Cryptocurrencies faced significant bearish pressure on Friday, with Bitcoin briefly dropping below the $58,000 mark, hitting $57,994.

Although bulls quickly reclaimed the $58,300 level, the altcoin market bore the brunt of the decline, with Enjin, Dent, and EOS leading the downturn.

Enjin (ENJ) shows bearishness

ENJ displays robust bearishness on the daily chart, following a swift 6.89% decline to trade at $0.1386. Friday’s dip extended the alt’s weekly losses by 15%.

Source: Coinmarketcap

Source: CoinmarketcapThe 1-day chart confirms Enjin’s struggles, suggesting continued price plunges in the near term.

Dent (DENT) on a downward trajectory

DENT lost 8% over the last 24 hours as bears induced fresh dips. It trades at $0.0007691 after surrendering 13% within the past seven days. The altcoin has dropped over 15% in August.

Source: Coinmarketcap

Source: CoinmarketcapDENT’s daily trading volume plunged 20%, indicating faded enthusiasm around the altcoin. Thus, Dent traders will likely witness more declines before potential revivals.

EOS plunges to new lows

Friday’s bearish wave left EOS down 5% on its 24-hour chart. The alt traded at $0.4773 during this publication, signaling a prolonged winter with an 18% plunge in 24-hour trading volume.

Source: Coinmarketcap

Source: CoinmarketcapEOS investors saw their portfolios reduce by 12% within the previous week.

Meanwhile, the trio reflects broad market sentiments and will likely follow Bitcoin’s performance in the upcoming sessions. The bellwether crypto remains in the bears’ hands as its multiple attempts to conquer $61K fail.

BTC trades at $58,242.16 as it tried to recover from today’s 4.07% sudden plunge.

Bitcoin’s struggles continue

The leading crypto by value has suffered limited moves since the 4 August correction. The historic dip, which had the crypto market cap losing $367B, coincided with massive crashes in equity markets. Nevertheless, Bitcoin has failed to recuperate relative to United States stock indices.

While digital assets witness steady demand, Bitcoin has displayed a lackluster performance due to various notable factors. Analysts believe the coin lacks the narrative that generally fuels speculative interest in digital assets.

Moreover, August hasn’t been friendly for Bitcoin in the past three years, with BTC losing 13.88%, 11.29%, and 7.98% in 2022, 2023, and 2024 respectively.

Also, the narrowing exchange-traded funds (ETFs) flows have added to Bitcoin’s woes.

Nevertheless, analyst Mags trusts the current declines are usual before robust upswings to new all-time highs.

#Bitcoin – just a matter of time 👀

He remained confident that hitting the $100K mark is only “a matter of time” for Bitcoin.

A Bitcoin rally to record ATHs will trigger a robust altcoin season, rescuing most tokens from prolonged plunges.

Investors capitalizing on discounted prices

While the market endures a bloodbath, savvy investors appear to seize the opportunity to buy at lowered prices. On-chain data shows enthusiasts have withdrawn 40,000 BTC, worth approximately $2.4 billion, from exchanges in the past two days.

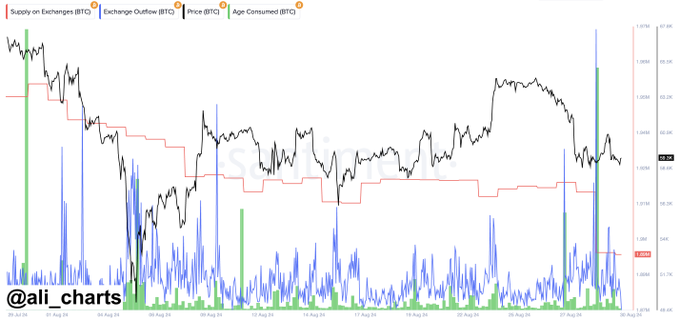

Seems like some major players bought the #Bitcoin dip! On-chain data from @santimentfeed reveals a 40,000 $BTC drop in exchange supply over the past 48 hours, equivalent to about $2.40 billion. This aligns with a notable surge in exchange outflows!

That reflects a massive interest in accumulating Bitcoin at plunged prices. Moreover, the development highlights confidence in significant recoveries.

The post Enjin, Dent, and EOS lead losses as Bitcoin briefly drops below $58K appeared first on Invezz

English (US) ·

English (US) ·