Businesses such as Coincheck become profitable

On the 31st, Monex Group, Inc. announced its financial results for the third quarter (October to December) of the fiscal year ending March 2024. The crypto assets (virtual currency) business became profitable, and consolidated quarterly profit was 2.28 billion yen. For the group as a whole, operating revenue was 62.3 billion yen, and net income increased 238% compared to the same period last year to 6.54 billion yen.

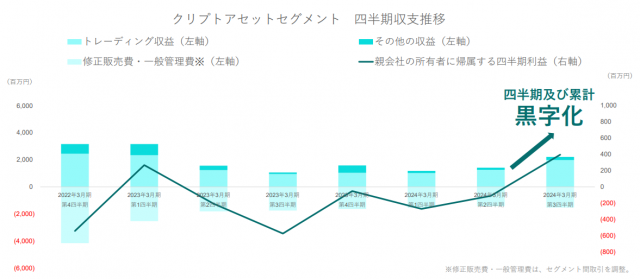

Source: Monex Group

In the virtual currency division alone, profits reached 400 million yen in 3Q. The company explained that its return to profitability was due to the results of cost structure reforms and market recovery due to expectations for the approval of a Bitcoin (BTC) spot ETF, resulting in a full-year profit.

In particular, the main virtual currency exchange, Coincheck, is a wholly owned subsidiary of the Monex Group.

Virtual currency trading revenue increased by approximately 730 million yen from 2Q to approximately 2 billion yen. Compared to the same period last year, although NFT (non-fungible token)-related revenue decreased, the amount of virtual currency transactions has recovered to almost the same level.

In addition, the company has been cutting costs such as system management costs, personnel costs, and advertising costs since 2Q. Advertising expenses were reduced by approximately 65% compared to the same period last year.

As of the end of November 2023, the number of accounts has reached 1.9 million accounts, with a domestic share of 22%, and as of the end of January 2024, it handles 29 stocks.

Coincheck is also aiming to list on the Nasdaq through a merger with special acquisition purpose company (SPAC) Thunder Bridge Capital Partners IV, Inc. (THCP). The aim is to reach global investors.

Initially, the merger was scheduled for July 2023, but the business integration agreement with THCP has now been extended until July 2, 2024.

connection: Coincheck’s listing on NASDAQ may be postponed for up to 12 months

Monex Group announced in December last year that it would make 3iQ Digital Holdings, a major Canadian virtual currency management company, a subsidiary. The company aims to meet the virtual currency management needs of institutional investors and exchanges around the world, which are expected to increase in the future.

What is SPAC?

SPAC is translated into Japanese as “special acquisition purpose company.” This refers to companies that do not conduct business themselves, but instead aim to merge or acquire unlisted companies or the businesses of other companies, and has been on the rise in recent years in the United States.

Virtual currency glossary

Virtual currency glossary

connection: Monex Group makes Canadian crypto asset management company 3iQ Digital Holdings a subsidiary

NISA account inflow from AEON Bank

Monex Securities has been providing the service in partnership with Aeon Bank since January. Aeon Bank will entrust Monex Securities with system management and back office operations related to asset management.

Along with this, Aeon Bank’s investment trust account has also been transferred to Monex Securities. 340,000 accounts were transferred, and 170,000 NISA accounts were transferred to Monex Securities. As of January 4th, the number of Monex Securities NISA accounts has reached 480,000.

Furthermore, Monex Securities and NTT DoCoMo, Inc. have also begun a partnership. There is also a mechanism to transfer to Monex Securities from the “Asset Management NISA” button on Docomo’s d Payment app.

connection:Start of business alliance between NTT Docomo, Monex Group, and Monex Securities

NISA, virtual currency related stocks special feature

The post “Cryptocurrency is coming out of winter” Monex 3Q financial results, Coincheck and other virtual currency businesses turn profitable appeared first on Our Bitcoin News.

1 year ago

110

1 year ago

110

English (US) ·

English (US) ·