Macroeconomics and financial markets

On the US New York stock market on the 16th, the Dow Jones Industrial Average closed down 145 points (0.37%) from the previous day, while the Nasdaq Index closed 130 points (0.82%) higher.

As a result, on the Tokyo stock market, the Nikkei Stock Average fell by 161.53 yen (0.41%) from the previous day. Expectations are high for the Nikkei Stock Average to break its record high of 38,915 yen, set in December 1989.

Among U.S. stocks related to crypto assets (virtual currency), Coinbase, which had a good financial result, continued to grow significantly, rising 8.08% from the previous day. Not only did trading revenue increase by 64.3% compared to the same period last year, which far exceeded market expectations, but the company was also praised for expanding its surplus capacity through significant cost reductions of -45% compared to the previous year.

CoinPost app (heat map function)

Regarding the impact of the approval of Bitcoin Spot ETF (Exchange Traded Fund), 10 stocks including BlackRock's Bitcoin ETF are in a position to greatly benefit from the soaring price of crypto assets by expanding their customer base and increasing trading volume. Eight of the stocks use Coinbase's custodian service, and stable fee income is expected.

Although Coinbase's tough stance on the crypto asset industry and dispute with the US SEC (Securities and Exchange Commission), which is proceeding with lawsuits, are cited as risks, Coinbase is expanding its trading products and registering licenses in countries outside the US. If we can win the case or reach a settlement, we will be able to eliminate any concerns.

connection:Why Sumitomo Mitsui Card Platinum Preferred is rapidly gaining popularity as a new NISA savings investment

Virtual currency market conditions

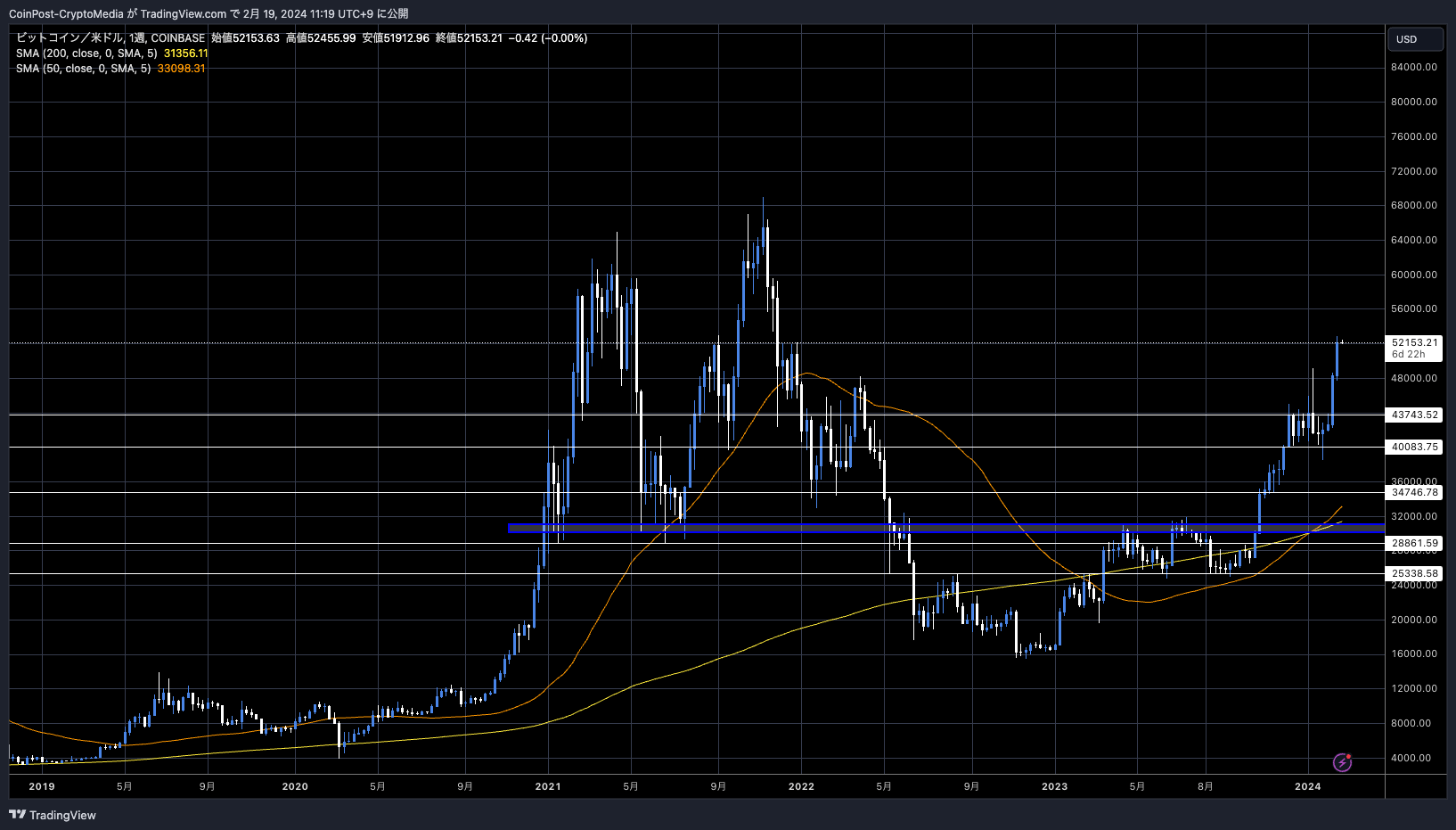

In the crypto asset (virtual currency) market, Bitcoin (BTC) rose 4.3% from the previous day to 1 BTC = $52,137.

