Driven by Bitcoin spot ETF

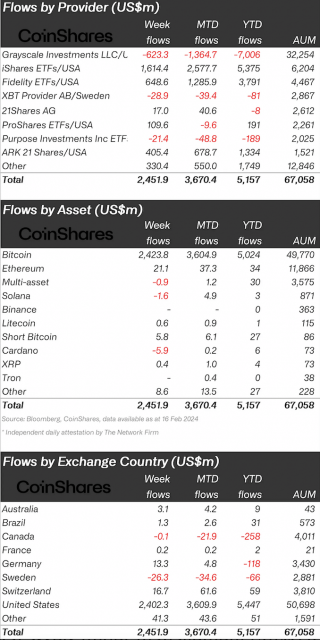

According to data from crypto asset (virtual currency) investment company CoinShares, the amount of funds flowing into existing virtual currency investment products in the week ending on the 16th sharply increased to $2.45 billion (approximately 368 billion yen). became.

The total assets under management (AUM) of the target funds is estimated to be $67 billion (approximately 10 trillion yen). The amount of assets under management appears to have returned to its highest level since December 2021.

Source: CoinShares

Regionally, the United States accounts for 99% of the inflow. Additionally, more than 99% of the inflow amount was Bitcoin (BTC), with a total value of $2.4 billion (approximately 360 billion yen).

The top inflows by provider are Bitcoin ETFs, with BlackRock's iShares ETF at approximately $1.6 billion (approximately 240 billion yen) and Fidelity's ETF at approximately $650 million (approximately 97.7 billion yen). , ARK 21 Shares is approximately $400 million (approximately 60.1 billion yen).

As of the 13th, BlackRock's Bitcoin spot ETF “IBIT” had assets under management (AUM) of over 100,000 BTC (market value equivalent to 780 billion yen).

connection:

BlackRock's Bitcoin spot ETF holds over 100,000 BTC (770 billion yen)

Coinbase, a major cryptocurrency exchange, pointed out on the 16th that a total of $3.3 billion (approximately 496 billion yen) has flowed into the Bitcoin Spot ETF in the month since its release, far exceeding prior expectations.

We predicted that the event of physical ETF approval and currency reflation would support the market for several months.

connection:

Coinbase predicts Bitcoin market will be supported for several months due to inflows from physical ETFs

What is Bitcoin ETF?

An Exchange Traded Fund that includes Bitcoin as an investment. An investment trust is a financial product that collects money from investors into a single fund and invests it in stocks, bonds, etc. The system is such that the investment results are distributed according to each investor's investment amount. Among investment trusts, ETFs are listed on stock exchanges, so they can be bought and sold like stocks.

Virtual currency glossary

Virtual currency glossary

connection:

Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

Inflow status to Ethereum etc.

Year-to-date, inflows into various virtual currency investment products have reached $5.2 billion (approximately 781 billion yen), driven by Bitcoin.

In the week ending on the 16th, there was an inflow of $5.8 million (approximately 870 million yen) due to some investors accumulating short positions in Bitcoin.

Ethereum (ETH) also received an inflow of $21 million (approximately 3.2 billion yen). Regarding Solana (SOL), $1.6 million (approximately 240 million yen) was leaked, probably due to the temporary chain suspension for about 5 hours that occurred on the 6th, which affected sentiment.

Avalanche (AVAX) received $1 million (approximately 150 million yen), Chainlink (LINK) and Polygon (MATIC) each received $900,000 (approximately 140 million yen), and steady inflows have occurred since the beginning of this year. continues.

connection:

Cryptocurrency Solana's blockchain stopped operating for about 5 hours due to a failure, but has now been restored

connection:

Avalanche announces new scaling technology “Vryx” to achieve 100,000 TPS

The post Cryptocurrency investment products record net inflow of approximately 370 billion yen in one week – CoinShares appeared first on Our Bitcoin News.

1 year ago

103

1 year ago

103

English (US) ·

English (US) ·