Ethena Labs remained on investor radar this week after crypto investigator Nomad claimed that the team owns approximately 25% of staked ENA assets in the current season 3 farming event.

Alert: Important Notice for ENA/USDe Holders The Ethena team is currently using 180M ENA tokens (25% of SENA supply that earns sats) to farm sats in Season 3, effectively diluting other participants’ rewards. This raises significant concerns about the team’s ethics. A thread

Nomad stated that this might dilute rewards for unsuspecting users, with those holding stablecoin USDe highly vulnerable.

The investigation highlighted that suspicious Coin Prime Custody wallets received about 3 billion ENA coins in August.

Moreover, six Ethena-linked wallets received 180 million ENA from Coinbase Prime Custody in October – after the sENA staking activation in September.

Meanwhile, the addresses have received farming rewards in the past sessions, triggering skepticism about incentive distributions.

The allegations triggered significant bearish momentum for ENA prices. Nevertheless, the downside was short-lived, as the Ethena Labs team denied the claims.

Ethena denies allegations of misusing staked assets

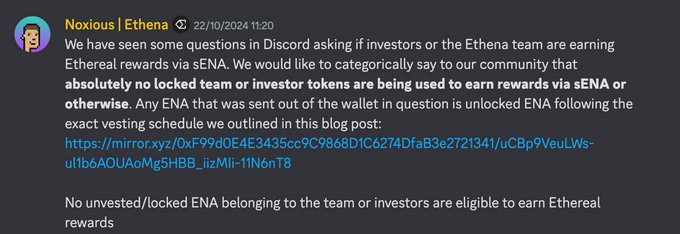

The synthetic dollar network confirmed that it didn’t use locked assets to farm rewards from DEX Ethereal.

The X post highlighted that the project did not hold tokens from team members or investors as staked assets to earn incentives.

We are aware of questions circulating in Discord and X as to whether investors or the Ethena team are earning Ethereal rewards via sENA using locked tokens. We would like to categorically confirm to our community that absolutely no locked team or investor tokens are staked as…

We would like to categorically confirm to our community that absolutely no locked team or investor tokens are stakes as sENA earning any rewards, including Ethereal.

Ethena Labs commented on the assets transferred from suspicious Ethena-linked addresses.

The team stated that none of the moved assets were locked, and the transactions matched their token unlock schedule.

Investor attention switched to ENA price actions amidst the developments.

ENA price outlook

Ethena maintained bullish price actions in the past day, climbing from the lows of $0.3325 to the $0.3937 intraday high – an 18.41% increase.

Source – Coinmarketcap

Source – CoinmarketcapThe 80% surge in ENA’s daily trading volume reflects robust momentum, suggesting continued gains for the altcoin.

Ethena Labs’ clarifications and the ongoing broad market recovery contribute to ENA’s bullishness.

The altcoin hovers above the 20-day EMA and 50-day SMA, indicating an upside trend.

Prices beyond the 20-day EMA reflect stable near-term strength and notable buyer action. Moreover, swaying above the 50-day SMA highlights bull dominance in the long term.

Such observations show that ENA has remained elevated in the past sessions. Meanwhile, that could attract more traders and investors.

Furthermore, the Average Directional Index of 29 suggests upward strength for ENA prices.

The indicator measures trend strength, with values below 20 reflecting weakness and above 25 a strong momentum.

The current broad market outlook supports continued gains for ENA prices.

The value of all digital coins increased by 1.75% in the past day as Bitcoin steadies above $71K.

Moreover, the 24-hour trading volume jumped 80% to $98.54 billion. Such momentum proves stability in the market – a perfect environment for attracting more bulls.

The post ENA gains 18% as Ethena Labs denies using locked assets to farm rewards appeared first on Invezz

English (US) ·

English (US) ·