The cryptocurrency market weakened further on Thursday, with Bitcoin slipping below $112,000 as its corrective phase deepened.

Major altcoins mirrored the decline, with Ethereum falling under $4,000, XRP edging toward $2.80, and Solana retreating to $203.

Despite the broader pullback, some tokens outperformed. Zcash and Synthetix posted double-digit gains, standing out among the top altcoins.

Recent high-flyers like 0G and Aster, however, succumbed to profit-taking pressures.

Overall market sentiment remained fragile, with global crypto market capitalisation dropping to $3.83 trillion.

CoinMarketCap data showed the average relative strength index at 37.13, suggesting most tokens are trading near oversold conditions.

Crypto struggles as Bitcoin dips under $112k

As the cryptocurrency market grappled with renewed uncertainty, Bitcoin tumbled below the significantly crucial level of $112,000.

Below this threshold, BTC dipped to intraday lows of $111,510 across major exchanges.

The nearly 1% decline over the past 24 hours came with a 10% increase in daily volume to suggest profit-taking deals were high.

However, analysts at QCP Group say BTC may bounce in the fourth quarter.

“Q4 seasonality and expected Fed cuts keep the backdrop constructive, unless next week’s payrolls break the narrative,” they shared on X.

Ethereum, XRP, and Solana drop to key levels

Bitcoin’s losses on the day also had top altcoins faring no better.

Ethereum (ETH), XRP (XRP), and Solana (SOL) slid toward critical technical support areas.

Correlated selling saw Ethereum price drop to lows of $3,978 before bouncing to $4,035 as of writing.

Meanwhile, XRP shed 2% to $2.82, and SOL dropped nearly 4% to lows of $202.

Speculation over new crypto exchange-traded funds, along with increased exposure to ETH, XRP, and SOL by treasury-focused crypto firms, has kept bulls active in the market.

That said, recent declines have pushed all three leading altcoins to critical support levels, which will test the strength of buyers and determine whether the altcoin rally still has momentum.

Analysts note that broader risk asset trends will likely influence crypto performance in the coming months.

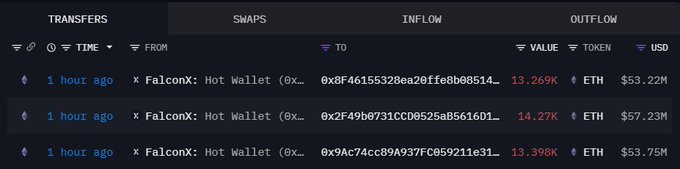

Meanwhile, some whale investors view the current dip as a potential buying opportunity.

🚨 BREAKING 🚨 A WHALE JUST BOUGHT 40,937 $ETH WORTH $163 MILLION. WHALES ARE BUYING THE DIP HEAVILY 🔥

Zcash and Synthetix highlight top gainers

Amid the broader altcoin turbulence, Zcash (ZEC) and Synthetix (SNX) outpaced peers to stand out as top performers.

Bucking the downward trend, ZEC extended its gains to $61.13, up more than 12% in the past 24 hours.

On the other hand, the Synthetix token’s nearly 10% jump allowed bulls to retest the $0.96 mark.

An uptick could propel SNX above $1, with the highs last seen in February likely.

0G, Aster, and Avalanche record sharp declines

Top losers on the day include 0G (0G), Aster (ASTER), and Avalanche (AVAX).

These tokens saw notable gains this week, but have suffered steep losses to rank among the biggest losers in the leading 500 coins by market cap.

0G, the modular AI blockchain token, plunged 25% to $3.97, while Aster, native to the tokenised real-world assets platform, dropped about 10% to $2.06. Avalanche price also shed 10% to $30.86.

Pump.fun, Story, Linea, and FTX Token are other major coins to record sharp downward action.

The post Crypto wrap: Bitcoin falls below $112K, Ethereum drops under $4K, XRP down 2% appeared first on Invezz

English (US) ·

English (US) ·