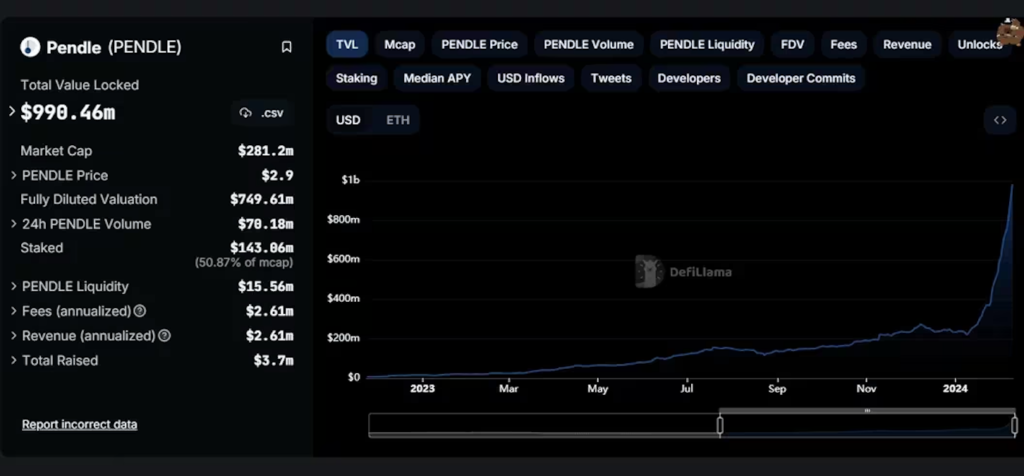

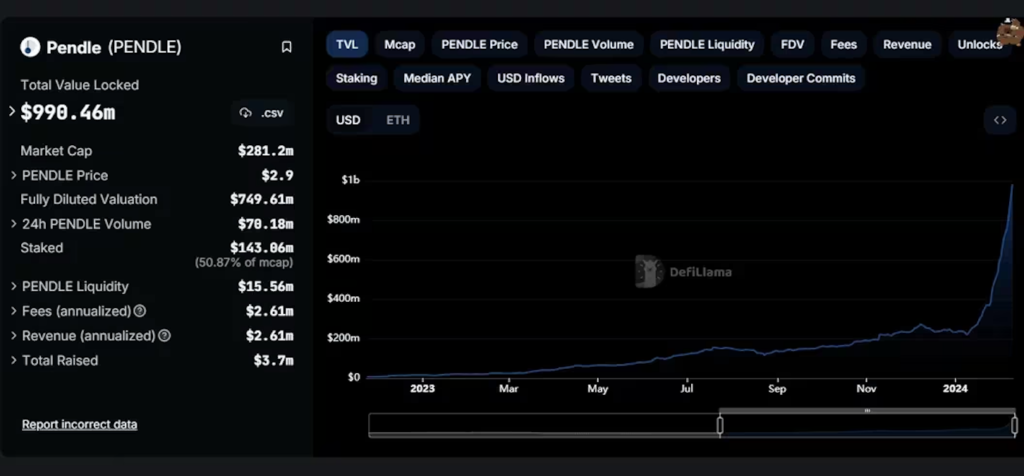

- Pendle's total assets under deposit reached nearly $1 billion. Most of them were locked within the past six months.

- This increased interest is due to the market's desire for liquid re-staking tokens.

- Pendle recently added support for BNB Chain and Real World Assets (RWA).

Pendle, a decentralized finance (DeFi) platform that provides yield in the form of tradable digital tokens, has total deposited assets (TVL) of $990 million, according to data from DeFiLlama. , 1 dollar = 150 yen).

Pendle acts as a price discovery tool by separating DeFi investments into Principal Tokens (PT) and Yield Tokens (YT), allowing investors to trade future yield and principal on the open market. Make it possible to estimate and determine future yields.

Pendle’s TVL (DeFiLlama)

Pendle’s TVL (DeFiLlama)“Interest in Liquid Restaking Tokens (LRT) has been a key driver of Pendle’s recent growth,” Pendle developer RightSide said in an interview on Telegram. .

LRT Finance is a new DeFi field that provides liquidity to staked assets through the issuance of LRTs, allowing users to earn rewards while the original assets are locked to maintain network services.

“Pendle was one of the earliest pioneers in LRT finance, offering users a unique proposition to speculate on EigenLayer yields and points,” Pendle added in an interview on Telegram.

Recently, Pendle expanded into the BNB chain and began offering products that allow users to leverage real world assets (RWA).

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: DeFiLlama

|Original text: DeFi Platform Pendle Nears $1B in Total Value Locked

The post DeFi platform Pendle’s TVL reaches $1 billion | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

74

1 year ago

74

English (US) ·

English (US) ·