The post Dogecoin (DOGE) Targets $0.18 as Open Interest Spikes 25% appeared first on Coinpedia Fintech News

Dogecoin (DOGE), the popular meme coin is poised for an upside rally due to its bullish price action and notable interest from traders and investors. It appears that the sentiment for the meme coin seems to have shifted from a downtrend to an uptrend.

Dogecoin Technical Analysis and Upcoming Levels

According to expert technical analysis, DOGE appears bullish and there is a strong possibility it could hit the $0.18 level in the coming days. The potential reason behind this bullish speculation is the successful breakout and retest of the horizontal resistance of the $0.135 level.

Source: Trading View

Source: Trading ViewOn October 18, 2024, DOGE broke out from a strong resistance level and consolidated there for ten days, which is often considered an accumulation zone. With this recent breakout, it is largely confirmed that the meme coin will soar significantly in the coming days.

As of now, DOGE is trading above its 200 Exponential Moving Average (EMA) on a daily time frame, indicating an uptrend.

Bullish On-Chain Metrics

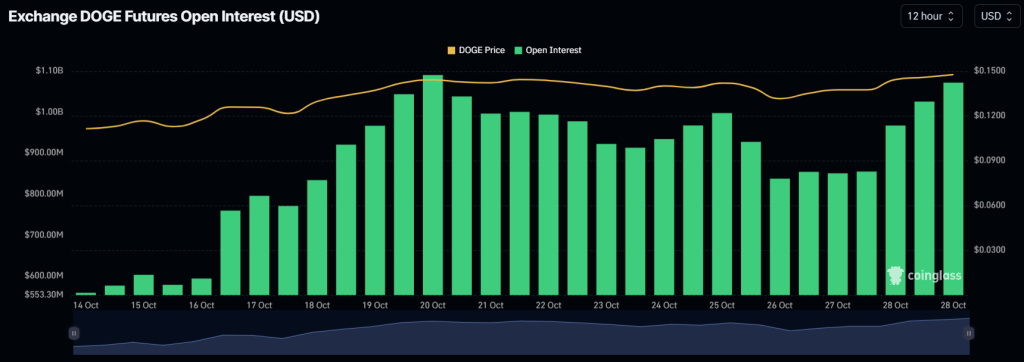

Dogecoin’s bullish outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, DOGE’s Long/Short ratio currently stands at 1.044, indicating a strong bullish sentiment among traders.

Additionally, its open interest has skyrocketed by 25% over the past 24 hours and 8.56% over the past four hours. This rising open interest suggests a growing interest of traders as their bets on DOGE are significantly rising.

Source: Coinglass

Source: CoinglassThe combination of the bullish on-chain metrics with technical analysis suggests that bulls are currently dominating the asset and may drive a rally in the coming days.

Current Price Momentum

At press time, DOGE is trading near $0.149 and has experienced a price surge of over 7.2% in the past 24 hours. During the same period, its trading volume skyrocketed by 155%, indicating heightened participation from traders and investors amid bullish price action.

3 weeks ago

29

3 weeks ago

29

English (US) ·

English (US) ·