Macroeconomics and financial markets

On the 24th of last week, the Dow Jones Industrial Average closed down 96 points (0.25%) from the previous day, while the Nasdaq index closed 65 points (0.43%) higher.

CoinPost app (heat map function)

connection:Ranking of recommended securities accounts for the stock market that can be used at a profitable price

NISA, virtual currency related stocks special feature

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price fell 0.42% from the previous day to 1 BTC = $ 39,800.

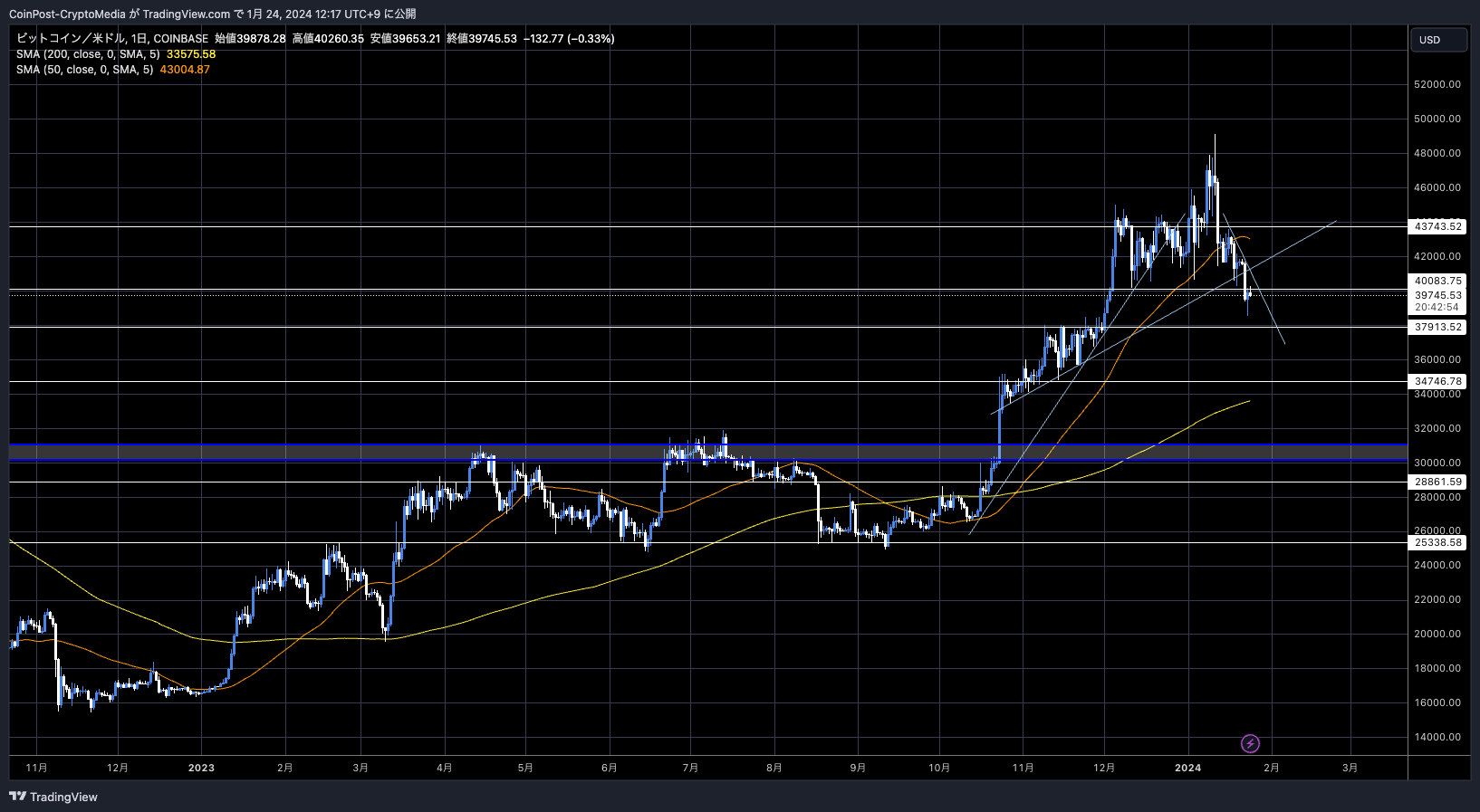

BTC/USD daily

