Ethereum (ETH) is up 61% in the first six months of this year. Some investors have bought $10 million ($1.45 million) in option contracts betting that Ethereum could rise in the second half of the year.

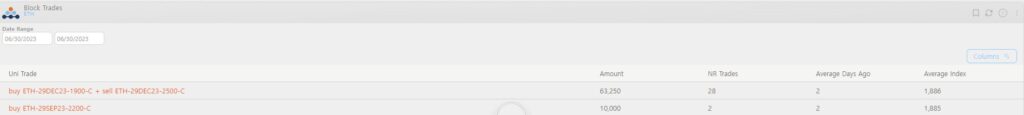

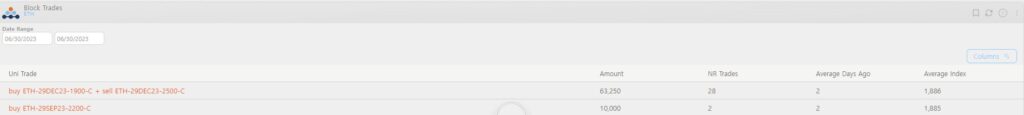

Purchased approximately 63,250 bull call spreads

According to Amberdata, an investor bought approximately 63,250 Ethereum bull call spreads (1 contract = 1 ETH) for $10 million on Dec. 1. . A bull call spread is a combined sale and purchase of a call option that includes a sale of a call option with a strike price of $2500 and a purchase of a call option with a strike price of $1900. rice field.

When you buy a call option, you pay a premium to buy the right to purchase the asset at the strike price. If the rate at maturity falls below the strike price, the right to buy is waived and the premium is lost. On the other hand, when you sell a call option, you receive a premium and sell “the right to buy the asset, which is the strike price.” If the rate at maturity exceeds the strike price, you will be obligated to sell the asset at the strike price, resulting in a loss.

The premium earned from selling call options was applied to the premium paid for buying call options, but since the premium for buying was greater, the net initial purchase cost was $10 million.

bullish exposure

Amberdata’s Director of Derivatives Greg Magadini said in the evening newsletter that “the standout for Ethereum is the net paid premium for the $1,900-$2,500 callspread expiring in December. is about $10 million,” he said.

Magadini said the strike prices chosen indicate a desire to have bullish exposure.

Bull call spreads are popular in both traditional financial instruments and cryptocurrencies because they can limit the range of losses and gains.

This bull call spread becomes more profitable as the price of Ethereum rises, but profit potential is limited to the difference between the two strike prices minus the initial purchase cost. If Ethereum trades below $1,900 at the end of December, it will be a loss. However, the loss is limited to the initial purchase cost paid.

Investors who bought this bull call spread expect the Ethereum price to rise gradually over the next six months.

There is also a view that Ethereum will rise

“Bull call spreads are the classic directional trade,” Chang, partner and analyst at crypto asset data tracking platform Greeks.Live, told CoinDesk, noting that increased interest in such strategies doesn’t necessarily have to do with Ethereum. said it did not promise a rise in Meanwhile, cryptocurrency service provider Matrixport said Ethereum will see a notable rally.

As of this writing, Ethereum is trading at $1,966, its highest since May 6, according to CoinDesk data.

“A buy signal occurred when Ethereum traded at $1,700[during the mid-June low],” said Markus Thielen, head of research and strategy at Matrixport. “While prices are rising in the dollar, we believe we have an opportunity to explode even further.” Ethereum could catch up with Bitcoin.

Bitcoin surged nearly 85% in the first half, outperforming many other coins by a wide margin.

Overall options markets are trending bullish on both Ethereum and Bitcoin (BTC), with short-term and long-term call/put skew positive at the time of writing. Skew indicates the cost of a call versus a bearish put, or bullish sentiment.

|Translation: CoinDeskJAPAN

|Editing: Rinan Hayashi

|Image: Shutterstock

|Original: A $10M Options Bet on Ether Shows Positioning for a Bullish Second Half

The post Ethereum bullish option trading of $ 10 million ─ Expect to rise in the second half | CoinDesk JAPAN | Coin Desk Japan appeared first on Our Bitcoin News.

2 years ago

113

2 years ago

113

English (US) ·

English (US) ·