The cryptocurrency market displayed bearishness on Monday, with Bitcoin (BTC) losing 1.45% in the past day to hover above $64.5K.

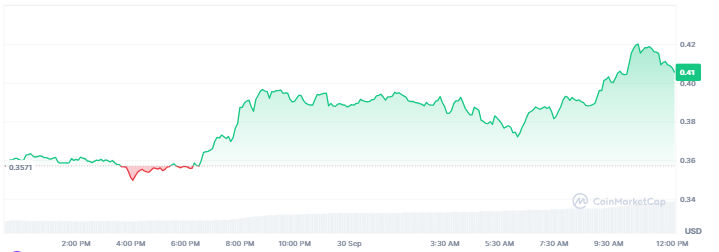

While most altcoins mirrored the top asset’s performance, Ethena (ENA) stole the show with a 20.16% uptick from a 24-hour low of $0.3497 to $0.4202 % on its daily chart.

ENA’s upside stance emerges as the community awaits voting on a crucial proposal seeking to launch the Ethereal decentralized exchange on USDe.

A new proposal was made on Ethena governance a few hours ago Ethereal Exchange is requesting the community approval to launch a new spot and perpetual exchange built on USDe and integrated into the Ethena hedging engine and liquidity Their proposal includes a 15% commitment of…

Ethereal is a DEX on the Ethena blockchain, and the proposal seeks to integrate it into Ethena’s reserve management to bolster demand and use cases for the synthetic stablecoin USDe.

Meanwhile, Ethereal Exchange seeks community authorization to introduce a spot and perpetual exchange on USDe.

The proposal read:

We are requesting that Ethereal be directly integrated into Ethena-related reserve management from launch to provide a fully on-chain venue for management of spot and derivatives positions backing USDe.

Furthermore, ENA holders will enjoy 15% of any Ethereal governance token if the proposal goes through.

The latest proposal comes as the community awaits the Ethereal V1 testnet launch in Q4 2024.

The app chain will deliver CEX-like performance while ensuring full self-custody and supporting functionalities such as portfolio margin, liquid automation, and cross-margin.

Recently, Ethena Labs announced BlackRock-backed UStb stablecoin to address issues associated with USDe.

With support from lender Securitize and BUILD fund, UStb fights negative funding rate cases and systemic vulnerabilities.

We are excited to announce Ethena’s newest product offering: UStb UStb will be fully backed by @Blackrock BUIDL in partnership with @Securitize, enabling a separate fiat stablecoin product alongside USDe Details below on why this is important:

Meanwhile, the positive developments triggered optimism in the Ethena community, catalyzing significant trading volume and price surges.

ENA’s investors saw their balances increase by 20% in the past 24 hours as top cryptos recorded dips.

ENA looks to extend its upsides amid reduced selling pressure.

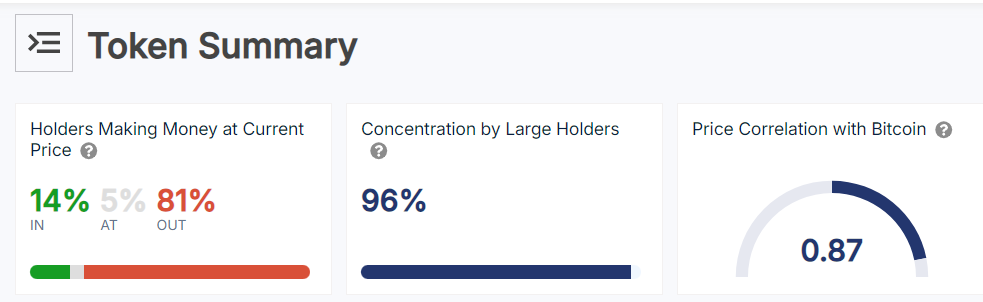

IntoTheBlock data shows large players (96%) control Ethena’s circulating supply.

With only 14% of holders making money at current prices, investors will likely buckle up expecting more gains, translating to diminished bearish momentum.

Source: IntoTheBlock

Source: IntoTheBlockENA’s current price action

The latest proposal saw Ethena Labs’ native token decoupling from the broad market.

The global cryptocurrency market capitalization plunged 0.82% in the past day to $2.28 trillion, reflecting bearish tendencies.

Meanwhile, ENA painted its 24-hour chart green, changing hands at $0.4105 after touching the $0.4202 daily high.

The 145% increase in daily trading volume underscores massive trader interest, confirming potential upside continuation.

Source: Coinmarketcap

Source: CoinmarketcapThe Moving Average Convergence Divergence supports a bullish stance, with the MACD line well above the signal line on the 4H timeframe.

Also, ENA price sways beyond the crucial 50- and 200-day Exponential Moving Averages, underscoring a bullish edge.

Nevertheless, broad market sentiments remain vital in shaping ENA’s mid- and long-term price trajectory, considering its 0.87 correlation with Bitcoin.

The post ENA surges 20% as Ethena Labs unveils bold plan to boost demand for stablecoin USDe appeared first on Invezz

English (US) ·

English (US) ·