Macroeconomics and financial markets

On the 12th of last week, the Dow Jones Industrial Average closed down 118 points (0.31%) from the previous day, while the Nasdaq index closed 2.5 points higher.

On the 15th day of the week, the Tokyo stock market saw continued growth, with the Nikkei average stock price rising by 249.6 yen (0.69%) from the previous day.

Among U.S. stocks related to crypto assets (virtual currencies), Coinbase fell 7.9%, and MicroStrategy fell 10.4%. The decline in mining stocks, which had soared before the ETF approval, was also notable, with Marathon Digital down 18.2%, Riot down 11.6%, and Hut8 down 13.4%.

CoinPost app (heat map function)

connection:10 major virtual currency stocks in the Japanese and US stock markets

Virtual currency market conditions

In the crypto asset (virtual currency) market, the Bitcoin price fell 1.06% from the previous day to 1 BTC = $42,318. Ethereum (ETH), which had been rising on expectations for ETF approval, fell 2.5%.

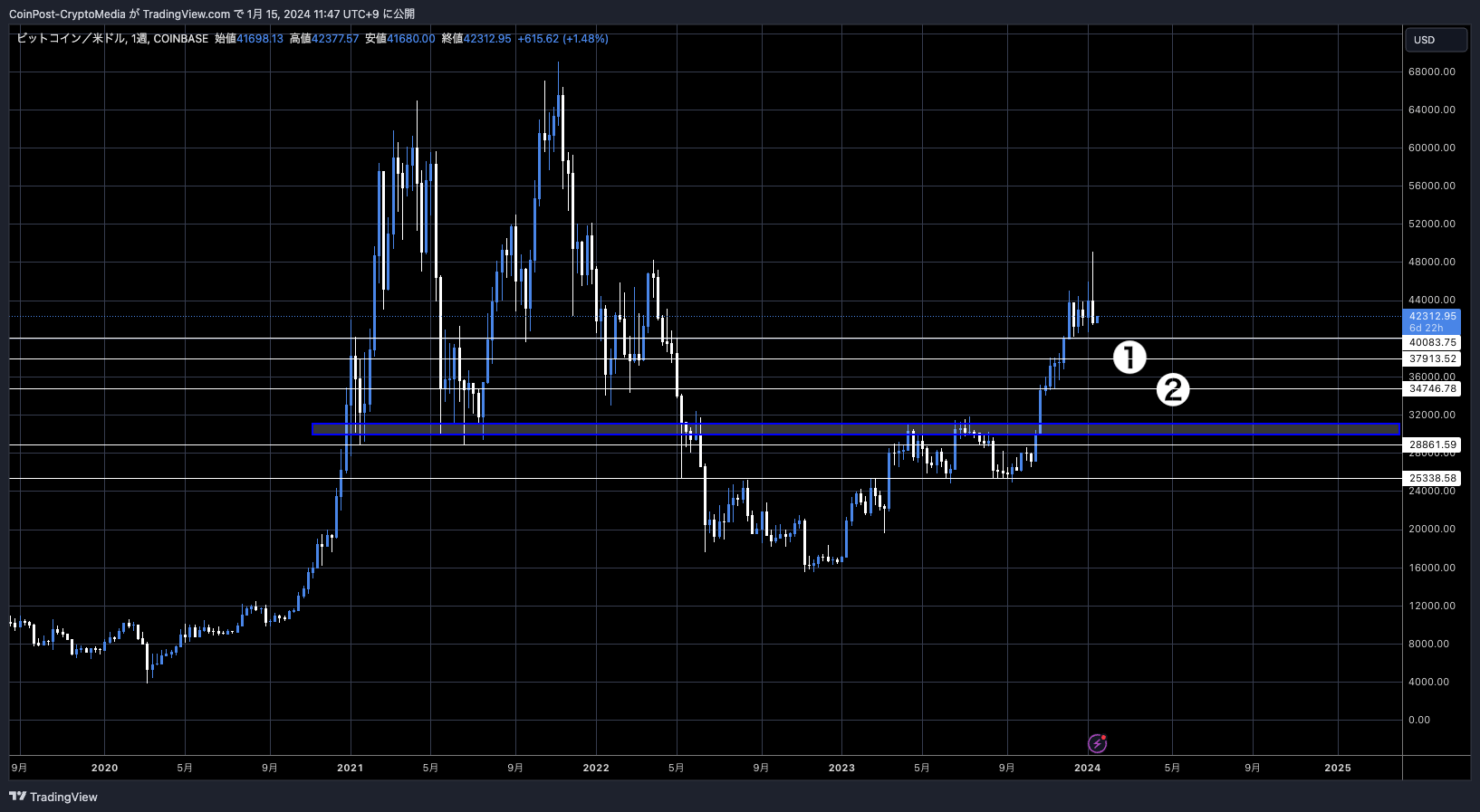

BTC/USD daily

In addition to the psychological milestone of $40,000, potential downside prospects are likely to be the support lines of $38,000 (①) and $35,000 (②).

