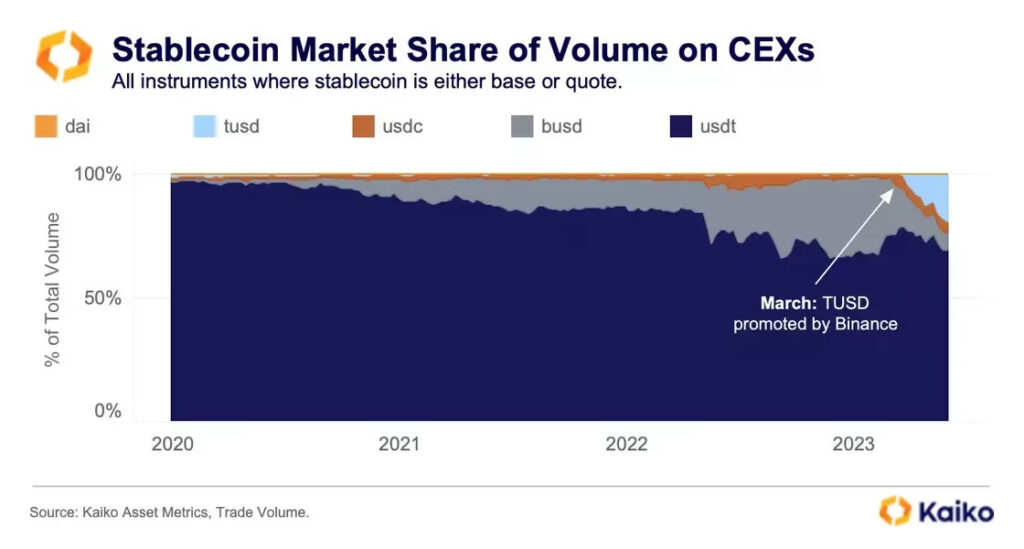

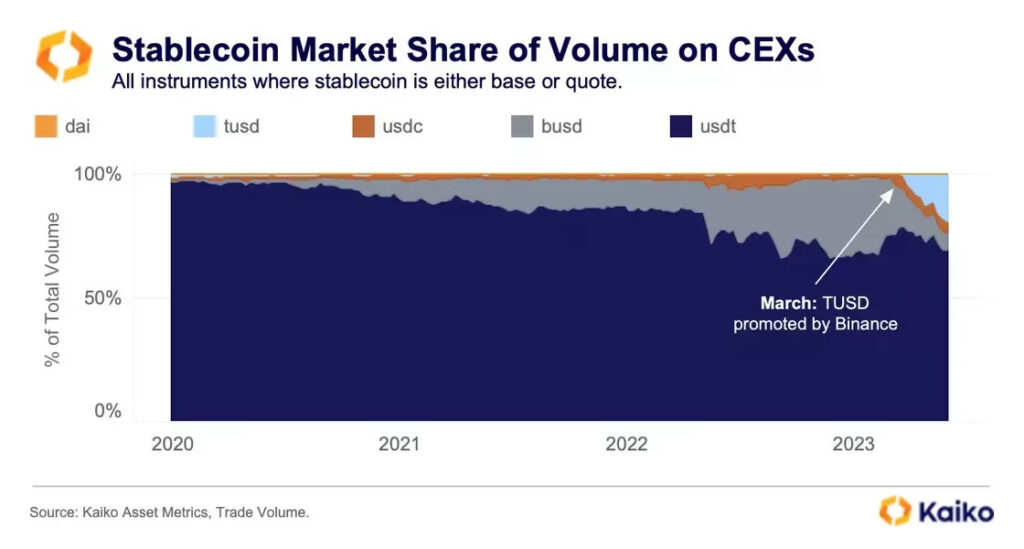

Centralized stablecoins dominate cryptocurrency trading, but the recent turmoil has shown the market to rely heavily on stablecoins that lack transparency in reserves. , TrueUSD (TUSD) poses the biggest risk, according to a report by cryptocurrency market research firm Kaiko.

As of Tuesday, 74% of all transactions on centralized cryptocurrency exchanges were in stablecoins, while only 23% incorporated fiat currencies, according to data from Kyco.

TUSD trading volume surges

Binance, the world’s largest cryptocurrency exchange, had zero trading fees on TUSD to encourage its use after it was ordered to suspend the issuance of Binance USD (BUSD) earlier this year. TUSD surged as a result.

Despite recent scrutiny following the bankruptcy of custodian partner Prime Trust and turmoil in reserve reporting, TUSD volume has dramatically increased from less than 1% to 19% in three months. increased. Tether (USDT), whose reserves were partly Chinese commercial paper in the past, has a 70% share of trading volume.

Stablecoins have become an important part of the crypto ecosystem, facilitating trading and onboarding from government-issued fiat currencies. According to CCData, a crypto asset data company, the total market capitalization of stablecoins is $128 billion (approximately ¥17.92 trillion, converted to ¥140 to the dollar).

Large Scale Stablecoins Survive Turmoil

All of the larger stablecoins have endured a period of turmoil over the past few months. In February, regulators in New York state ordered Paxos to stop issuing BUSD, then the third-largest stablecoin by market cap. The following March, the bankruptcy of Silicon Valley Bank temporarily froze a significant portion of USD Coin (USDC) cash reserves, affecting Maker’s stablecoin DAI. Last month, Tether weathered selling pressure in major stablecoin liquidity pools, while TUSD survived the collapse of Prime Trust.

Lack of reserve transparency

Clara Medalie, Head of Research at Silkworm, said these volatile times have highlighted just how exposed the crypto markets are to the risks and vulnerabilities of stablecoins. “The cryptocurrency market relies heavily on centralized stablecoins, which often lack transparency regarding reserves,” she said.

“Circle has made a lot of efforts to improve the transparency of its USD coin (Tether has also made some efforts over the past year), but information about reserves and corporate structure is not available,” Medalley said. “There is little available, and the relatively unknown TUSD is currently the biggest risk,” he warned.

TUSD reserves are legal assets

With a market capitalization of $3 billion (approximately ¥420 billion), TUSD is a dollar-pegged stablecoin. At the end of 2020, it was acquired by lesser-known Asian conglomerate Techteryx, which took over the intellectual property. The company has denied reports about its relationship with Tron founder Justin Sun, who has been sued by the U.S. Securities and Exchange Commission (SEC) for alleged market manipulation.

According to Chainlink’s reserve proof technology, TUSD reserves are fiat assets. The technology relies on data received from the Network Firm reserve certification. Network Firm is a rebranded accounting team working with FTX.US, the U.S. arm of failed cryptocurrency exchange FXT.

|Translation: CoinDeskJAPAN

|Editing: Rinan Hayashi

|Image: Kaiko

|Original: Crypto Markets ‘Highly Dependent’ on Stablecoins Lacking Transparency, TUSD Poses Risk: Kaiko

The post Crypto Asset Market Dependent on Stablecoin, TUSD Risks: Silkworm | CoinDesk JAPAN | CoinDesk Japan appeared first on Our Bitcoin News.

2 years ago

96

2 years ago

96

English (US) ·

English (US) ·