Macroeconomics and financial markets

In the US NY stock market on the 20th, the Dow Jones Industrial Average fell by $110 (0.33%) from the previous day, and the Nasdaq Index fell by 97 points (0.8%) to close for the third consecutive day.

In addition to the sluggish financial results of major companies such as Tesla’s forecast of a decline in profits, and the adjustment selling of holdings, and the Philadelphia Fed’s manufacturing business index worsening beyond market expectations in April, the priority is to tighten monetary policy to control inflation. The president of the US Federal Reserve also mentioned one after another, raising concerns about a recession.

connection:Tesla and virtual currency-related stocks fall sharply, concerns about recession rise | 21st Financial Tankan

connection:Stock investment recommended for cryptocurrency investors, representative cryptocurrency stocks of Japan and the United States “10 selections”

Virtual currency market

In the crypto asset (virtual currency) market, bitcoin continued to drop to $28,300, down 2.02% from the previous day.

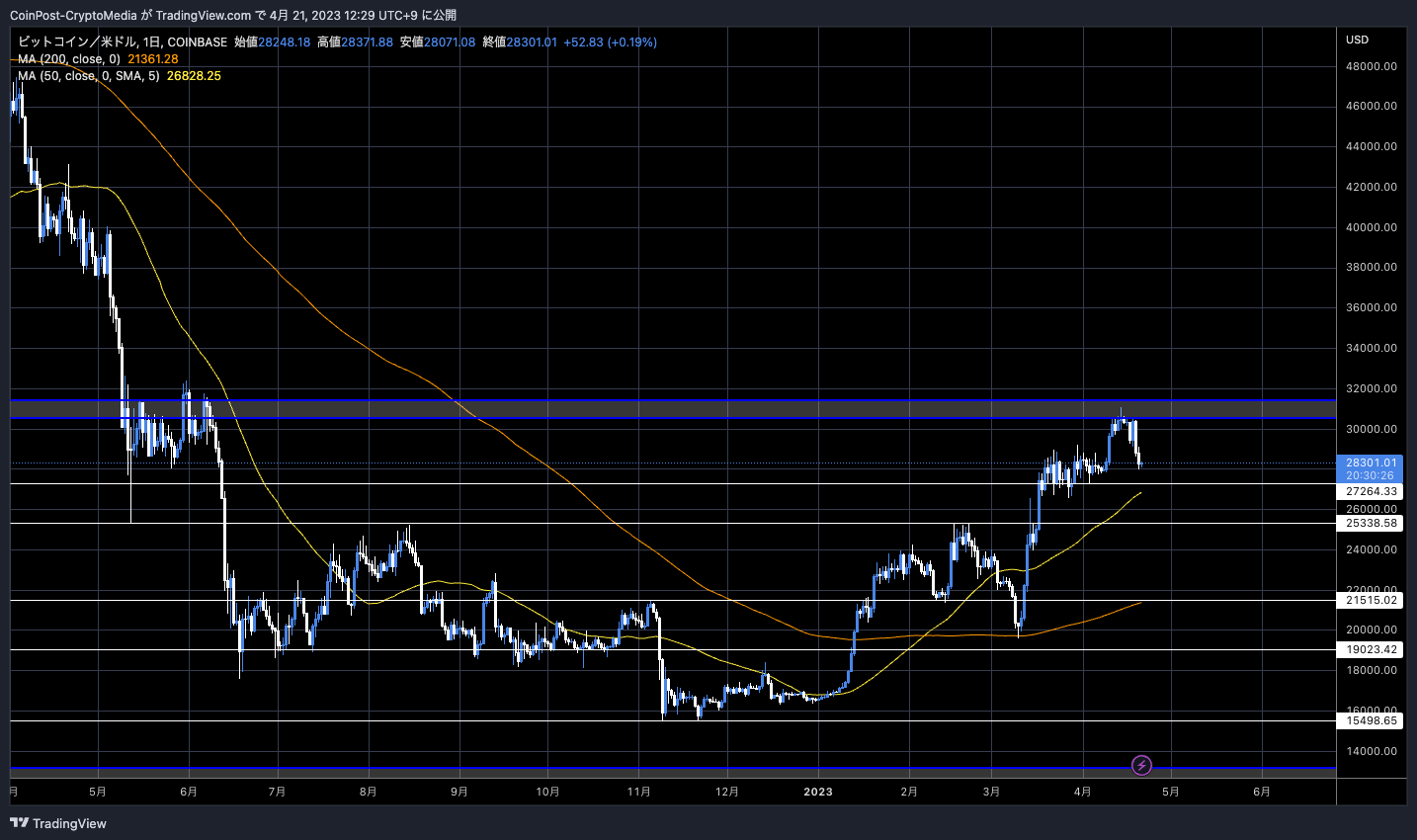

BTC/USD daily

If the price falls below $27,300, there is a risk that the price will fall further, but at this point it will remain within the scope of correction. A support line at $25,300 (lower price support line) is likely to be conscious as a prospect for the downside.

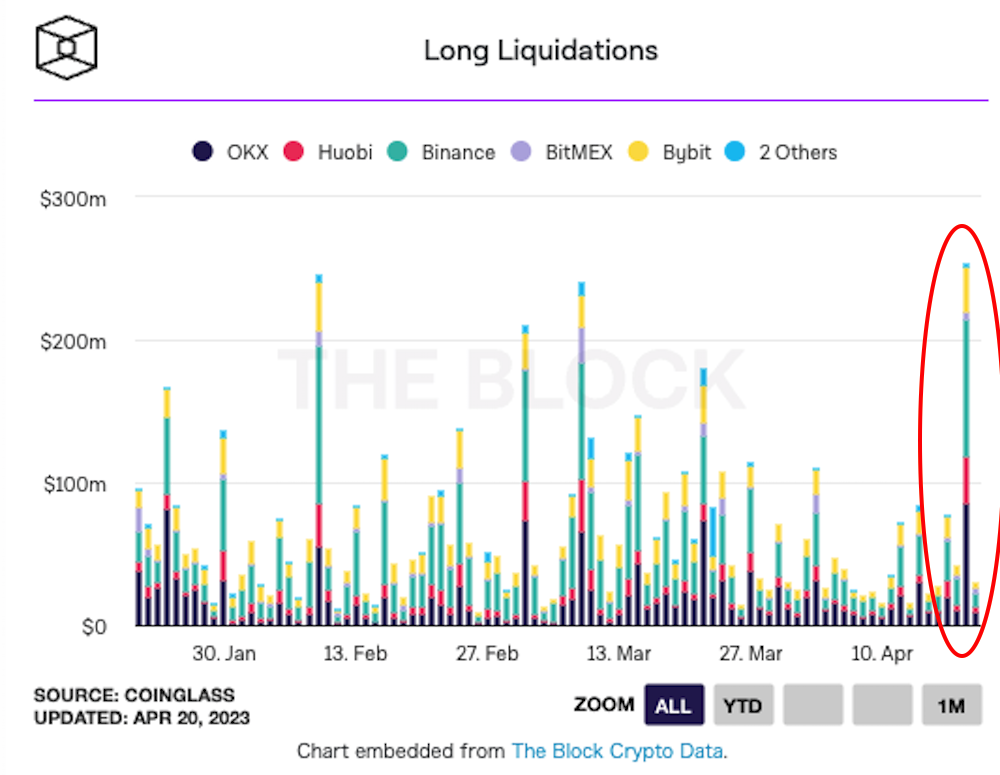

According to data from The Block, the derivatives market lost $253 million in long positions yesterday, the largest of the year, with Binance and OKX taking the majority.

The block

With the increase in short positions, the funding rate of perpetual futures has turned negative in the futures market.

