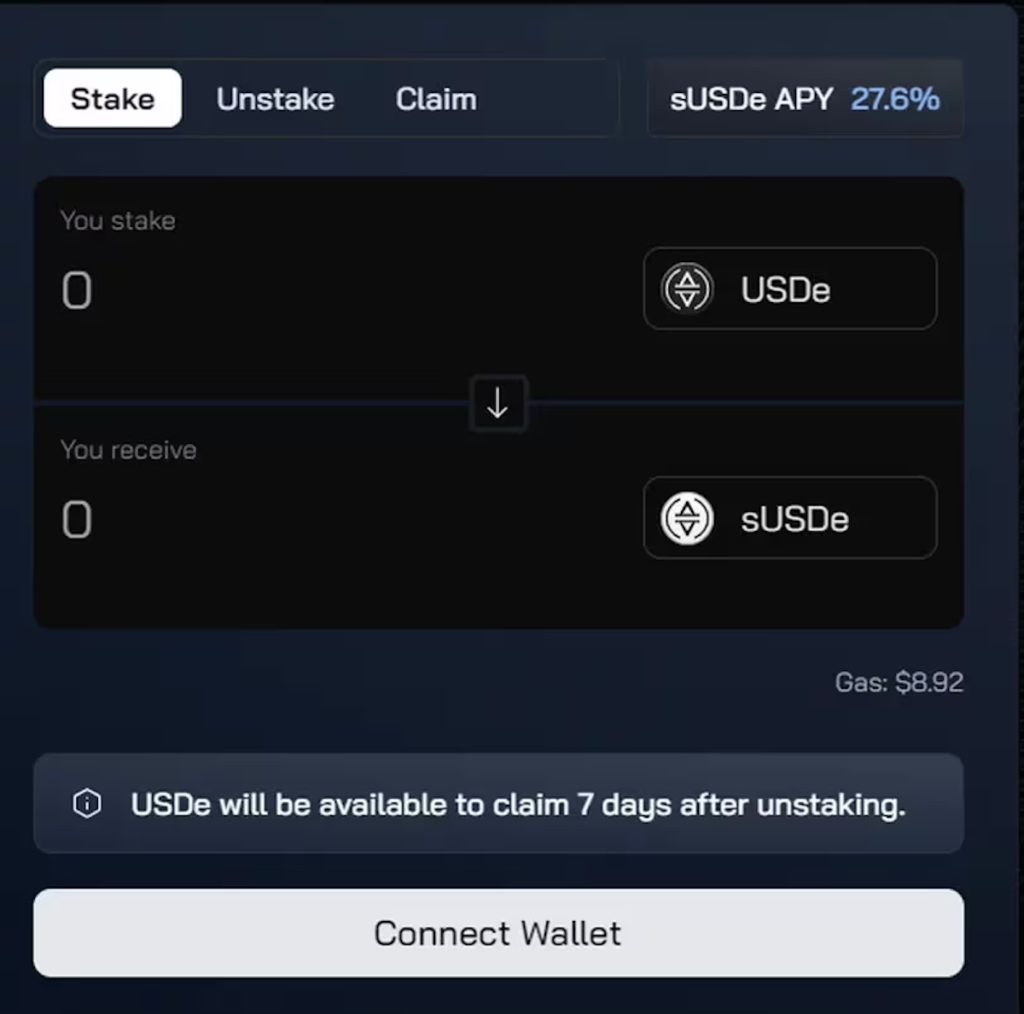

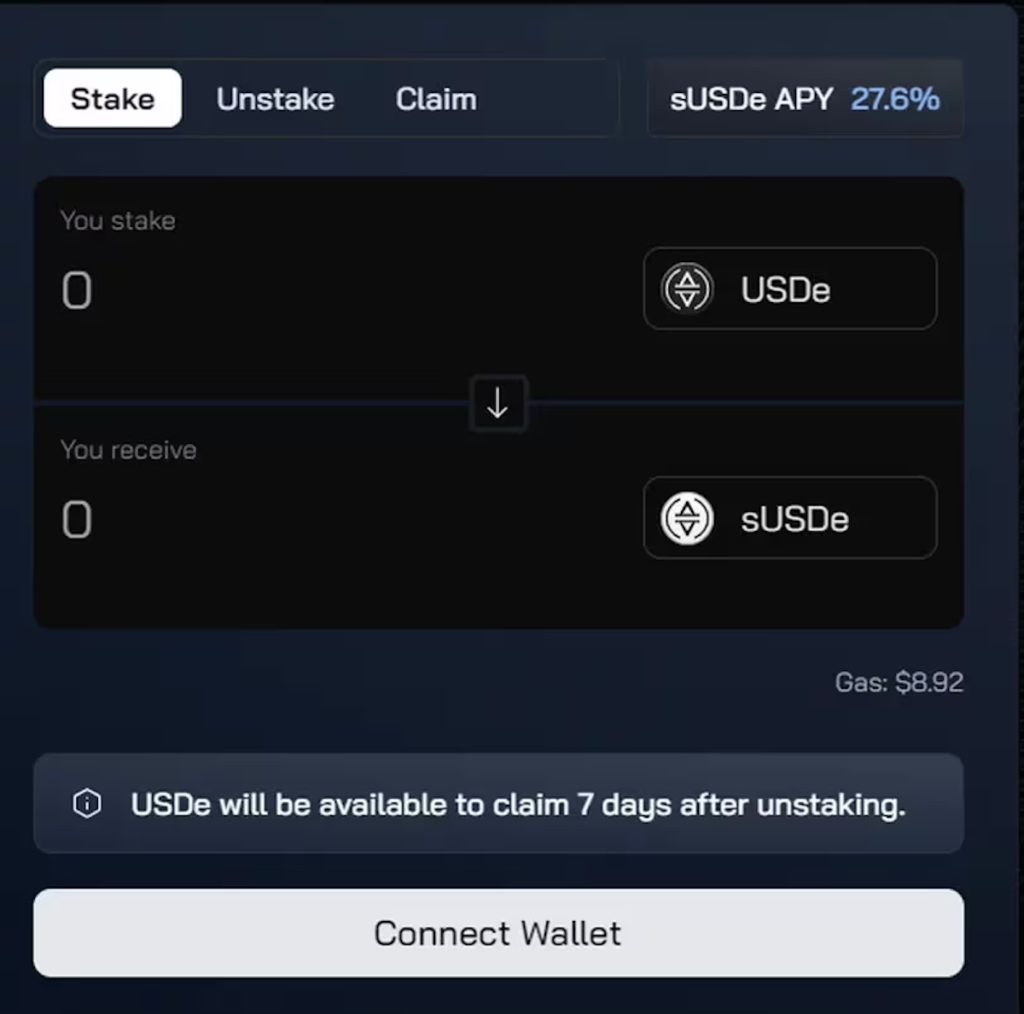

- Over $287 million USDe tokens were minted on the platform within days of launch. The 27% reward is calculated on a 7-day basis and is subject to change.

- Users can deposit stablecoins and receive USDe, which they can then stake.

- Yield is generated by staking Ethereum to validators to earn 5% of capital and shorting Ethereum futures to earn a funding rate estimated to be over 20% based on historical modeling be done.

Decentralized finance (DeFi) platform Ethena raised a huge amount of capital on its first day of launch amid criticism of its model, which provides holders of its USDe token with a 27% annualized yield.

As of the morning of February 20th, a few days after the platform was launched, more than $287 million USDe (approximately 43 billion yen, equivalent to 1 dollar = 150 yen) had been minted. The 27% reward is calculated on a 7-day rolling basis and is subject to change based on underlying factors.

Users can receive and stake Ethena USDe instead of depositing stablecoins such as Tether (USDT), FRAX, DAI, Curve USD (crvUSD), and mkUSD. You cannot unstake for 7 days. Staked USDe can be fed to other DeFi platforms for additional yield.

Ethena calls USDe a synthetic dollar, much like an algorithmic stablecoin. The token has a target peg of $1 and will be minted once Ethereum tokens are deposited on the platform.

Revenue is generated from two sources:

1) Stake Ethereum to a validator and earn a 5% yield.

2) Short selling Ethereum futures to obtain a funding rate estimated to be over 20% based on past modeling.

The way futures work is similar to a “cash-and-carry” trade, in which a trader takes a long position while simultaneously selling the underlying derivative. Such trades are theoretically directionally neutral, earning revenue from the funding rate payout instead of the price movement of the underlying asset.

opened twitter and see

yall raised a bunch of money

for someone to do cash carry for u?@ethena_labs

can't u just sign up on the exchange and just hedge off on coin margined urself tf

nvm yall need influencers and vcs to tell u what buttons to clickhttps://t.co/vgpGYfpGmQ

