It’s easy to forget that Microsoft used to stumble from time to time, especially when you look at its gaudy $2 trillion market cap today. Around 2010, four years before Satya Nadella would succeed Steve Ballmer as CEO, the company pretty much completely missed the mobile boat.

When Nadella came on board as CEO eight years ago, his mission seemed to be to make damn sure the company didn’t make the same mistake with the cloud. One way to do that would be to throw money at the problem, and just buy the companies to make the path easier.

Since its founding, Microsoft has acquired 250 companies, according to Crunchbase data, but most of the biggest deals, totaling $5 billion or more, have come during Nadella’s tenure. The two exceptions were Nokia and aQuantative, both of which happened under Ballmer, and neither worked out very well.

The three biggest, including the $69 billion Activision deal announced in January, the $26 billion deal for LinkedIn in 2016, and the $20 billion purchase of Nuance Communications last year all happened with Nadella in the corner office.

Microsoft has long had the resources and capability to handle multiple large businesses, as Jared Spataro, corporate vice president for Office 365, pointed out in his TC Sessions: SaaS interview last year: “The context for Microsoft had been our ability to develop multiple, very large businesses that ran in parallel. So this idea that we had multiple billion-dollar-plus businesses [like the] Windows business and Office businesses … Even a server business associated with productivity [certainly helped].”

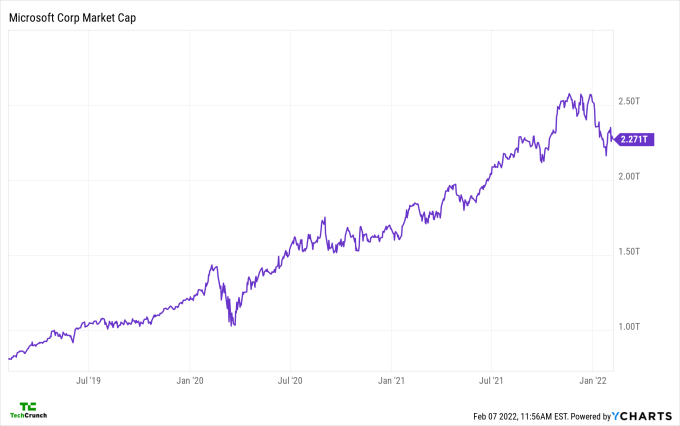

Those resources have grown dramatically as the company’s market cap has soared. Consider that since I covered Nadella’s five-year anniversary in 2019, the company’s public market value has grown from just over $800 billion to over $2 trillion. That kind of growth gives you a lot of options, which Nadella has certainly taken advantage of.

Image Credits: YCharts

English (US) ·

English (US) ·