The original meme token appears poised for more pain amid the persistent broad market bearishness.

The altcoin is about to form a dangerous pattern on the daily chart, which could mean extended consolidations or downtrends.

With network activity at lows never seen since October last year, can DOGE avoid more price dips below the $0.20 support?

Dogecoin network activity at multi-month lows

The latest DOGE price underperformance has dampened investor activity and interest in the meme token.

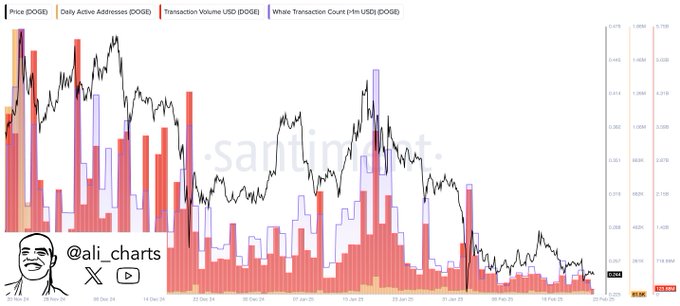

Analyst Ali Martinez (using Santiment’s data) highlighted that Dogecoin’s network activity has plummeted to lows not seen since October 2024.

The dog-themed token saw only 66 large-scale transactions and less than 60K active addresses daily.

Such trends indicated dwindled interest and faded user engagement in the altcoin.

Less activity from whales confirms their distrust in DOGE’s near-term performance.

The dog-themed token remains poised for continued price struggles before potential rebounds.

The daily chart highlights Dogecoin’s dire conditions. It has approached a death cross, hinting at intensified bearish action.

DOGE’s looming death cross

Dogecoin’s price actions approach a death cross formation on the 1D chart.

The 50-day Exponential Moving Average has declined since mid-January, signaling a potential bearish cross with the 200-day Exponential Moving Average.

Source – TradingView

Source – TradingViewThe pattern signals a prolonged downtrend for Dogecoin. Other indicators complement the dominant seller influence.

The 1D Moving Average Convergence Divergence demonstrates emerging bearishness after short-lived uptrends.

The small histograms suggest potential consolidations for Dogecoin prices.

Further, the Chaikin Money Flow has plummeted in the past two days.

The indicator plunged from 0.12 on 22 Feb to -0.10 at press time.

That confirms massive cash moving out of Dogecoin’s ecosystem as investors lose confidence in the asset.

DOGE’s current price

The meme token changed hands at $0.2307 after losing more than 5% in the past 24 hours.

Chart by Coinmarketcap

Chart by CoinmarketcapThe decline has extended DOGE’s weekly losses to 13%.

The increased daily trading volume likely signals ongoing sell-offs in the Futures market.

Dogecoin eyes the nearest support level at $0.22836. The barrier will unlikely survive the prevailing selling pressure.

Losing $0.22836 will trigger declines beneath the psychological mark of $0.20 to explore $0.19361.

That would translate to a nearly 20% dip from DOGE’s prevailing price.

The waning demand supports the bearish trajectory and extended struggle for Dogecoin.

However, some traders anticipate massive bounce-backs after prevailing underperformances..

Trader Tardigrade believes DOGE boasts a lucrative structure that could send it to its 2025 target of $1.

He highlighted that the alt is about to complete its 4th descending wedge pattern.

The initial breakout catalyzed a nearly 90% upswing in Q4 2023.

The following one triggered a 208% surge. Lastly, the third falling wedge breakout in Q4 2024 propelled DOGE by 445% towards the $0.50 mark.

The fourth breakout will likely initial a substantial rally that will see Dogecoin reclaiming the $1 psychological level.

The post Dogecoin risks death cross as network activity hits 5-month low appeared first on Invezz

English (US) ·

English (US) ·