Elevate, a consumer benefits administration platform, today announced that it raised $28 million in a funding round led by Anthemis with participation from Fin Capital Norwest Venture Partners, Greycroft, Bowery Capital, and Firebolt Ventures.

The new cash, which brings Elevate’s total raised to $43 million, will be put toward product development, hiring and customer acquisition, according to CEO Brian Cosgray.

“Having worked at legacy benefits companies, Elevate’s founding team all saw what the industry lacked — flexible and scalable technology that met the needs of the changing workforce,” he told TechCrunch in an email interview. “These legacy company platforms were built using the best practices twenty years ago, but a lot has changed in two decades. Elevate started from scratch using the best technologies of today, like AI, keeping employee’s needs at its core and delivering on their expectations of a modern experience.”

Cosgray, whose background is in private wealth management, co-founded Elevate after selling his previous startup, DoubleNet Pay, to Purchasing Power in 2018. With Elevate, he sought to address some of the major pain points in employee benefits processing, like the long turnaround time for claims.

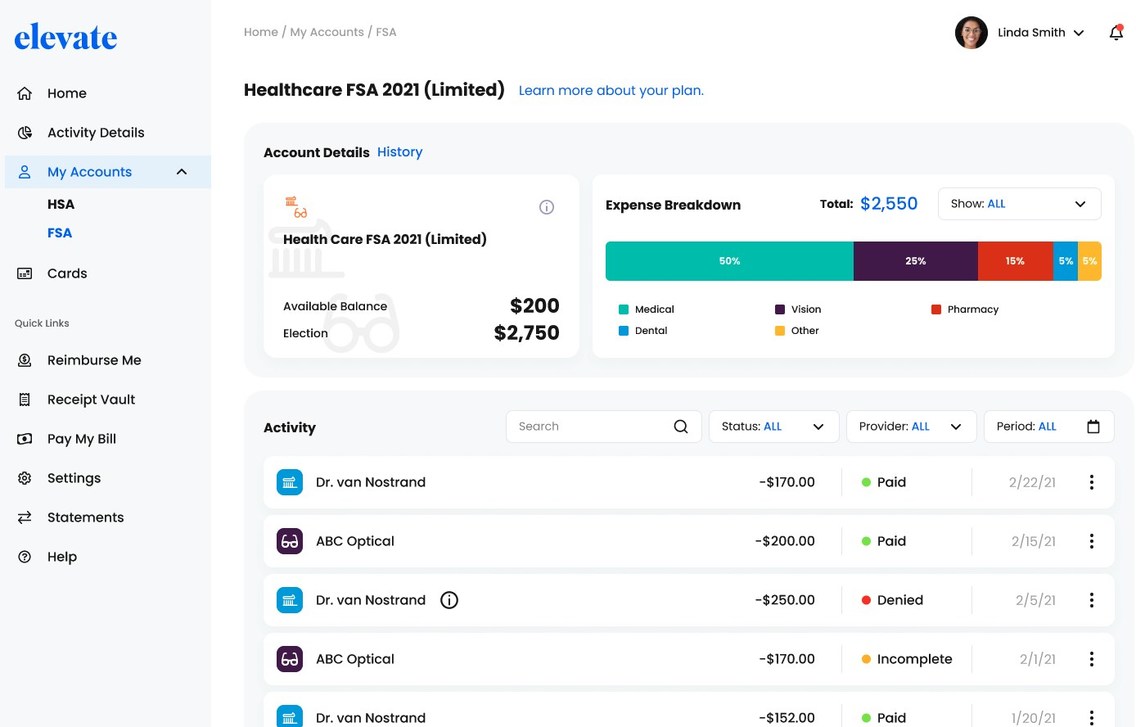

Using Elevate, employees can view, plan and manage pre-tax benefits from a dashboard on the web or mobile. Elevate offers real-time reimbursement for benefits such as health savings accounts and flexible spending accounts and a contactless card that supports popular mobile payment providers (e.g. Apple Pay).

Elevate’s benefits management dashboard.

Claims are processed “instantly” through Elevate, Cosgray says, with managers receiving reports just as quickly (if the sales pitch is to be believed).

“Legacy benefits platforms still use people behind the scenes to process claims. On average it takes up to three business days to process a claim,” Cosgray said. “Elevate’s platform leverages AI technology, so claims are processed quickly.”

Elevate occupies a space — employee benefits platforms — that’s full of vendors, some of which rival it directly. Fringe and Forma enable companies to offer customizable perks and benefits to employees. Cobee is developing an employee benefits “superapp” complete with a payment card and payroll software integrations.

Cosgray credits the pandemic with Elevate’s growth, asserting that it encouraged businesses to seek out “agile and tech-native benefits partners” to keep pace with changing the workplace needs (i.e. the shift to remote and hybrid work).

“The way modern business is done keeps changing and that change only helps us, because our platform is scalable and configurable to fit partners needs and grow with them,” he added. “With our new capital, we’re not just the smarter option, but the sustainable option, which is crucial for employees and employers using our platform.”

Cosgray claims that Elevate has formed more than half a dozen partnerships that service a user base in the “six figure” range. He wouldn’t talk in detail about revenue or burn rate, save that the new funding gives Elevate, which has around 45 full-time employees, more than three years of runway.

Anthemis managing director Kate Sampson, an investor, had this to say via email: “Although many have recognized the legacy provider experience was due for a complete overhaul, Elevate stands alone among the next-generation challengers with its capabilities to administer all plan types on a single, unified platform and card. In an age where employers are looking to drive efficiencies while also bringing modern, relevant benefit solutions to employees, we don’t think the current point solutions are going to find scale.”

Elevate lands $28M to help employers better manage benefits by Kyle Wiggers originally published on TechCrunch

English (US) ·

English (US) ·