Bitcoin consolidated within a tight range between $82,060.62 – $84,693.29 as the price seemed to stabilize ahead of key economic data set for release this week.

The total crypto market cap remained relatively stable throughout the day, following a slight dip during the early Asian trading hours.

At press time, it stood at $2.81 trillion, down a little over 1% in the past 24 hours.

Market sentiment skewed towards fear territory at 32, with Bitcoin trading activity remaining muted and showing no gains.

Top altcoins mostly saw limited gains, with the sector’s total market cap also slipping slightly over the day.

What Bitcoin price is not going up?

Bitcoin traders remained cautious amid economic uncertainty.

With Donald Trump’s tariffs already wreaking havoc across both crypto and traditional markets, bulls had a hard time reclaiming the $84,000 support.

Some of the caution also stemmed from anticipation of key economic data, with the Federal Reserve’s latest policy decision in focus.

Firstly, on March 17, the latest US retail sales data will be released, giving traders insight into consumer spending trends.

Then, on March 19, the Federal Reserve is set to announce its interest rate decision, with no changes expected.

While the decision itself may not shake the markets, investors will be closely watching the Fed’s updated economic projections and Fed Chair Jerome Powell’s comments for hints on future policy moves.

Over in Europe, all eyes are on the Eurozone inflation report, also due on Wednesday, which is expected to dip slightly to 2.4% but remain above the ECB’s 2% target.

Meanwhile, the Bank of England is set to meet on Thursday, with traders increasingly betting on a rate cut later this year.

Current odds point to a 75% chance of a cut in May and 55% in August. However, persistent wage growth could keep the BOE cautious.

Moreover, Bitcoin exchange-traded products have been facing heavy selling pressure, further dampening market sentiment.

Investors reportedly pulled $1.7 billion from crypto ETPs last week alone, bringing the total five-week outflows to $6.4 billion, according to CoinShares.

Will the Bitcoin price go up?

Currently, analysts remain divided over Bitcoin’s next move in the short term.

One of the key catalysts that could influence price action is Federal Reserve Chair Jerome Powell’s post-FOMC remarks.

While the Fed is widely expected to keep rates unchanged, Powell’s tone on future policy could drive volatility.

If he hints at quantitative easing or a more accommodative stance, risk assets, including Bitcoin, could see a swift rebound.

Crypto analyst Kyle Doops believes Powell will likely keep things “as vague as possible,” making it difficult for markets to get a clear direction.

However, “if Powell even whispers ‘QE’ at the next FOMC, markets will move fast,” he added.

Bitcoin’s next likely move could be a drop to $78k, according to pseudonymous trader Captain Faibik

Bitcoin’s next likely move could be a drop to $78K, according to pseudonymous trader Captain Faibik, who sees this level as a key liquidity grab before any major upside move.

However, once this shakeout is complete, he expects a breakout toward $109K by mid-April.

Analyst Marzell also expects a similar dip, which he believes would be “good” for long-term recovery. (See below.)

Seeing this next $btc price move down towards $72,000 imo would be good for support & continuation to the upside.

Fellow trader CrypNuevo also sees upside potential, noting that liquidity is mostly stacked above the current range.

According to the analyst, $85.4K–$87.1K is a key target for bulls in the short term, making a move toward this zone “more than likely” in the coming week.

Another bullish case was presented by Merjin the Trader, who flagged a bullish cross on Bitcoin’s stochastic RSI, a momentum indicator.

According to Merjin the Trader, every time this bullish crossover has occurred on the weekly chart, Bitcoin has historically seen strong rallies within three to five months, with gains averaging around 56%—sometimes even surpassing 90%.

If this pattern holds, Bitcoin could be set for another parabolic rise by July or August, potentially pushing the price toward $120,000.

At the time of writing, Bitcoin was trading at $83,423 with no gains on the day.

Slow day for altcoins

The top altcoins saw only limited gains, with the biggest movers being small-cap tokens, mostly driven by community hype.

The top gainer across the entire crypto market, Epic Cash (EPIC), privacy-focused crypto, which rallied over 344% in the past 24 hours after an exchange listing, had a market cap of only $28.2 million.

Meanwhile, the total altcoin market cap dipped 0.68%, and the Altcoin Season Index remained unchanged at 20.

