4/4 (Tue) morning market trends (compared to the previous day)

- NY Dow: $33,601 +0.9%

- Nasdaq: $12,189 -0.2%

- Nikkei Stock Average: ¥28,188 +0.5%

- USD/JPY: 132.4 +0.007%

- USD Index: 102 -0.4%

- 10 year US Treasury yield: 3.4 -2.1% annual yield

- Gold Futures: $2,001 +0.7%

- Bitcoin: $27,567 -2%

- Ethereum: $1,789 -0.2%

traditional finance

crypto assets

Today’s NY Dow continued to rise and closed at +327 dollars. Energy-related stocks were the main buys. On the other hand, the IT and high-tech centered Nasdaq dropped to -32.4 dollars.

MarchISM

Last night, the US Institute for Supply Management released its ISM manufacturing index for March, the lowest since May 2020, at 46.3. It fell below February’s 47.4 and market expectations of 47.5. With the US Federal Reserve (Fed) continuing to raise interest rates to curb high inflation and the recent bank failures, demand for goods that are often traded on credit has fallen. Manufacturing accounts for about 11% of the U.S. economy, and an index below 50 indicates contraction.

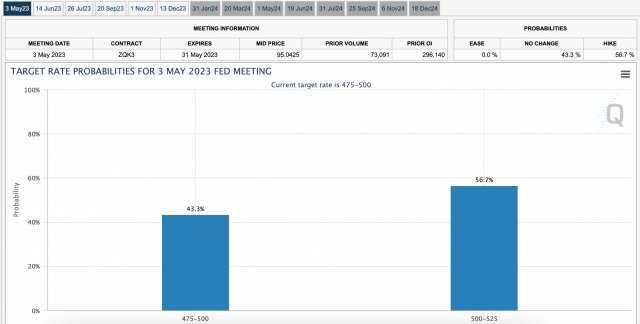

Last Friday’s US PCE price index deflator and the University of Michigan data also showed a slowdown in inflation, with some analysts betting that the 0.25% rate hike at the next FOMC meeting will be the last hike in the cycle.

connection: The development of bitcoin’s latest high price range, arbitrum temporarily down 20% from the previous day

connection: Nasdaq and AI-related stocks rise sharply Favorable slowdown in US inflation | 1st

high oil prices

Until the end of last week, however, expectations were high that the FRB would stop raising interest rates at the next FOMC meeting. As the interest rate skyrocketed, expectations for the next 0.25% rate hike in May rose again in the interest rate futures market, and expectations for a halt to rate hikes seemed to have receded significantly.

Source: CME

OPEC Plus, which consists of the Organization of the Petroleum Exporting Countries (OPEC) and major oil-producing countries that are not members, announced on the 2nd that it would make a surprise additional production cut of about 1.16 million barrels per day. It will start in May and continue until the end of this year.

The risk of another sharp rise in oil costs is likely to complicate future interest rate outlooks for European and US central banks, which are priced in a scenario of continued weakness in consumer prices and a halt to rate hikes. “We’ve started to see some signs that inflation is normalizing, but now a new problem has resurfaced,” said State Street strategists, according to Bloomberg.

Oil prices, which fell toward $70 a barrel last month to a 15-month low on concerns that the global banking crisis would hit demand, are now back down toward $80. ing.

Source: investing.com

Economic indicators (Japan time)

- Wednesday, April 5, 21:15: U.S. March ADP Employment Statistics

- April 12, 21:30 (Wednesday): US March Consumer Price Index (CPI)

- Thursday, April 13, 3:00 PM: Federal Open Market Committee (FOMC) Minutes

- Friday, April 14, 21:30: U.S. March Retail Sales

- April 14, 23:00 (Friday): April University of Michigan Consumer Confidence Index, preliminary figures

connection: The monthly trading volume of Ethereum futures is at the highest level since May last year as bitcoin struggles in the latest high price range

US stocks

European and American energy stocks were bought on the back of soaring crude oil costs. ExxonMobil +5.9%, Chevron +4.1%, Shell +5% (vs. previous day).

On the other hand, US IT/tech stocks took a break due to concerns about inflation due to the sharp rise in crude oil costs. Compared to the previous day for individual stocks, NVIDIA +0.6%, c3.ai +0.8%, Big Bear.ai +28.2%, Tesla -6.1%, Microsoft -0.3%, Alphabet +0.6%, Amazon -0.8%, Apple +0.7% , Meta +0.5%, Coinbase -5.8%.

Tesla

Tesla found that orders slowed in the first three months of this year as production outpaced deliveries. Despite the price cuts on several models, it seems that the number of vehicles delivered has grown only slightly, which is disappointing.

connection: Elon Musk denies plaintiff’s allegations in Dogecoin lawsuit

Rumors of International Wanted Letters on Binance

Coinbase stocks and Bitcoin (BTC) fell sharply. In the background, rumors surfaced that Interpol would issue a “Red Notice” to Binance.

The authenticity of the international wanted letter is currently unknown, but was revealed in the form of a message encrypted with a SHA-256 hash function.

AHHHHH IM HEARING THINGS

brb withdrawing a decent chunk just in case. pic.twitter.com/2weMwBMP7C

— hyuk (@hyuktrades) April 3, 2023

In response to this rumor, Binance’s CZ pointed out that it was “FUD.”

How FUD starts, then… pic.twitter.com/spg9iiI8As

— CZ  Binance (@cz_binance) April 3, 2023

Binance (@cz_binance) April 3, 2023

connection: Top 10 cryptocurrency stocks in Japan and the US

The post Energy stocks rise due to high crude oil prices, Tesla and coinbase stock prices fall | 4th Financial Tankan appeared first on Our Bitcoin News.

2 years ago

166

2 years ago

166

English (US) ·

English (US) ·