Macroeconomics and financial markets

In the US NY stock market on the 19th, the Dow closed at $613 (1.8%) lower than the previous day.

While the US Wholesale Price Index (PPI) for December 2022, announced on the same day, indicated a slowdown in inflation, there is a view that concerns about a recession (economic recession) were conscious of the earnings season.

The US stock index has been on an upward trend since the beginning of the year, but with the announcement of the US Federal Open Market Committee (FOMC) ahead of the announcement, profit-taking selling of position adjustment took precedence.

Relation:Financial market tankan on the morning of the 19th | NY Dow and cryptocurrency-related stocks fall across the board Inflation slows down, but concerns about economic slowdown grow

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 2.55% from the previous day to $20,750.

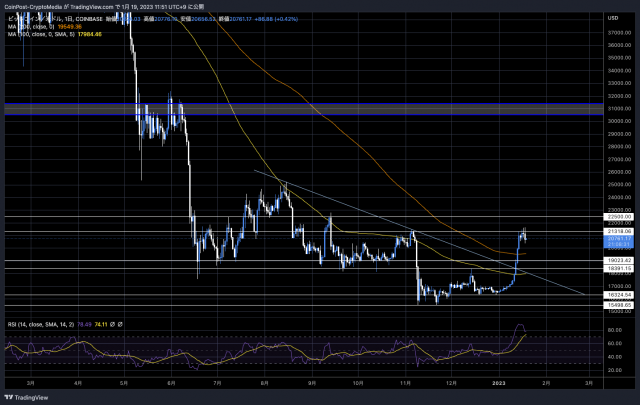

BTC/USD daily

The streak accompanied by a short squeeze has come to a halt, and the pair is moving into a correction phase at the resistance line near $21,500. If the price continues to drop, the 200 MA of $19,550 and $19,000 are the main support lines (lower support lines).

Volatility (price volatility) is higher in the alt market, with Ethereum (ETH) down 3.86% and Solana (SOL), which has rebounded sharply since the beginning of the year, down 8.00%. According to CoinGecko data, the Solana Ecosystem’s market capitalization fell by 7.2%.

Analysts are split on the outlook for the market. KALEO expressed optimism that BTC price will hit the $30,000 level after a bear trap below $20,000.

$30K is a magnet. pic.twitter.com/yhpJh0zwqt

— KALEO (@CryptoKaleo) January 16, 2023

DataDash founder Nicholas Merten is pessimistic.

“The current BTC price is overbought even if you look at the RSI, which is similar to the temporary rebound phase from June to August last year.” If it does, a full-scale winter will come to the cryptocurrency market.”

At midnight Japan time, FUD spread due to speculation that it was related to the money laundering problem of Binance in connection with the information that the U.S. Department of Justice would stream “international enforcement measures” related to cryptocurrencies. pushed down.

This comes after Reuters reported last December that federal prosecutors at the U.S. Department of Justice were considering filing criminal charges against Binance for money laundering allegations.

Relation:Binance Rebuts Reports of US Department of Justice Money Laundering Complaints

However, the target of the enforcement measures confirmed at the time of the announcement was the Hong Kong exchange Bitzlato, which was established in 2016 and is said to have strong ties to Russia, and the founder was arrested and seized.

Genesis Global Capital, a subsidiary of Digital Currency Group (DCG), is expected to file for bankruptcy as soon as this week, Bloomberg reported, citing sources familiar with the matter.

Relation:Crypto lender Genesis to file for bankruptcy this week: report

Last year, Genesis had a liquidity crisis due to the bankruptcy of Singaporean hedge fund Three Arrows Capital (3AC) and FTX, and stopped withdrawals on November 16th. Partner exchange Gemini’s lending service “Gemini Earn” and creditors were also severely affected.

If it fails to raise funds, it seems that it is in a situation where bankruptcy cannot be avoided, and there are concerns about the impact on the related company Grayscale Investment Trust (GBTC).

Relation:DCG, a major cryptocurrency with liquidity problems, explains points about the impact on the market

altcoin market

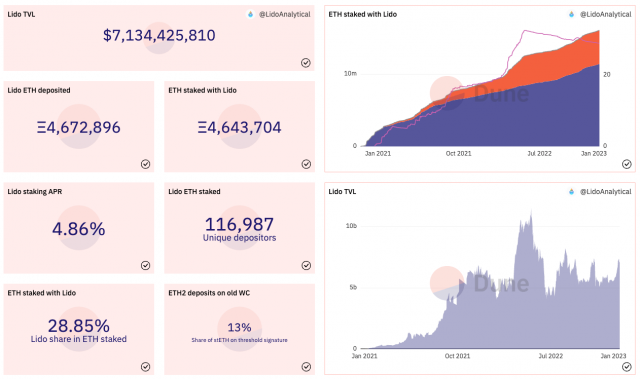

Lido Stoked Ether (stETH) has been doing well recently, up 12.6% w/w and 28.5% m/m.

Earlier this month, liquid staking stETH surpassed MakerDAO to take the top spot in “Total Value Locked (TVL),” which indicates the total amount deposited into DeFi protocols. Investor interest is increasing ahead of Ethereum’s “Shanghai upgrade” scheduled for March this year.

stETH is a mechanism that issues the same amount of ETH deposited by staking via Lido Finance.

Even if the minimum unit for staking is “32ETH”, if stETH is used, it is possible to operate DeFi (decentralized finance) using stETH as collateral while earning interest rewards for ETH staking. gained popularity from

So-called liquid staking derivatives also contribute to improving liquidity, and according to the cryptocurrency data site Dune Analytics, stETH accounts for about 30% of the total amount of ETH staked on the Ethereum PoS beacon chain.

Dune

On the other hand, in June last year, multiple institutional investors, including the lending platform Celsius Network, which went bankrupt due to the impact of the Terra (LUNA) shock, held large positions in stETH, so we built it with leverage. The risk of liquidation of DeFi positions that have been closed has increased.

Relation:Ethereum-related “stETH” price divergence, the background

GM radio archive release

https://t.co/nr8dNhvmzM

— CoinPost Global (@CoinPost_Global) December 22, 2022

Special guests this time are Yat Siu, chairman of Animoka Brands, a major Web3 (decentralized web) company, and Benjamine Charbit of Darewise Entertainment. He talks about the current challenges of Web3 games and NFTs, Darewise’s first title “Life Beyond”, and the outlook for the industry.

Relation: To hold the 2nd “GM Radio”, guests are the chairman of Web3 major Animoka Brands

[Announcement]

CoinPost Hosts One of Asia’s Largest International Conferences

Date: July 25th and 26th, 2023

Venue: Tokyo International Forum

Press release https://t.co/vvgzhfPOVb

[Specified]Accepting pre-whitelist registration that can be completed in 2 seconds https://t.co/bigJoFNBvh pic.twitter.com/5FfHvqKppB

— CoinPost-virtual currency information site-[app delivery](@coin_post) December 26, 2022

Click here for a list of market reports published in the past

The post Crypto Market Rebounds, U.S. Department of Justice Concerns Also Pushing Down appeared first on Our Bitcoin News.

2 years ago

159

2 years ago

159

English (US) ·

English (US) ·