Although the price rebounded by $1,500 from the low of $38,500, the upper price has broken and the top price has been cut down, so the resistance level around $40,000 is exposed to selling pressure. The main supports that are likely to lead to a downside are around $38,000 and $34,700.

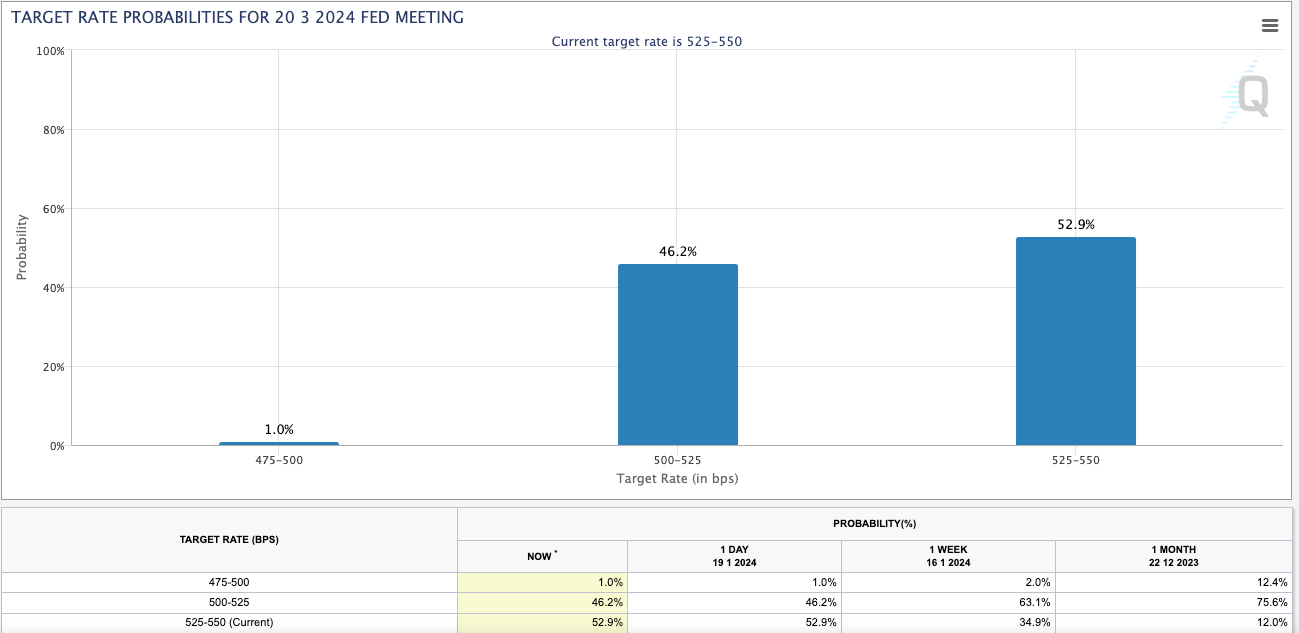

In the altcoin market, Ethereum (ETH) was down 4.7% from the previous day, and XRP was down 2.8%. This is partly due to a decline in expectations for early interest rate cuts from the Federal Reserve, and headwinds include rising US Treasury yields and the US dollar index (DXY).

