The post Crypto Market Crash Amid $300M Liquidation Surge and OI Crash appeared first on Coinpedia Fintech News

Amid the broader correction, Bitcoin and altcoins have registered a downfall. With buyers failing to hold onto critical levels, the crypto market is witnessing long-side liquidations and a massive shift in underlying sentiments toward bearishness. Let’s take a closer look at the on-chain data of the crypto market to find the bottom of the crash.

Liquidations On The Rise

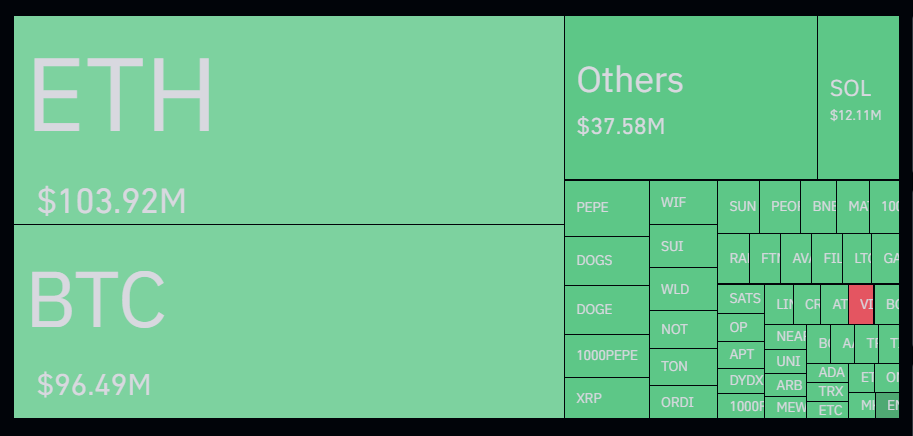

Coming to the liquidations, the crypto market witnessed a massive surge alongside liquidations. The total crypto market witnessed a surge of $281 million alongside liquidations, with $32 million on the short side.

Hence, with more than $300 million worth of positions being liquidated, the volatility has surged amid the crypto market crash. Over the past 24 hours, Ethereum has registered $103 million liquidations, Bitcoin $96.49 million, Solana $12.11 million, and $37.58 million in other altcoins.

The Open Interest Crash

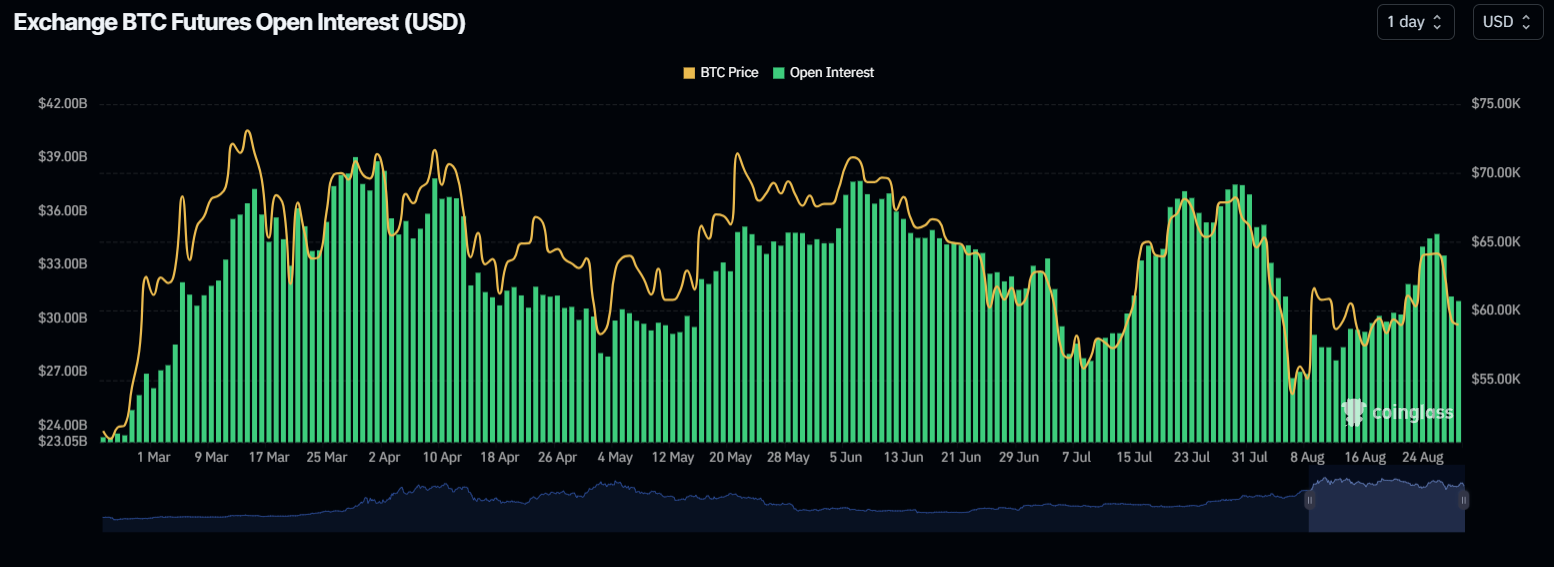

Since March 2024, the highly volatile sideways movement within a huge price range in Bitcoin resulted in an equally volatile Open Interest. At present, the crypto market crash comes with a sharp fall in the Bitcoin open interest from $34.72B to $30.79B in just three days.

Matrixport Waits To Siren Sell Signal

In a recent tweet from Matrixport, a report suggests that the ongoing crash lacks any significant news to trigger the motion. Hence, the downfall comes with the long-liquidations in a low liquidity market.

As of now, BTC sustains the $59K support level, and the bulls might not have to worry as long as they hold this level.

Stablecoins Market Cap Hits $166B

With the increasingly volatile market, the Stablecoins market cap hits a record high of $166 billion. The increase in the stablecoins market cap is often a signal of an upcoming surge in Bitcoin and altcoin prices. Hence, the chances of a recovery from the sudden crypto market crash are high, based on the historical trend of stablecoins market cap.

Conclusion

In conclusion, the recent crypto market crash, with $300 million in liquidations and a crash in open interest, increases the bearish sentiments. However, Bitcoin holds tight to the $59K support level, providing a glimmer of hope for bulls.

Additionally, the surge in the stablecoins market cap to $166 billion suggests potential recovery opportunities, as historically, such increases often precede upward movements in crypto prices.

1 year ago

83

1 year ago

83

English (US) ·

English (US) ·