypto Asset Flare Token (FLR) Domestic Listing, Comparison of Exchange List and Support Status appeared first on Our Bitcoin News.

2 years ago

147

2 years ago

147

English (US) ·

English (US) ·