Even in the usually exciting world of cybersecurity, discussions on enterprise security budgets tend to veer toward the mundane. However, today’s macroenvironment has thwarted almost every market prediction, and while we know for certain that the down market has driven most companies toward austerity, its true impact on cybersecurity spending has remained an enigma — until today.

A recent report by YL Ventures based on data pulled from surveying Fortune 1000 CISOs (chief information security officers) and cybersecurity decision-makers is shedding light on the impact of the down market on buying behavior, how security strategies are evolving in response and how customer interactions with vendors have changed as a result.

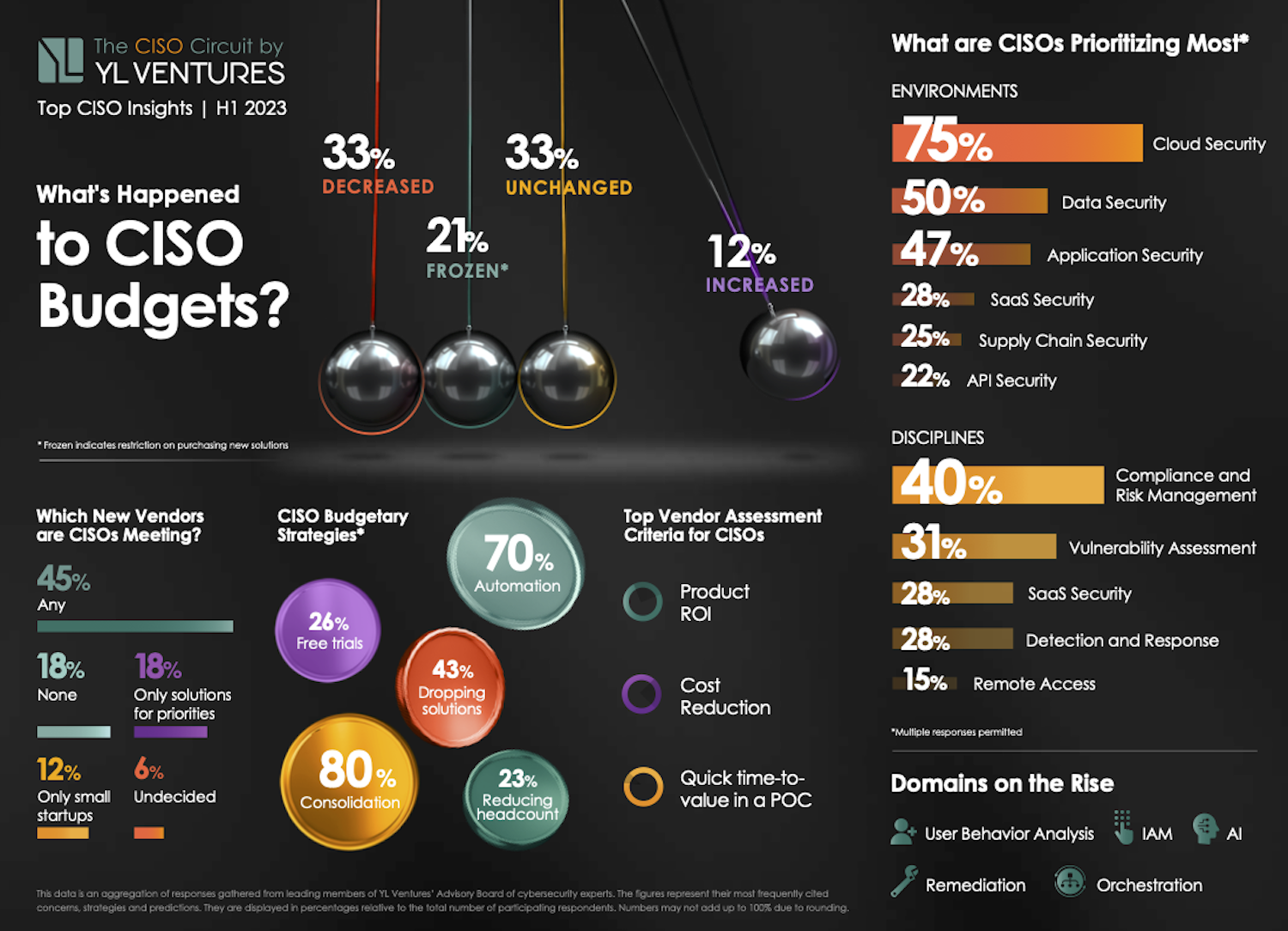

The biggest takeaway? Half of CISOs can still accommodate new solutions, and, contrary to low expectations, 45% of cybersecurity budgets remained unchanged or have even been increased. Specifically, a third of respondents (33.3%) report unchanged budgets and 12.2% saw their budgets raised.

Meanwhile, another third (33.3%) of cybersecurity budgets have been cut while 21.2% of cybersecurity leaders are currently managing frozen budgets, meaning that new spending is not possible.

Image Credits: YL Ventures

Making first contact

Though the data may seem intimidating, vendors still have ample opportunity to get a foot in the door. A considerable majority (75.8%) of cybersecurity leaders are still willing to meet new vendors — there are simply more caveats involved. While almost half (45.5%) are willing to meet any vendor, 18.2% are only meeting with those who strictly address their most pressing security priorities and 12.1% are only interested in meeting younger and smaller startups.

Indeed, this is an excellent time for small startups to shine and perhaps for larger vendors to take note. In the eyes of most cybersecurity leaders, smaller and earlier-stage companies tend to offer more advantageous licensing costs as well as design partnerships, which enable bespoke solutions that better suit their unique pain points and operational needs.

Currently, 26.7% of respondents are relying on free trials as provisional measures. If we think back on the more difficult days of the pandemic, when many cybersecurity providers offered their services for free, we can see ample evidence of just how much goodwill such gestures built and how they propelled companies to the top. For vendors who find this too difficult to stomach, consider how effective land and expansion tactics have tended to work in the past, and remember that the rising tide of fiscal conservatism leaves little room for obstinacy.

English (US) ·

English (US) ·