In the interest rate futures market, the probability of an interest rate cut in March of this year has dropped significantly from 63.1% to 46.2%.

connection:Mt.Gox will send notice to creditors regarding virtual currency repayments

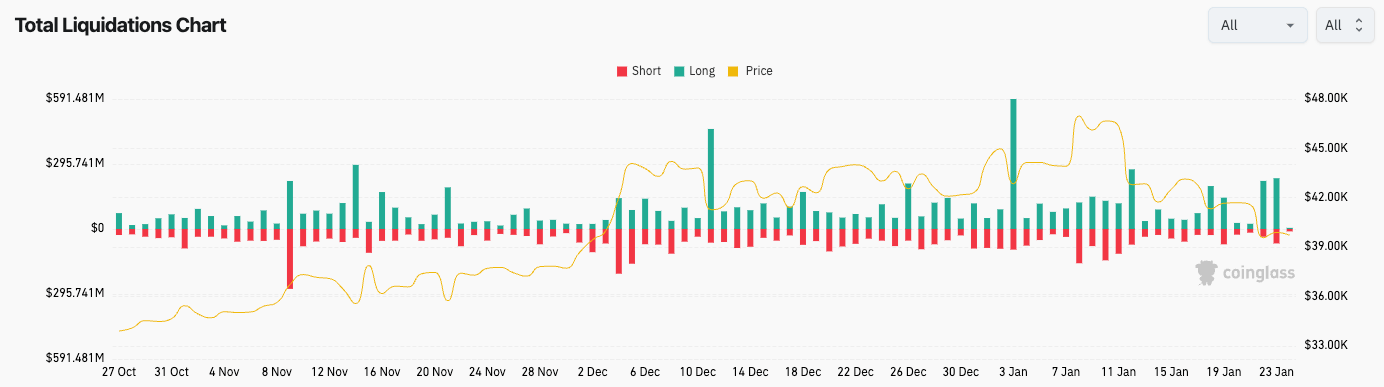

In the futures market, long positions worth $450 million (66 billion yen) were liquidated in the past two days.

Bloomberg analysts pointed out that on the 23rd alone, more than $640 million was outflowed from Grayscale’s Bitcoin Trust (GBTC), which was converted into an exchange-traded fund. The total outflow to date has reached $3.45 billion.

Woof. BAD day for #Bitcoin ETFs overall in the Cointucky Derby. $GBTC saw over $640 million flow out today. Outflows aren’t slowing — they’re picking up. This is the largest outflow yet for GBTC. Total out so far is $3.45 Billion. (Don’t have BlackRock data yet) pic.twitter.com/jNOyiTADVq

— James Seyffart (@JSeyff) January 23, 2024

Grayscale’s trust fee is 1.5%, while BlackRock, the largest asset management company that handles Bitcoin ETFs (exchange traded funds), has a total trust fee of 0.12%, and has lost much of its previous advantage. It can be seen that there is.

