Frax Finance, a decentralized finance (DeFi) application, has attracted investor support with its strong product range as Ethereum’s next upgrade, Shanghai, looms and LSD (Liquid Staking derivatives) heats up. there is

The Frax protocol consists of two tokens, the stablecoin FRAX and the governance token Frax Share (FXS). FRAX remains pegged to the US dollar by being partially collateralized in USD Coin (USDC), alongside regular FXS trading to maintain its market cap.

FRAX’s staked Ethereum product launched in October is attracting funding. Users deposit Ethereum (ETH) and receive Frax ETH (frxETH), a token backed 1:1 with ETH. This frxETH can be freely traded and staked in other DeFi applications and DEX (decentralized exchange) curve liquidity pools, and currently stakers earn up to 10% annual return. .

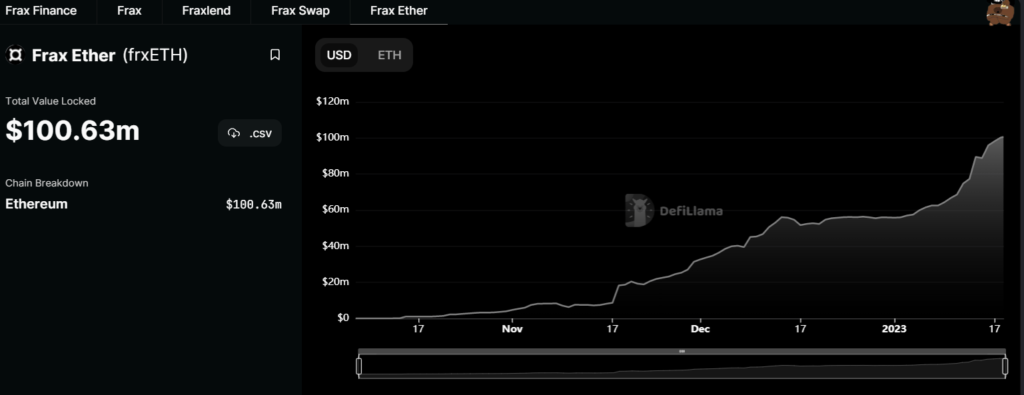

As of January 17th, the total amount of frxETH is over $100 million (approximately ¥12.8 billion), according to data from DeFiLlama. That’s nearly $50 million since the start of January, and nearly quadrupled since November.

Frax’s frxETH product has grown many times over the past few months. (DeFi Llama)

Frax’s frxETH product has grown many times over the past few months. (DeFi Llama)Frax currently offers annual returns of 6% to 10% or more for users who spend ETH on its platform. These rewards will be paid out in Curvedao Tokens (CRV), FRAX and FXS, depending on the liquidity pool in which users stake their tokens.

Meanwhile, Lido, the largest DeFi application by assets under custody (TVL), yields just 5.2% to users.

The attraction of funds to Frax’s Ethereum pool has resulted in demand for FRAX and FXS, with the price of the latter up more than 62% over the past week, according to CoinGecko. And since some liquidity pools pay in FXS, higher prices theoretically mean higher rewards for stakers, resulting in more ETH going into Frax and more tokens in Frax among users. demand for

According to some observers, Frax’s holdings of CRV and Convex Tokens (CVX) have yielded very large returns for some stakers.

Hal Press, a partner at crypto fund North Rock, tweeted earlier this week, “Right now, FRAX outperforms other LSD platforms due to its prominent CRV/CVX holdings. This gives us a competitive edge, which allows us to offer higher yields on staked Ethereum derivatives products than others on the market.”

“Trader sentiment has increased as the utility of FXS has increased. These tokens will gain value from newly minted FRAX and fees from Frax,” Press also noted bullish sentiment.

The summary of the FXS thesis is as follows. FRAX has an advantage over other LSD platforms at the moment due to their outsized CRV/CVX treasury holdings. This allows them to stimulate higher ETH staking yield on their staked ETH derivative product than the rest of the market. https://t.co/ODdkHjxq1O

—Hal Press (@NorthRockLP) January 17, 2023

understanding the curve

To understand the reason for Frax’s high yields, it’s essential to know how DEX (Decentralized Exchange) Curve Finance works.

Curb offers a highly efficient way to exchange stablecoins while maintaining low fees and low slippage, according to the documents. Currently deployed pools on Curb are backed by baskets of centralized or decentralized stablecoins, wrapped tokens (such as wrapped Bitcoin), or various other crypto assets.

Curve depositors can earn annual yields of up to 4% from one of the many pools on the platform.

High trading volume in Curb’s liquidity pool, which includes Frax, helps FRAX to hold its intended dollar peg. Additionally, Curve allocates CRV as a reward for liquidity providers to select pools, called Gauge Reward, resulting in higher returns to liquidity providers.

“The long-term impact of Curve AMO is that Frax has the potential to become a large governance participant in Curve itself,” Frax’s technical document reads. Curb has over $6 billion in tokens as of Jan. 17, making it one of the few “good” DeFi protocols.

As a result of all of the above, Frax is currently offering 6% to over 10% annualized returns to Ethereum users on its platform.

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

| Image: DeFiLlama

|Original: DeFi Service Frax Finance Gains Momentum Amid Ether Staking Narrative, FXS in Focus

The post DeFi service Frax, staked Ethereum products are popular | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

144

2 years ago

144

English (US) ·

English (US) ·