Value locked in decentralized finance (DeFi) applications running on blockchains in tokens deemed securities by the US Securities and Exchange Commission (SEC) has remained largely stable despite the ongoing drama. rice field.

The absence of a sharp flight of capital suggests positive sentiment among global market participants despite the price drop. Binance Coin (BNB) hit a six-month low on June 7, while prices of Solana (SOL), Cardano (ADA), Polygon (MATIC) and other tokens plummeted.

On June 5 and 6, the SEC sued Binance and Coinbase for selling unlicensed securities in the country.

The accusation comes despite regulators failing to clarify whether crypto assets (virtual currencies) are considered securities. The SEC has not given a formal legal definition of a token issuer and has not responded to a petition from Coinbase for clear rules.

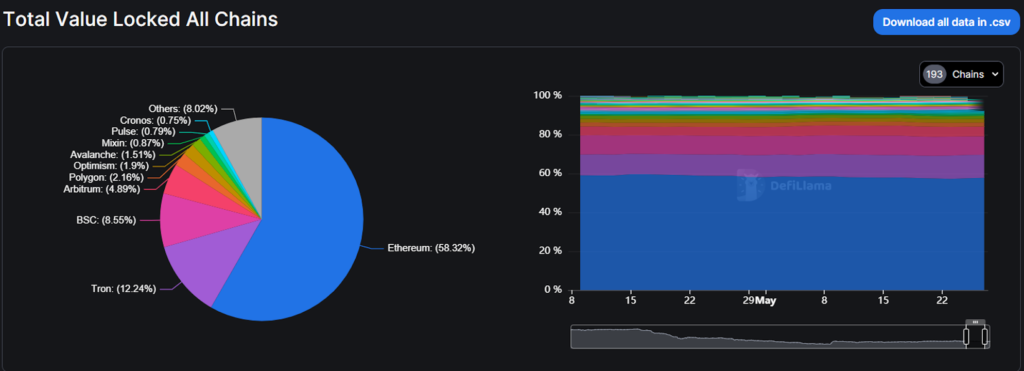

DeFi, at least as of Wednesday, is unshaken. The data shows that the value locked in the Cardano, Solana and BNB chains has fallen by just over 5% over the past week, which is in line with the overall market decline. The data shows that the rate of decline is just over 1% for the month.

Change in value locked across the DeFi ecosystem. (DeFi Llama)

Change in value locked across the DeFi ecosystem. (DeFi Llama)DeFi remains resilient

Some market observers said the lack of capital from DeFi applications suggests the type of market participants that dominate the current landscape.

Kyle Doane, a trader at cryptocurrency firm Arca, told CoinDesk in an email that “the long crypto winter is over, and the majority of ‘tourists’ are already in the space. I have left.” “Remaining participants are likely to be more ardent followers and thus less susceptible to action from the SEC.”

“The token itself being considered a security is irrelevant to the viability of DeFi’s underlying technology, and neither the value of the token nor the application will go up or down. It will only drive more activity,” Dorn added.

Martin Lee, an analyst at crypto-analysis firm Nansen, shared this sentiment. “We haven’t seen any significant changes in the number of users or transactions on Polygon, Solana, and BNB chains, and they have remained at roughly the same level as the past month,” Li said.

“My personal view is that until regulation is implemented and these tokens are officially classified as securities, I don’t think there will be much impact on the ecosystem,” he added.

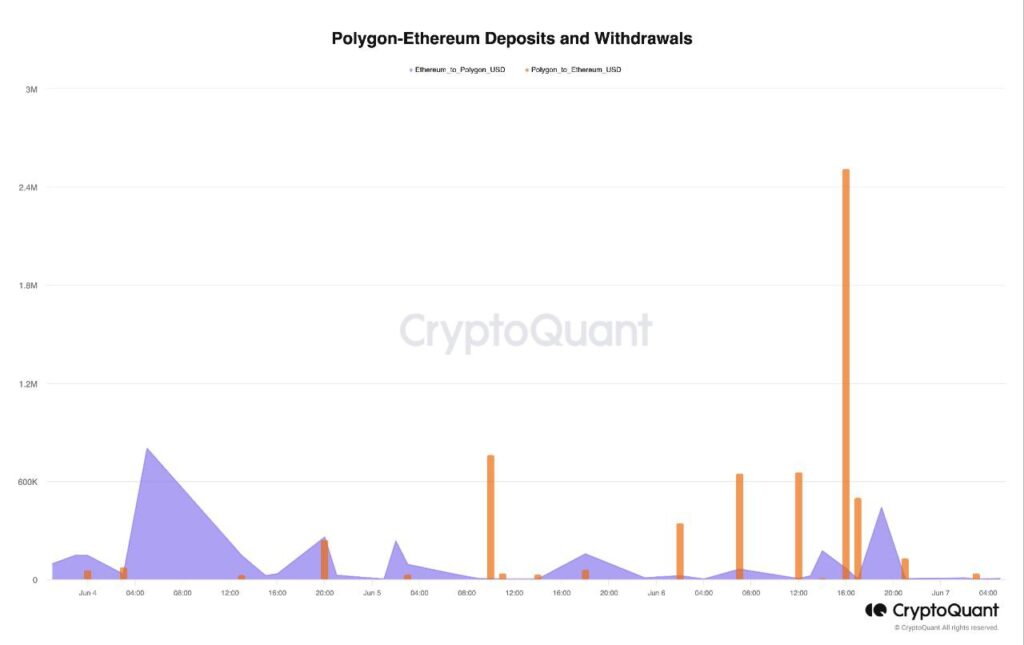

There has been a sudden withdrawal in Polygon Networks following the classification of MATIC as a security in the United States, but based on long-term analysis, the volume remains moderate, said head of research at analytics firm CryptoQuant. As one Julio Moreno puts it:

“In terms of exiting the Polygon network to the Ethereum network, as the graph shows, there was a surge after the SEC mentioned that MATIC is a security,” Moreno said on the 6th, $2.5 million ($2.5 million). Approximately 350 million yen) was withdrawn.

“However, from a historical perspective, the volume of these withdrawals remains low,” he added.

(CryptoQuant)

(CryptoQuant)|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

|Image: CryptoQuant)

|Original: DeFi Unfazed by SEC’s Classification of Tokens as Securities

The post DeFi is unaffected by the securitization of tokens by the SEC ── Locked value remains flat | CoinDesk JAPAN | CoinDesk Japan appeared first on Our Bitcoin News.

2 years ago

123

2 years ago

123

English (US) ·

English (US) ·