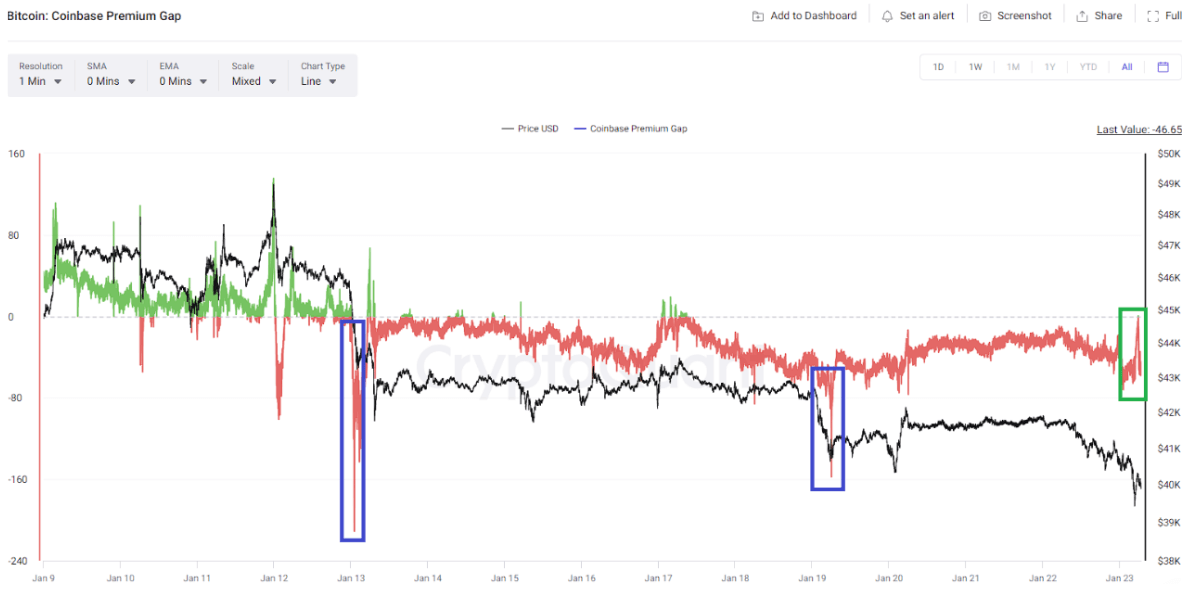

Indicating a decrease in selling pressure

Mignolet, a certified analyst at data analysis site CryptoQuant, said based on the trend of the Coinbase premium that the selling pressure from US institutional investors that caused the market to plummet is gradually weakening, and there is a possibility of a rebound in the current range. It was assumed that the

CryptoQuant (Mignolet)

The Coinbase Premium indicator represents the gap between the Coinbase Pro price (USD currency pair) and the Binance price (USDT currency pair), and is a measure of the gap between the price of Coinbase Pro (USD currency pair) and the price of Binance (USDT currency pair). Useful for analyzing investor sentiment and position trends.

According to Bloomberg’s chief ETF analyst, while there was a huge amount of grayscale selling, major asset management companies BlackRock and Fidelity were large net buyers, and the total outflow remained at $74 million.

Even when Grayscale sells $640,000,000 there only was a total outflow of $74,000,000 due to the fact that Blackrock and Fidelity are buying up so many #Bitcoin pic.twitter.com/Z7RQC4vlnB

— Crypto Rover (@rovercrc) January 23, 2024

The US Bitcoin spot ETF is believed to hold 638,900 BTC as of 9:00 am on the 22nd.

#Bitcoin ETFs in the US now hold over 638,900 $BTCworth around $27 billion! Probably nothing…  pic.twitter.com/IQbM2DT4FJ

pic.twitter.com/IQbM2DT4FJ

— Ali (@ali_charts) January 22, 2024

Additionally, according to Ali’s analysis, the number of wallet addresses of whales (large investors) holding 1,000 BTC or more has reached its highest level since August 2022.

Today marks a notable uptick in #Bitcoin whales! The number of addresses holding over 1,000 $BTC has reached its highest since August 2022, now totaling 1,510.

This increase in large #BTC holders could signal strong confidence or strategic positioning in the market. pic.twitter.com/IooigIa9d0

— Ali (@ali_charts) January 19, 2024

“WebX2024” New IP area will be established where Kodansha, Toho and others will exhibit, ETH Tokyo and DAO Tokyo will also be held at the same time https://t.co/Gs5y7wI1Kx

Date and time: 2024/8/28 (Wednesday) – 8/29 (Thursday)

Location: The Prince Park Tower Tokyo

*The video is “WebX2023” pic.twitter.com/vHZmFbNjwM

— CoinPost (virtual currency media) (@coin_post) January 18, 2024

Bitcoin ETF special feature

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Cryptocurrency market falls across the board; 66 billion yen worth of futures longs are cut short in 2 days appeared first on Our Bitcoin News.

1 year ago

123

1 year ago

123

English (US) ·

English (US) ·