Bitcoin (BTC) is flowing into wallets controlled by illiquid entities, network participants with little transaction history, at the fastest pace in six months, with long-term investors accumulating. indicates that there is

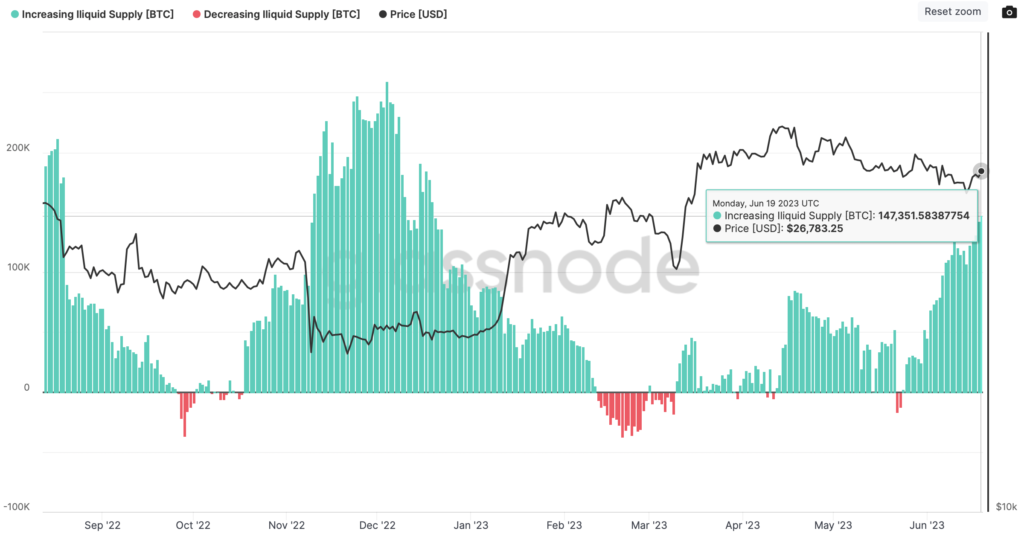

Glassnode’s illiquidity supply volatility indicator measures the number of coins held by illiquidity wallets compared to the same day of the previous month. 3.9 billion dollars, about 552 billion yen), the highest since December 19. The total number of Bitcoins held by illiquid entities jumped to a record high of 15,207,843 BTC, an increase of 215,000 BTC over the past four weeks.

The data shows that investors remain confident in Bitcoin’s price outlook despite continued macroeconomic uncertainty and heightened regulatory risks.

Last week, the US Federal Reserve (Fed) kept interest rates on hold, ending a 15-month rate hike cycle. But while the Fed has ruled out a rate cut this year, it leaves open the possibility of further rate hikes if needed. The tightening so far has contributed to the plunge in the cryptocurrency market last year.

Earlier this month, the U.S. Securities and Exchange Commission (SEC) sued major cryptocurrency exchanges Coinbase and Binance for offering a number of altcoins as unregistered securities. Bitcoin was not mentioned in the lawsuit, which triggered a move of funds from altcoins to bitcoin.

Glassnode analyst James Check said in a weekly report released Wednesday that inflows into illiquid wallets were “gradually and steadily accumulating. It confirms that,” he said, pointing to record balances held by less liquid entities and declining exchange balances.

“Overall, the market appears to be in a quiet agglomeration period, suggesting a pick-up in demand despite recent regulatory headwinds,” Chek said.

The monthly (30-day) net change in illiquid entity holdings surged to its highest level since December. (glass node)

The monthly (30-day) net change in illiquid entity holdings surged to its highest level since December. (glass node)The illiquidity supply fluctuation indicator turned positive on May 24, suggesting a resumption of accumulation, and has since increased sharply.

Other things being equal, the acceleration in accumulation means that market supply is weakening and prices are likely to rise. Technical charts suggest a bullish comeback is possible as long as the critical support at $25,200 holds, which means Bitcoin price does not break below this level.

Bitcoin is trading around $26,750 at the time of writing, after surpassing $27,150 during Asian trading hours, according to CoinDesk data.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

| Image: Glassnode

|Original: Bitcoin Is Becoming Illiquid at 147K a Month in Signal of Steady Accumulation

The post Decreased liquidity of Bitcoin ── Proof of accumulation by long-term investors | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

1 year ago

93

1 year ago

93

English (US) ·

English (US) ·