The top gainers for the day were:

PancakeSwap

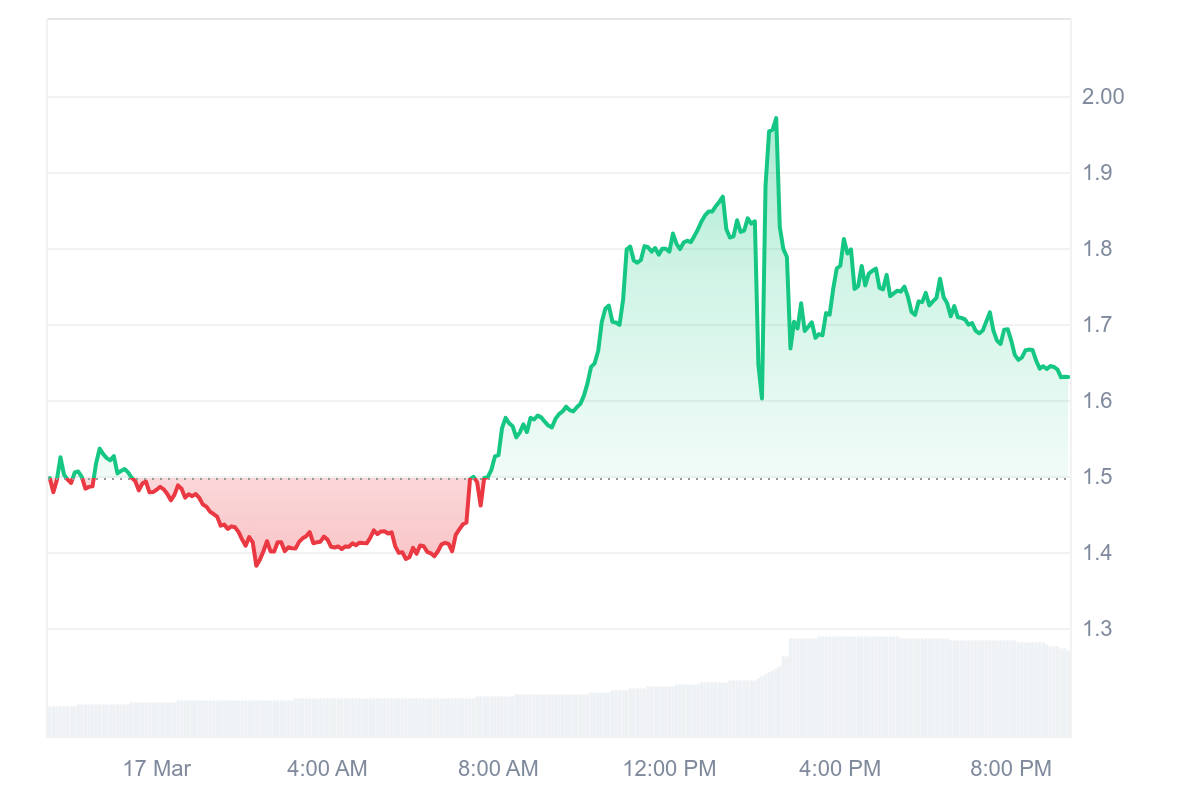

PancakeSwap (CAKE) soared 40.5% over the last day to $2.52 at the time of writing, bringing its market cap to over $760 million.

Notably, the gains accompanied a jump in trading volume which increased by 367% to over $819 million.

Source: CoinMarketCap

Today’s rally came as PancakeSwap took the lead spot in the decentralized exchange market, recording $1.64 billion in 24-hour trading volume surpassing Uniswap and Raydium.

The surge in trading activity follows Binance’s massive $2 billion investment in Abu Dhabi-based tech investment firm MGX, boosting investor confidence in Binance-related projects like PancakeSwap.

Additionally, the growing hype around meme coins has fueled more transactions on decentralized exchanges (DEXs), further driving PancakeSwap’s momentum.

BinaryX

Over the last 24 hours, BinaryX (BNX) gained 8.8%, breaking out of its consolidation range of $0.7 to $1.3 with its price rising to an all-time high of $1.97.

Its market cap was seated at $620 million with nearly double daily trading volume which hovered over $560 million.

Over the last 24 hours, BinaryX (BNX) gained 8.8%, breaking out of its consolidation range of $0.7 to $1.3 with its price rising to an all-time high of $1.97.