On the 20th, it was revealed that a whale (major investor) holding 6,071 BTC, which had been dormant for about nine years since December 2013, woke up and transferred 2,071 BTC (equivalent to about 1 billion yen).

A whale with 6,071.5 $BTC($178M) that has been dormant for 9.3 years transferred 2,071.5 $BTC($60.7M) out today.

And the 2,071.5 $BTC was finally transferred to the address starting with “bc1q”.

The whale received 6,071.5 $BTC on Dec 19, 2013, when the price was $663. pic.twitter.com/CBpoIy2mEk

— Lookonchain (@lookonchain) April 20, 2023

If the destination of the funds transfer is a crypto asset (virtual currency) exchange, it suggests potential selling pressure, but it does not necessarily mean that it will be sold.

altcoin market

Data from Nansen shows that staked deposits exceeded withdrawals in the days following Ethereum’s mega-upgrade “Shapella”.

Staked ETH deposits now outpacing withdrawals

• Withdrawals are now possible, boosting confidence

• People restaking their ETH rewards for higher yields

• Potential negative balance wave as full withdrawals are processed in 18-20 days

Dashboard  https://t.co/AcFM8zBb7Z pic.twitter.com/On0BxwydHV

https://t.co/AcFM8zBb7Z pic.twitter.com/On0BxwydHV

— Nansen  (@nansen_ai) April 19, 2023

(@nansen_ai) April 19, 2023

Deposits reached about 95,000 ETH compared to about 27,000 ETH withdrawn in the last 24 hours. It seems that they are seeking higher yields, withdrawing the staking rewards that they have accumulated over the past few years, and staking additional rewards.

According to CoinShars, about 80% of withdrawn validators were Kraken. Kraken was forced to suspend its staking service for U.S. customers after being sued by the U.S. Securities and Exchange Commission (SEC).

After de-staking, the majority of users have moved to other staking platforms such as DeFi (decentralized finance) protocols, indicating the demand for continued staking.

Liquid staking protocols such as Lido, Rocket Pool, and Frax Ether are one of them, and “Total Value Locked (TVL)”, which indicates the total amount deposited, has increased by 10 to 20% in a week.

connection:Explaining “LSD (Liquid Staking Derivatives)” that enables operation while staking Ethereum

CoinShars said, “We will continue to monitor the transition of the withdrawal queue value, but the most important thing is whether the ratio of validators withdrawing will accelerate in the future.”

connection:Ethereum staking release after Shapella implementation, total amount exceeds 1 million ETH

Negative factors include regulatory pressure on cryptocurrency exchanges by the US SEC (Securities and Exchange Commission) and CFTC (US Commodity Futures Trading Commission). Most recently, Bittrex and co-founder William Shihara were indicted for “securities law violations.” In the complaint, it was found that several altcoins were pointed out as securities.

connection:US SEC sues cryptocurrency exchange Bittrex, claiming securitization of 6 stocks

In addition, investor sentiment worsened when information spread that there was a series of unexplained unauthorized leaks from digital wallets such as Metamask.

connection:Unexplained asset outflow from cryptocurrency wallet, total damage estimated at 1.3 billion yen (5,000 ETH)

Click here for a list of market reports published in the past

[Recruitment]Recruitment of new personnel due to Web3 business expansion

Japan’s largest cryptocurrency media CoinPost is looking for full-time employees and interns as it expands its Web3 business.

1. Media Business (Editorial Department)

2. Marketing operations

3. Conference management and launch work

4. Open Position (students welcome)

Details https://t.co/UsJp3v8mSH pic.twitter.com/B98JZmoQbW

— CoinPost-virtual currency information site-[app delivery](@coin_post) February 14, 2023

The post Cryptocurrency weakened by US stock index, bitcoin temporarily falls below $28,000 appeared first on Our Bitcoin News.

2 years ago

144

2 years ago

144

English (US) ·

English (US) ·