The crypto market displays significant fear as Bitcoin approaches new lows of $80K.

Amid the uncertainty, Ethena (ENA) witnessed optimism, with a large-scale investor purchasing its latest dip.

Investors scoop ENA’s dip

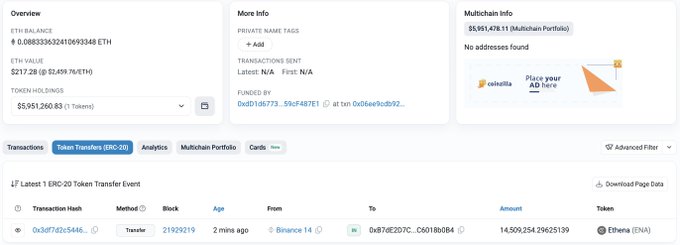

Lookonchain highlighted a new wallet that cashed out 14.51 million ENA assets (worth around $5.95 million) from Binance.

A newly created wallet just withdrew 14.51M $ENA($5.95M) from #Binance. etherscan.io/address/0xb7de…

The potential whale accumulation underscored the dip-buying strategy, where investor leverage crashed prices to buy at a discount.

ENA reflected the enthusiasm with significant price gains on its daily chart.

While the global crypto market capitalization lost 2.30% in the past day to $2.86 trillion, Ethena soared more than 6%.

Coinglass data confirms the ongoing ENA accumulation by market-moving players.

The Spot Outflow/Inflow data shows exchanges have seen ENA outflows worth approximately $2.10 million in the previous 24 hours.

Such developments suggest notable buying from large-scale investors.

That can lead to magnified bullish momentum for stable price rallies.

Furthermore, IntoTheBlock data indicates an over 1,000% increase in ENA’s large transactions within the past day.

Moreover, daily active addresses surged 64% in that timeframe.

Institutional players are likely exploring Ethena’s bounce-back opportunity after the latest market rash.

ENA price outlook

The alt trades at $0.4368 after gaining over 6% in the past 24 hours.

While broad-based sentiments suggest bear dominance, prevailing whale interest could keep ENA prices afloat in the near term.

The latest jump has pushed Ethena above the crucial support barrier of $0.41 – where the alt has historically reversed with stability.

Sustenance above $0.36 will cement the $0.41 foothold in the upcoming days. That could catalyze upswings to $0.65 – a nearly 50% surge from Ethena’s current price.

Enthusiasts should watch key levels like the massive liquidation region at $0.394 (lower) and $0.418 (upper). These price levels have seen staggering leverages from intraday traders.

The liquidation map suggests a potential price dip to $0.394 would liquidate long positions worth approximately $6.26 million.

Intraday traders executed these positions, hoping Ethena’s price would stabilize above the price level.

On the other hand, possible price surges to $0.418 would liquidate short positions worth about $2.44 million.

The over-leveraged positions by sellers and buyers indicate bull dominance that could support short-term recoveries.

Meanwhile, broad market trends will influence ENA’s price actions in the upcoming sessions.

Decisive recoveries will support the alt’s projected surges to the targeted highs. However, continued Bitcoin dips will likely delay the anticipated Ethena surge (in the near term).

Analysts forecast bounce backs despite the visible market weakness.

For instance, Michael van de Poppe stated that Bitcoin collected liquidity below $85K with its latest plunge below $83K.

#Bitcoin took the liquidity beneath the $85.3K level and reached $83-87K. I think that the chances of having the low here are substantially high. Given that altcoins are breaking up massively against Bitcoin, I expect them to outperform from here for the remainder of 2025.

A Bitcoin low at this level could spark decisive recoveries and welcome the much-awaited altcoin season in the coming months. Michael added:

Given that altcoins are breaking up massively against Bitcoin, I expect them to outperform from here for the remainder of 2025.

The post Ethena surges 6% after whale buy: can ENA price rally further? appeared first on Invezz

English (US) ·

English (US) ·