A group of developers deployed Uniswap smart contracts on the Bitcoin network to take advantage of the rise of BRC-20 tokens to develop a decentralized finance (DeFi) ecosystem.

Called Trustless Market, the protocol has reached $500,000 in daily trading volume, attracted more than 2,000 users, and liquidity providers earn 2% of all swaps made on the network. you can get a commission.

DeFi on Bitcoin is showing slow but steady growth. (Trustless Market)

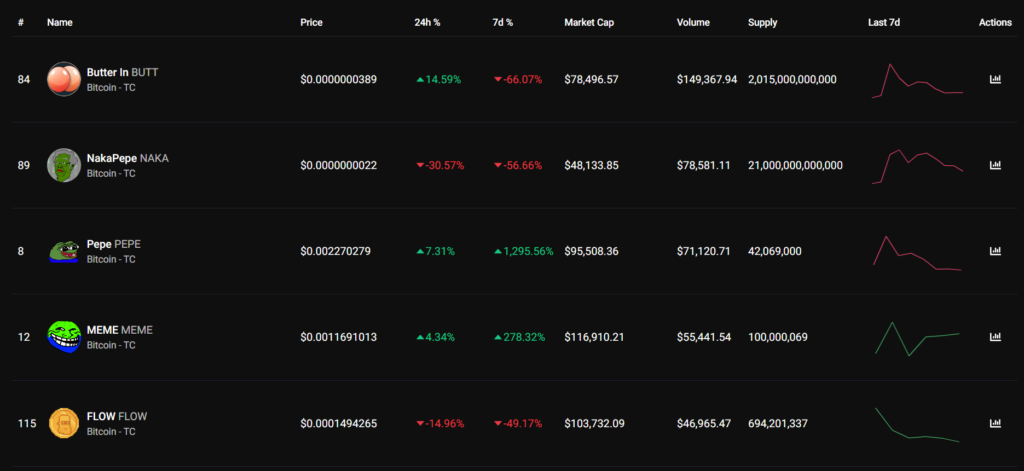

DeFi on Bitcoin is showing slow but steady growth. (Trustless Market)Most of these tokens are memecoins, not tokens that might be used in advanced DeFi applications built on Bitcoin, but they still count as a start.

@punk 3700, one of the developers of Trustless Market, said on Twitter, “We want to make Bitcoin as versatile as possible and have value beyond just a currency.” “It will start with art, then AI, and then naturally DeFi will be added.”

“It’s still very early days. It feels like Uniswap in 2018. But it’s fun,” said @punk3700.

DeFi relies on automated smart contracts to provide users with financial services such as lending and borrowing. About $47 billion worth of tokens are locked in these protocols, data from DefiLlama reveals.

The use of Bitcoin in DeFi applications has so far been limited to tokenization of Bitcoin on other chains, such as Ethereum and Solana. However, the recently introduced “Bitcoin Recent for Comment” (BRC-20) token standard allows developers to issue tokens, as well as DeFi applications, natively on Bitcoin, and over the past few weeks there has been an increase in production on Bitcoin. The popularity of digital artworks and meme coins that have been created is spurred on.

According to data from OrdSpace, which tracks BRC-20 data, as of May 8, more than 11,000 tokens issued on Bitcoin were available on the open market, with a cumulative market capitalization of $500 million ( 67.3 billion yen), down from the $1.5 billion figure earlier this week.

So far, the Ordinals Marketplace token ORDI is the most highly valued BRC-20 token with a market cap of $400 million and 8,300 unique token holders. ORDI is said to be the first BRC-20 token to be deployed on Bitcoin, which may also play a role in its value proposition among holders.

PEPE on Bitcoin is the third largest issue in the BRC-20, unlike those issued on Ethereum, but with a relatively small market capitalization of $17 million. There is also the Shiba Inu Coin (SHIB) of Bitcoin, with a market capitalization of $3.7 million, compared to the original SHIB on Ethereum, which has a market cap of $5.5 billion. It’s just a little.

As such, Trustless Market is one of the few protocols among the new collective looking to develop the Bitcoin ecosystem, and the move has seen transaction fees skyrocket.

Bitcoin users paid more than $17.42 million in fees in the last 24 hours, marking the second-highest day ever, analytics tool DefiLlama tweeted May 11.

But others like @punk3700 say the fee issue could be a stepping stone to boost adoption in the long run.

“Actually I think it’s a good thing!” @punk3700 tweeted. “Always think of the use cases and utilities coming first. Infrastructure upgrades come later.”

|Translation: coindesk JAPAN

|Editing: Toshihiko Inoue

|Image: Trustless Markets

|Original: Developers Deploy Uniswap Contracts on Bitcoin as BRC20-Based SHIB, PEPE Gain Popularity

The post Developing a DeFi ecosystem by introducing Uniswap’s smart contract to Bitcoin ── Taking advantage of the popularity of BRC-20 | coindesk JAPAN | Coindesk Japan appeared first on Our Bitcoin News.

2 years ago

110

2 years ago

110

English (US) ·

English (US) ·