Macroeconomics and financial markets

In the US NY stock market on the 3rd of the previous weekend, the Dow closed at $127 (0.38%) lower than the previous day.

As the results of the “US employment statistics” released on the 3rd greatly exceeded market expectations, expectations for an early halt in interest rate hikes by the Fed (US Federal Reserve) have receded. In the foreign exchange (FX) market, the dollar rose sharply, and gold, which had been overheated as it continued to rise, plummeted. Risky assets such as stocks and Bitcoin were also sold.

A strong sense of overheating in the labor market could lead to higher wages and increased costs for companies, making it easier to see room for interest rate hikes to curb inflation.

connection:U.S. Nasdaq, Bitcoin, etc. fall sharply, US dollar rises, fears of continued Fed interest rate hike | 4th Financial Tankan

On the 7th (2:00 a.m. on the 8th in Japan time), important figures such as FRB Chairman Powell and Philadelphia Fed President Harker will be interviewed at the Economic Club in Washington, DC. There are also voices of concern in the market about hawkish statements about monetary policy and excessively cautious economic forecasts as the divergence from the market perception widens following the US Federal Open Market Committee (FOMC) meeting.

Virtual currency market

In the crypto asset (virtual currency) market, Bitcoin fell 1.52% from the previous day to $22,945.

BTC/USD daily

The upper end of last summer’s range was also heavy, and it fell back in response to the results of the employment statistics.

connection:Even with the risk-on mood such as Bitcoin, the upward trend momentum is receding | Contribution by bitbank analyst

Willie Wu, an on-chain analyst, points out that stablecoin inflows to cryptocurrency exchanges are “concentrated on institutional investors’ business days.” He suggested that major Western institutions may be buying.

This recent rally coincides with a new pattern emerging of stablecoins flowing into exchanges during work days only. Seems to me like the heat signature of large institutions doing the buying. pic.twitter.com/VZuoL4de9U

— Willy Woo (@woonomic) January 31, 2023

Well-known analyst Michaël van de Poppe assumes a pessimistic scenario for the macroeconomy, saying, “If the Fed’s soft landing fails and a recession becomes apparent, risk assets (stocks and Bitcoin) will fall sharply.”

In that case, a price adjustment to 1BTC=$20,000 would make sense and could be a good buying opportunity.

Theoretically speaking, a correction to $20K makes a lot of sense and would be a great buy opportunity for #Bitcoin.

However, most of the people are waiting for this correction to happen, as a large group is sidelined.

In that regard, continuation upwards is max pain.

— Michaël van de Poppe (@CryptoMichNL) February 4, 2023

Game of Trades said he is in the process of breaking out and testing the trendline, suggesting that a breakout of the $25,000 resistance line could target $46,000.

$BTC has had a clean breakout above its macro downtrend line + a backtest

The next big resistance to clear is the $25k region pic.twitter.com/hmL4Pk68U4

— Game of Trades (@GameofTrades_) February 3, 2023

According to Prof. Chaîne, the futures market has turned to a bullish bias and there are signs of a trend reversal.

At the end of last year, the bankruptcy of FTX/Alameda Research wiped out positions in the derivatives market in a mass liquidation.

[Dérivés] Suite à la faillite des entités FTX/Alameda, une purge significative a eu lieu sur les marchés dérivés, accompagnée de liquidations long et d’un fort biais baissier

Actuellement, la tendance s’inverse, avec de fortes liquidations short et un biais haussier prononcé  pic.twitter.com/EBMWnF8Z8p

pic.twitter.com/EBMWnF8Z8p

— Prof. Chaîne (@profchaine) February 3, 2023

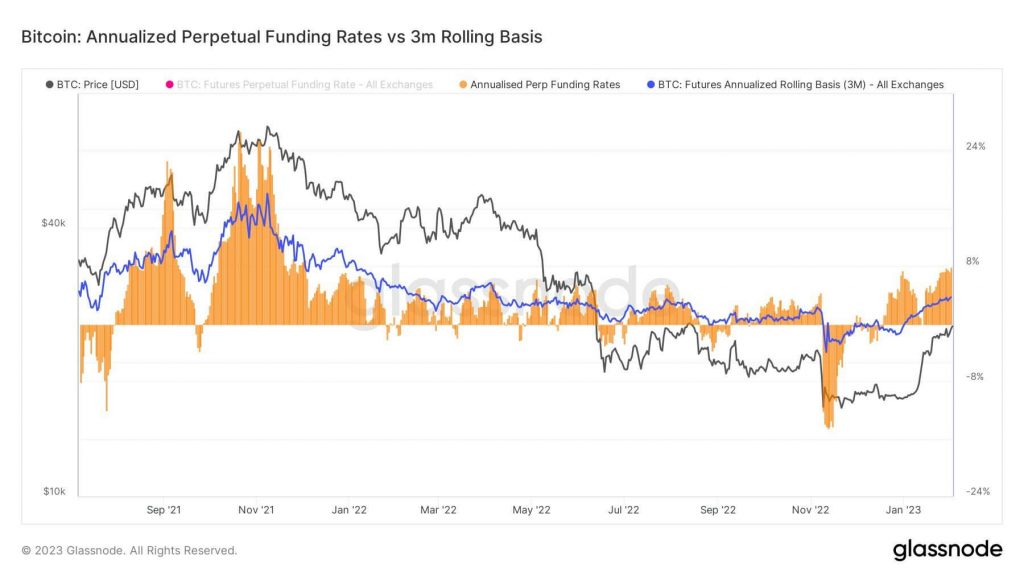

According to Glassnode data, the “funding rate” of perpetual futures, which sank to an unprecedented level of “negative divergence” during the FTX turmoil, has risen since the beginning of the year. is reversing along with

Glassnode

Click here for a list of market reports published in the past

The post Economic Club’s Powell Lecture Ahead, Bitcoin, etc. Wait-and-see appeared first on Our Bitcoin News.

2 years ago

165

2 years ago

165

English (US) ·

English (US) ·