— ӈ (@jeff_w1098) February 19, 2024

While the influx was huge on the first day, some in the crypto community say the concept has been tried before but didn't catch on.

“There were two previous projects that tried this concept, but both were abandoned due to yield inversions and loss of capital,” said @0xngmi, co-founder of DefiLlama.mentioned in X's post. “When yields reverse, you start losing money, and the bigger the stablecoin gets, the more money you lose.”

Some say the concept could face challenges in how to manage risk.

“While new stablecoin efforts are welcome, there are some aspects of Ethena that could be problematic, especially when it comes to risk management,” said Dou, founder of governance research firm Stable Lab. Doo Wan Nam said in a Telegram chat.

Conor Ryder, Ethena's head of research, addressed some of these concerns in a Feb. 19 post to He said that the operation has started with the parameters based on the following.

A lot of new eyes on Ethena today and people are right to point out the risks involved

I wanted to take a sec to highlight some of the extensive work we've done surrounding the risks of the design, and specifically addressing funding risk

Before I get into the meat and veg… pic.twitter.com/zfuWMljkSB

— Conor Ryder (@ConorRyder) February 19, 2024

According to Ryder, there is currently high demand for long Ethereum, so short futures rates are expected to remain high.

“There is a clear demand for leveraged longs in crypto assets,” he said. “Negative funding rates are more of a feature than a bug in the system. USDe was built with that in mind.”

Ryder said Ethena's model determined that $20 million per $1 billion USDe would help weather “nearly all bearish funding rate forecasts.” The bulk of Ethena's $14 million funding round will be earmarked for an initial $20 million insurance fund.

|Translation: CoinDesk JAPAN

|Edited by: Toshihiko Inoue

|Image: Ethena

|Original text: DeFi Platform Earning Yield by Shorting Ether Attracts $300M on First Day

The post DeFi platform that earns yield by shorting Ethereum raises $300 million | CoinDesk JAPAN appeared first on Our Bitcoin News.

1 year ago

103

1 year ago

103

English (US) ·

English (US) ·