There is an old adage in the market that traditional institutional ratings are lagging indicators. The recent experience of Bitcoin holder El Salvador also suggests that.

Credit rating agency Fitch downgraded El Salvador in September 2022 and predicted it would default in January 2023, but the country’s junk-rated bonds have soared, reflecting Bitcoin’s surge throughout 2023.

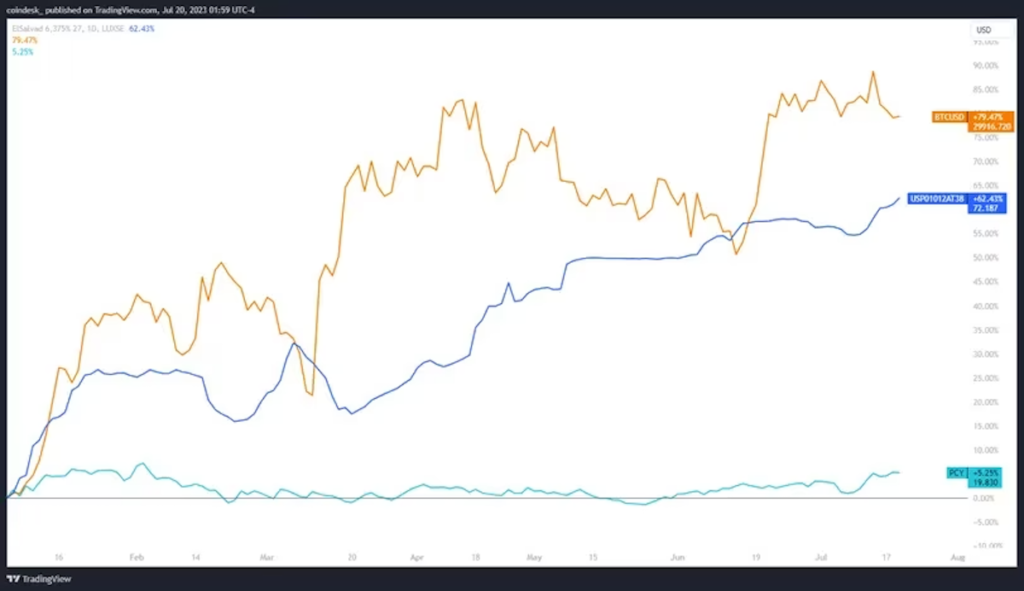

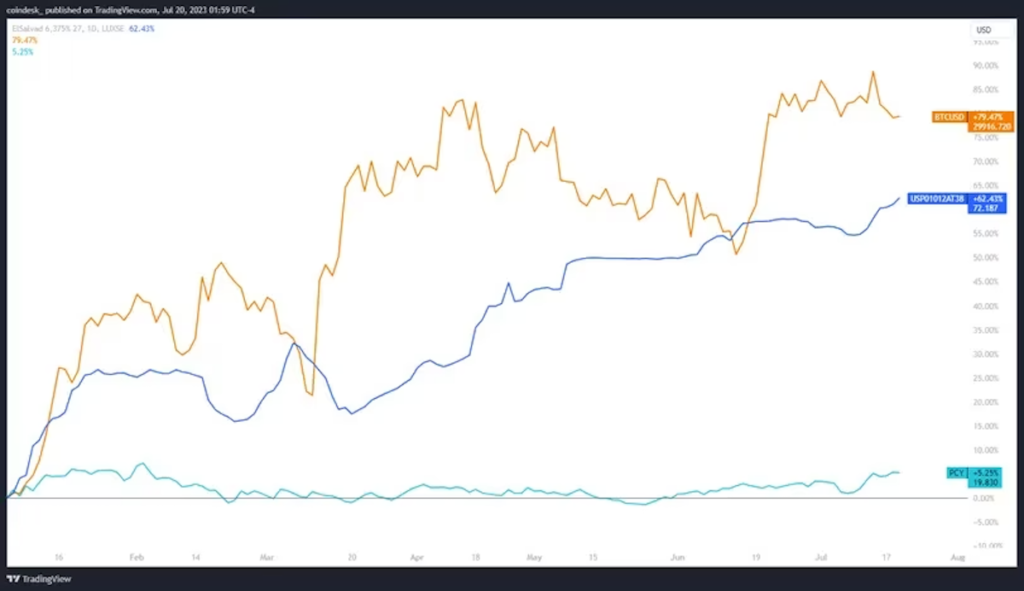

Bitcoin and El Salvador Government Bonds (TradingView)

Bitcoin and El Salvador Government Bonds (TradingView)The value of El Salvadoran government bonds is up 62%, trading at 72 cents on the dollar, according to market data. Bitcoin rose 79% over the same period.

Salvadoran government bonds have also outperformed one of the country’s largest holders, the Invesco Emerging Markets Sovereign Debt ETF, according to FactSet.

The country announced in January that it had redeemed $800 million in bonds that Moody’s Investors Service, one of the world’s largest credit rating agencies, had predicted could not be repaid.

El Salvador has announced that Bitcoin will become legal tender in mid-2021, and has started to reserve this crypto asset (virtual currency) from September 2021. As of April, the country held 2,546 bitcoins, according to Bloomberg estimates. The digital asset was purchased for $108.2 million and is worth $76.6 million according to current market data.

Separately, Volcano Energy recently announced a $1 billion investment to build a 241-megawatt bitcoin mining facility in El Salvador’s Metapan region. Investors include Tether, the issuer of Tether (USDT).

Rating agency negative

El Salvador’s adoption of Bitcoin has consistently drawn ire from rating agencies and the International Monetary Fund (IMF).

“Different policies related to government bitcoin adoption have reduced the chances of the IMF reaching an agreement in time for the $800 million debt redemption due in January 2023,” Moody’s wrote last fall.

In 2021, rating agency S&P Global Ratings said El Salvador’s decision to adopt bitcoin as legal tender would have “immediate and negative consequences.”

“The risks of Bitcoin adoption in El Salvador outweigh its potential benefits,” S&P said at the time. “There is an immediate negative impact (on credit).”

In February, the IMF said that the risks related to Bitcoin adoption in El Salvador “so far have not materialized due to the limited use of Bitcoin.”

“However, given the legal risks, fiscal vulnerabilities and the largely speculative nature of the cryptocurrency market, authorities should reconsider any plans to increase their exposure to Bitcoin,” the IMF said in a statement, reported by Reuters.

A change in the fortunes of El Salvador government bonds appears to be part of a broader market trend. Junk bonds from countries like Turkey, Argentina and Nigeria also outperformed investment-grade bonds earlier this year.

|Translation: CoinDesk JAPAN

|Editing: Toshihiko Inoue

|Image: TradingView

|Original: El Salvador’s Bonds Surge 62% Amid Bitcoin’s ETF-Driven Rally

The post El Salvador government bonds skyrocketed ── Bitcoin ETF-led rise | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

2 years ago

82

2 years ago

82

English (US) ·

English (US) ·