The post ETH, AVAX, SOL, and NEAR Price To Hit This Low Level In Current Bearish Cycle appeared first on Coinpedia - Fintech & Cryptocurreny News Media| Crypto Guide

Fears of inflation and economic uncertainty continue to drive down the price of bitcoin, altcoins, and the volume of the cryptocurrency market. Bitcoin’s price plummeted to $21,000 on Wednesday while the altcoins too followed BTCs suit and crashed. Although, at the time of writing, the majority of the top 10 coins had made minor gains in the previous 24 hours and were trading in the green.

As the markets plummet, a well-known expert is delving into the charts to set price goals for four cryptocurrencies.

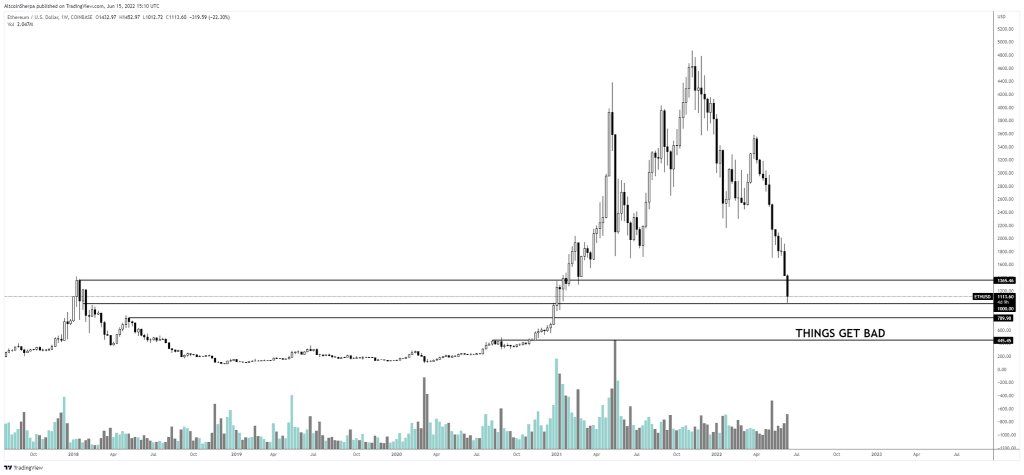

Ethereum (ETH)

Altcoin Sherpa, a pseudonymous trader, says he’s looking at Ethereum, the top smart contract platform, using one-week candles, and that the $500 to $800 range is a possibility if ETH capitulates above $1,000.

For obvious reasons, he believes $1,000 is a good short-term bottom. The next target would be $800, and if things get worse, $500. At the time of writing, ETH is trading at $1,198 and is up by more than seven percent in the last 24 hours.

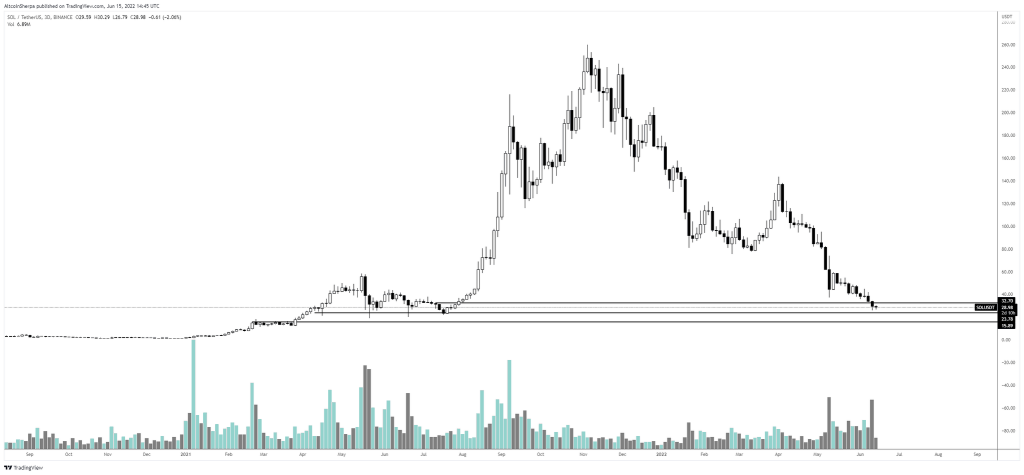

Solana (SOL)

Moving on to layer-1 blockchain Solana, the analyst believes the altcoin will recover some of its losses in the near term, but it will still go below $20.

“[In my opinion] current area is a good buy zone for a short-term bounce, would NOT get greedy and assume this is ‘the bottom’. The bottom is probably sub-$20 if things continue lower.”

At the time of writing, SOL has gained a whopping 21 percent in the last 24 hours and is trading at $33.

Avalanche (AVAX)

Next, Altcoin Sherpa evaluates Avalanche, a layer-1 smart contract platform, and predicts that AVAX will eventually collapse to $10, noting that a price below $5 would imply “things are really bad.” At the time of writing, Avalanche was trading at $17.81, up 15 percent. AVAX was trading above $24 a week ago.

Near Protocol (NEAR)

NEAR Protocol, a decentralized application (dApp) platform and Ethereum competitor comes last on the analyst list. He sees $2.50 as a possible bottom but warns that additional market capitulation could push NEAR below $2.

“$2.50ish would be a target in the mid-term; we could see a bounce before then, though. If things get bad, eyeing sub-$2.”

3 years ago

142

3 years ago

142

English (US) ·

English (US) ·