The cryptocurrency market saw a sharp selloff on Tuesday, wiping out recent gains across major digital assets.

Bitcoin (BTC) once again dropped to the $84,000 level, reversing its rally after former US President Donald Trump’s announcement regarding a crypto reserve.

Source: CoinMarketCap

Ethereum (ETH), XRP, and Solana (SOL) also experienced significant losses, plunging between 14% and 20% in intraday trading.

The crash coincided with over $1 billion in liquidations across the crypto sector, with analysts pointing to liquidity gaps and broader market pressures.

The global cryptocurrency market cap tumbled nearly 10%, falling to $2.76 trillion. Altcoins bore the brunt of the downturn, with meme coins also mirroring the decline.

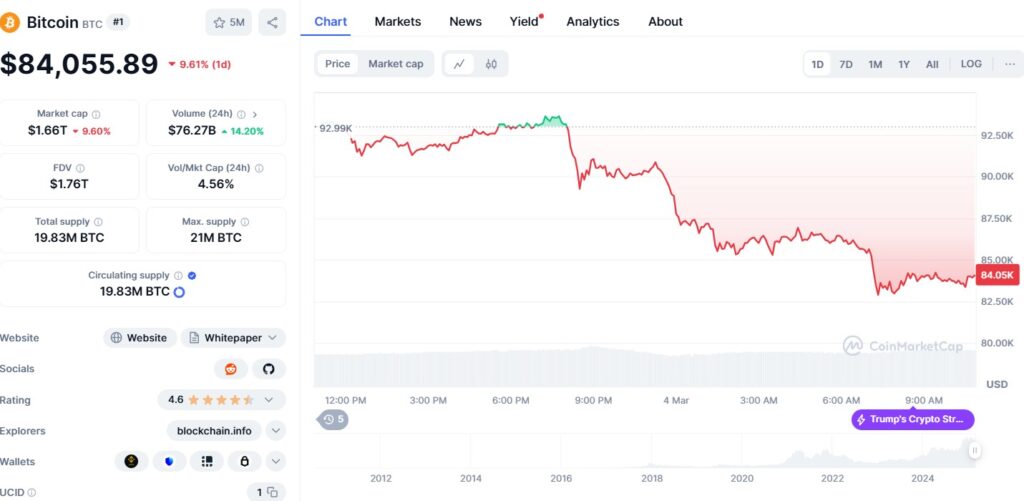

Bitcoin tumbles below $84K

Bitcoin fell nearly 10% on Tuesday, trading at $84,000 after reaching an intraday low of $82,467.24.

The flagship cryptocurrency saw nearly $400 million in liquidations within 24 hours, contributing to the sharp price reversal.

Despite the losses, Bitcoin’s dominance in the market rose slightly to 60.40%, indicating that alternative cryptocurrencies faced even greater selling pressure.

Investors cited CME futures gaps and liquidity constraints as key reasons for Bitcoin’s latest price dip, which overshadowed the optimism sparked by Trump’s pro-crypto stance.

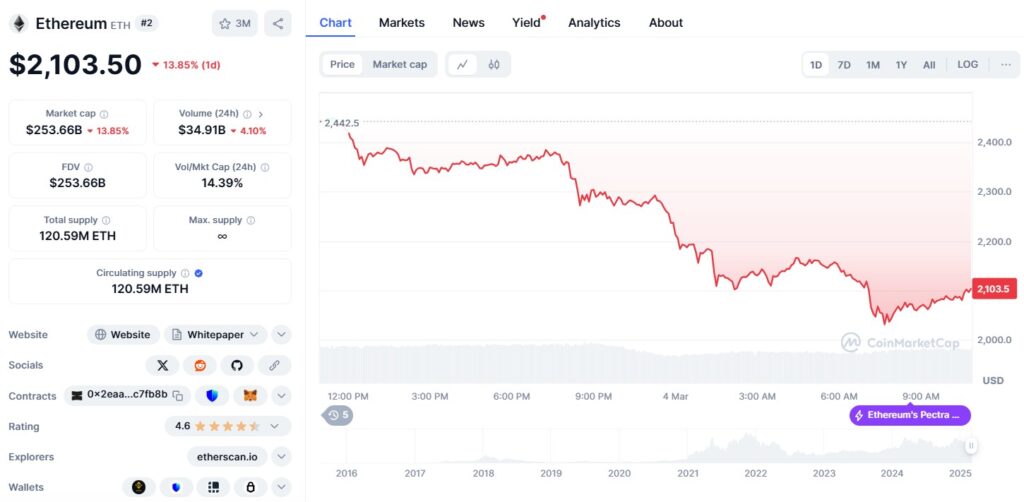

Ethereum and altcoins slump

Ethereum plunged 15% in the past 24 hours, sinking to $2,103.