Analyst The DeFi Investor said, “Such a decline is likely to continue over the next few months.However, if you think it will reach new all-time highs in 1-2 years, it could be a great push.” “If the price falls to the support of 1 BTC = $36,000, we will decide to purchase altcoins.”

Expect many dips like this over the next months.

But if you believe that BTC will hit new ATHs in the next 1-2 years, every big dip is a massive buying opportunity.

I’ll buy more altcoins if BTC somehow goes to $36K. pic.twitter.com/2HDLGPf7C5

— The DeFi Investor  (@TheDeFinvestor) January 13, 2024

(@TheDeFinvestor) January 13, 2024

Anthony Scaramucci, founder of Skybridge Capital, said the sale of his stake in Grayscale Bitcoin Trust (GBTC) spurred the fall in the Bitcoin (BTC) market following approval of a Bitcoin ETF (Exchange Traded Fund). , he expressed his view.

This selling pressure is expected to be resolved within six to eight business days.

Ki Young Ju (@ki_young_ju), CEO of data analysis company CryptoQuant, also pointed out that $579 million was leaked from GBTC in two days. With the conversion to an exchange-traded fund, GBTC holders appear to have recorded losses on their shares as they hold the ETF at lower fees.

$579 million outflows from $GBTC in the last two days according to market data.

Assuming 21k $BTC settled on-chain initially, expect an additional outflow of at least 8k #Bitcoin in the GBTC market. https://t.co/TxFntt5hWr

— Ki Young Ju (@ki_young_ju) January 14, 2024

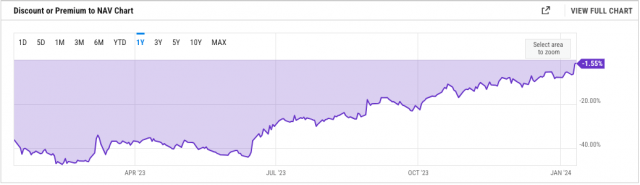

The discount, which indicates the negative divergence between net asset value and GBTC price, had declined to the -1.5% level, the lowest level since February 2021.

Julian Hosp, CEO of Singapore-based investment firm Cake Group, cited three reasons for the market weakness following the ETF approval.

The first is grayscale-related selling pressure. Second, the majority of Bitcoin spot ETFs are OTC swap transactions, making it difficult to generate direct buying pressure. Third, the skeptical stance toward crypto assets by Chairman Gensler of the US SEC (Securities and Exchange Commission) and major traditional financial institutions such as Vanguard appears to be still having an impact.

connection:US asset management giant Vanguard plans not to offer Bitcoin ETF

Size of capital inflow

Bitcoin spot ETFs have attracted $1.5 billion in funds within two days of approval, according to data from senior analysts at Bloomberg.

LATEST: With two days in the books, the Nine Newborns have taken in +$1.4b in new cash, overwhelming $GBTC‘s -$579m of outflows for net total of +$819m. $IBIT now leading pack w/ half a bil, Fidelity close second tho. The newborns’ $3.6b in trading volume on 500k indiv trades… pic.twitter.com/b7U5DjENaw

— Eric Balchunas (@EricBalchunas) January 13, 2024

BlackRock topped the list with $500 million in inflows, followed by Fidelity with $420 million in inflows, and Bitwise in third with $240 million in inflows. Meanwhile, Grayscale experienced a capital outflow of $580 million.

Investors are looking for better conditions, higher liquidity, and lower costs, and Grayscale’s 1.5% fee compared to BlackRock and Fidelity’s 0.2% fee, which prioritize market competitiveness, seems to have made the difference.

connection:U.S. companies applying for Bitcoin spot ETF face fee competition

The average premium (ratio by which the market price exceeds the standard price) of Bitcoin spot ETFs (exchange traded funds) was 0.2%.

connection:Learn about Bitcoin ETFs from the beginning: Explaining the advantages and disadvantages of investing and how to buy US stocks

altcoin market

Bitcoin ETF special feature

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Cryptocurrency market has fallen sharply after approval of Bitcoin ETF, selling pressure due to Grayscale’s GBTC etc. appeared first on Our Bitcoin News.

1 year ago

178

1 year ago

178

English (US) ·

English (US) ·