Its market cap was seated at $620 million with nearly double daily trading volume which hovered over $560 million.

Source: CoinMarketCap

Most of its gains are largely attributed to investor hype following BinaryX’s announcement of its rebranding to Four (FORM) and the corresponding token symbol revision.

Additionally, there has been a notable accumulation of BNX tokens by whales, ahead of the upcoming token swap scheduled for March 21, 2025, with a 1:1 conversion rate from BNX to FORM.

Major exchanges, including Binance, have expressed support for this transition, indicating a smooth process for token holders.

Curve DAO

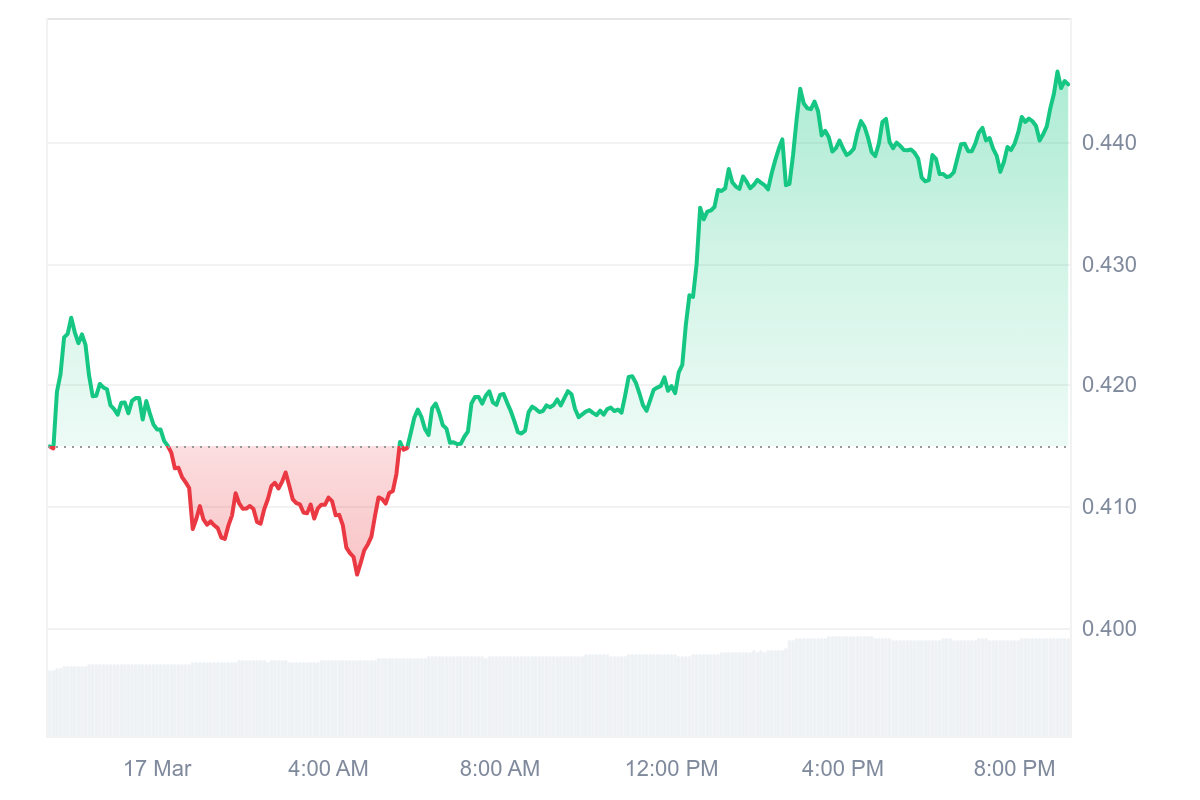

Curve DAO (CRV) rose 7.2% over the last day to a weekly high of $044 at press time.

Its market cap was seated at $578 million, while its daily trading volume increased by 47% to $117 million.

Source: CoinMarketCap

While no specific catalysts for its recent price gains were evident at the time of writing, CRV recently broke above a descending trendline, which was possibly perceived as a buy signal for traders.

The post Crypto price today: Bitcoin’s fate hinges on macro data, CAKE surges 40% appeared first on Invezz

![Story [IP] gains over 10% amid liquidity surge, but is a reversal here?](https://ambcrypto.com/wp-content/uploads/2025/07/Abdul-1.webp)

English (US) ·

English (US) ·