The second-largest cryptocurrency by market capitalisation saw its market share decline to 9.1% as nearly $210 million worth of ETH positions were liquidated.

Source: CoinMarketCap

The coin reached a daily low of $2,004.21 before briefly recovering.

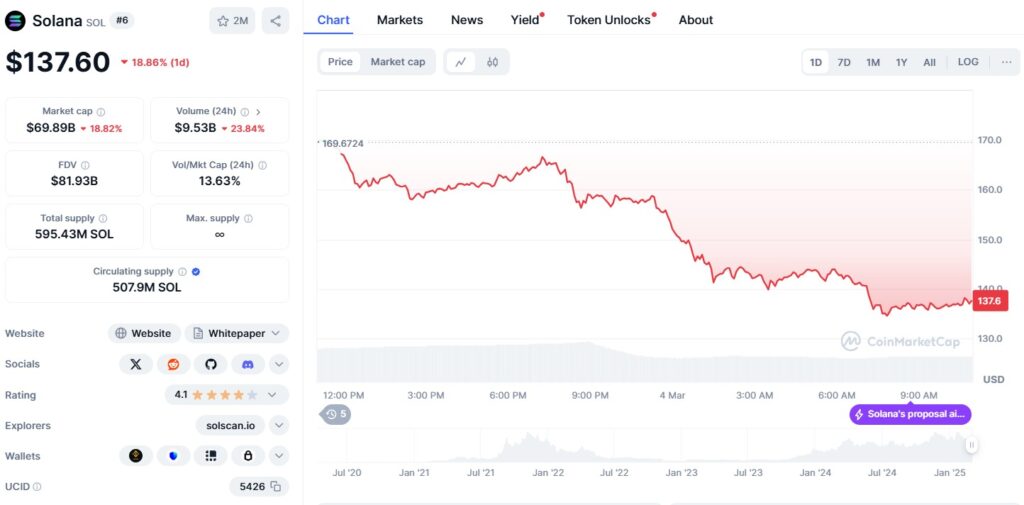

XRP and Solana faced even steeper declines. XRP lost 18%, falling to $2.29, while Solana nosedived 20% to trade at $137.5.

Solana recorded $70.55 million in liquidations as investors exited positions, while XRP suffered liquidations exceeding $62 million.

Source: CoinMarketCap

The downturn extended to meme coins as well, with Dogecoin (DOGE) shedding 15% to trade at $0.1917.

Shiba Inu (SHIB) and Pepe Coin (PEPE) also declined by 13% and 18%, respectively.

DOGE saw more than $20 million in liquidations, reinforcing the broader selloff trend in riskier crypto assets.

Crypto liquidations exceed $1B

Data from Coinglass confirmed that total liquidations in the crypto market surpassed $1 billion in the last 24 hours, contributing to the price instability.

Bitcoin alone accounted for $396.16 million of these liquidations, with Ethereum following at $209.58 million.

This wave of liquidations, primarily from leveraged positions, accelerated the downward pressure on prices.

Altcoins suffered disproportionately, with high-risk tokens experiencing the steepest losses.

Among the hardest-hit digital assets, Cardano (ADA) declined 25% to $0.7998, while Sonic (S) and Trump-backed Official Trump (TRUMP) tokens also registered 23%-25% losses.

Traders brace for more volatility

The latest crypto market slump underscores the sector’s ongoing volatility, even as institutional interest and regulatory discussions gain traction.

While Trump’s recent comments on crypto reserves signalled potential political support for digital assets, the market reaction suggests that broader economic factors continue to drive sentiment.

With liquidations still weighing on prices and liquidity gaps remaining a concern, traders remain cautious about further downside risks.

If the selloff persists, Bitcoin and other leading cryptocurrencies may struggle to regain momentum in the near term.

The post Crypto market erases $1 billion as Bitcoin, Ethereum, and Solana sink on liquidation wave appeared first on Invezz

English (US) ·

English (US) ·