5/25 (Thursday) morning market trends (compared to the previous day)

- NY Dow: $32,799 -0.7%

- NASDAQ: $12,484 -0.6%

- Nikkei Average: ¥30,682 -0.8%

- USD/JPY: 139.3 -0.1%

- US dollar index: 103.8 +0.3%

- 10-year US Treasury yield: 3.74 +1.3%

- Gold Futures: $1,959 -0.7%

- Bitcoin: $26,389 -2.9%

- Ethereum: $1,804 -2.6%

traditional finance

crypto assets

NY Dow Nasdaq today

Today’s NY Dow fell sharply to -255.5 dollars. The Nasdaq closed at -$76. There is still no concrete agreement on negotiations on the US debt ceiling, and the stalemate continues.

Progress on the U.S. Debt Problem

According to Bloomberg Economics, “A protracted deadlock in negotiations will have a negative impact on the U.S. economy. But even if a deal is reached, it will come at a cost.” It could put millions out of work and deepen the much-anticipated recession, he said.

In the current negotiations on raising the debt ceiling, the two parties are largely divided over the fiscal issues surrounding spending cuts. He remains optimistic about reaching an agreement for negotiations.

Meanwhile, Treasury Secretary Janet Yellen reiterated on Friday that the government could run out of money to keep paying as early as June 1, noting that signs of stress are now starting to appear in the market.

The yield on Treasury Bills rose sharply in response to the difficult negotiations, and the Treasury Bills maturing on June 1 temporarily exceeded 7%.

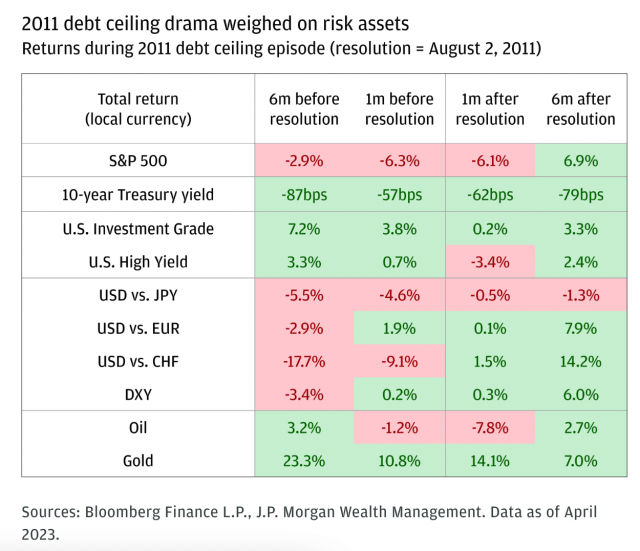

JP Morgan has released a price movement chart of the financial markets during the 2011 debt ceiling negotiations. 6 months before agreement, 1 month, 1 month after agreement, 6 months after agreement.

Source: JP Morgan

dollar yen

Demand to escape from US default risk continues, and the dollar hit a high of 139.48 yen against the yen, the highest since November 30 last year.

Source: Yahoo! Finance

connection: The background of the “strong dollar” that affects the virtual currency market also explains the correlation and factors of the weak yen

connection: Top 3 rankings of ETFs (listed investment trusts) in Japan and overseas that can be purchased with NISA

FOMC Minutes

The minutes of the US FOMC meeting held on May 2nd and 3rd were released on the 24th, revealing that the participants’ views were divided on the necessity of further interest rate hikes to curb inflation.

Not particularly new, the minutes emphasized a data-dependent approach and said a rate cut this year was unlikely.

Meanwhile, Fed Chairman Powell signaled last week that a halt to rate hikes in June (15th) is possible, citing the lagging effects of rate hikes over the past 14 months and concerns about financial stability.

connection: What is the US monetary policy meeting “FOMC” that attracts the attention of global investors | Easy-to-understand explanation

economic indicators

- May 25, 21:30 (Thursday): U.S. January-March Quarterly GDP Personal Consumption (revised value)

- May 26, 21:30 (Friday): U.S. April Personal Consumption Expenditure (PCE deflator)

- May 29 (Mon): U.S. market closed

- Thursday, June 1, 21:15: U.S. May ADP Employment Statistics

- June 1, 22:45 (Thursday): US May Manufacturing Purchasing Managers Index (PMI, revised value)

- June 1, 23:00 (Thursday): US May ISM Manufacturing Index

US stocks

IT Tech stocks vs. previous day: NVIDIA -0.4%, c3.ai +2.5%, Tesla -1.5%, Microsoft -0.4%, Alphabet -1.3%, Amazon -1%, Apple +1.5%, Meta + 1%.

NVIDIA Overtime Surge Bullish Outlook

The stock price of NVIDIA, a major US GPU maker, surged 38% in after-hours trading on the 25th, and the market capitalization was about to approach 1 trillion dollars. NVIDIA ranks sixth in the world market capitalization rankings.

Sales in the first quarter (February-April) announced after the close of business exceeded market expectations by the largest margin in the past five years, but the macro environment such as the Fed’s continuous interest rate hikes Plunging demand for PC components hit the GPU business, weighing down overall sales, which fell 13% year-over-year to $7.19 billion.

On the other hand, due to the rapid spread of generative AI, the sales forecast for the second quarter (May-July) is about 11 billion dollars (about 1.53 trillion yen), compared to the average forecast of 7.18 billion dollars. significantly higher than the dollar. The bullish outlook looks like a good sign.

According to Bloomberg and others, the company’s CEO Jensen Huang pointed out in a statement that “the installed infrastructure of the trillion-dollar data centers in the world will shift from general purpose to computing acceleration,” and “We are strengthening our supply,” he said, as demand for semiconductors for data centers, including those for data centers, surges.

Virtual currency-related stocks fall

- Coinbase|$58.3 (-1.2%/+2.7%)

- MicroStrategy | $284.4 (-1.6%/-1.3%)

- Marathon Digital | $9.4 (+1.1%/+2.7%)

connection: Ranking of investment trusts that can be selected under the tax incentive system “Tsumitate NISA”

The post Debt ceiling negotiations do not progress, US stocks continue to fall, Nvidia soars after hours | 25th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

104

2 years ago

104

English (US) ·

English (US) ·