BTC/USD weekly

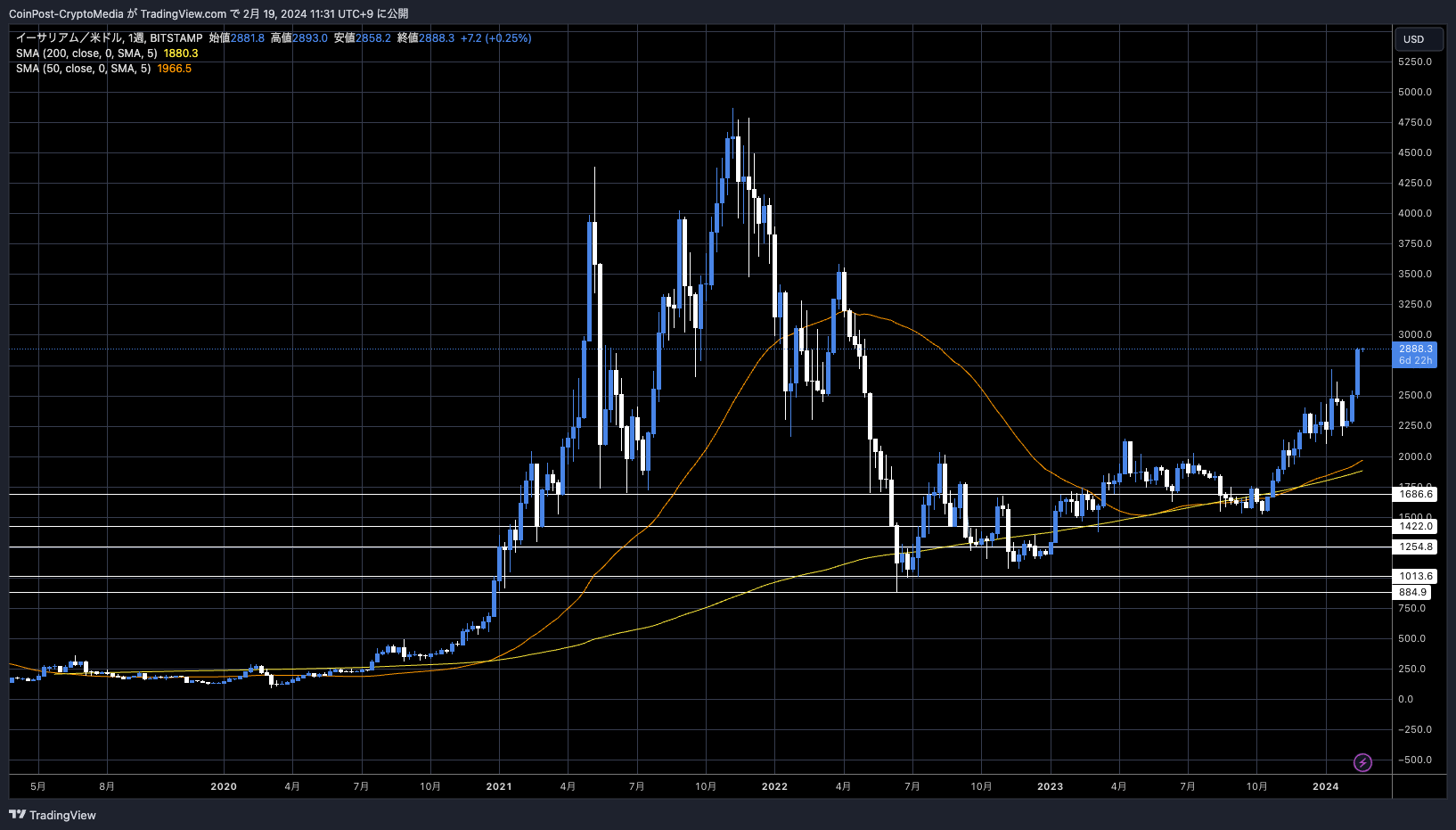

Ethereum (ETH), which ranks second in market capitalization, rose 8.1% from the previous day to $2,881. In addition to the upcoming mainnet launch of the next upgrade, “Dencun,” expectations for approval of the Ethereum spot ETF applied by BlackRock and others are creating buying pressure.

ETH/USD weekly

connection:Ethereum next upgrade Dencun, mainnet launch on March 13th

Recent inflows into Bitcoin ETFs indicate growing confidence in the crypto sector.

Capital inflows into BlackRock's IShares (IBIT) and Fidelity's Bitcoin ETF (FBTC), two of the largest asset management companies, increased by 260,000 BTC in just five weeks after their listing was approved by the US SEC (Securities and Exchange Commission).

In

Only *5 weeks* of trading since spot bitcoin ETFs went live.

“No demand.”

via @apollosats pic.twitter.com/xepu2v9Het

— Nate Geraci (@NateGeraci) February 18, 2024

Analysts at CryptoQuant predict that if current levels of capital inflows continue, Bitcoin price could reach $112,000 by the end of the year.

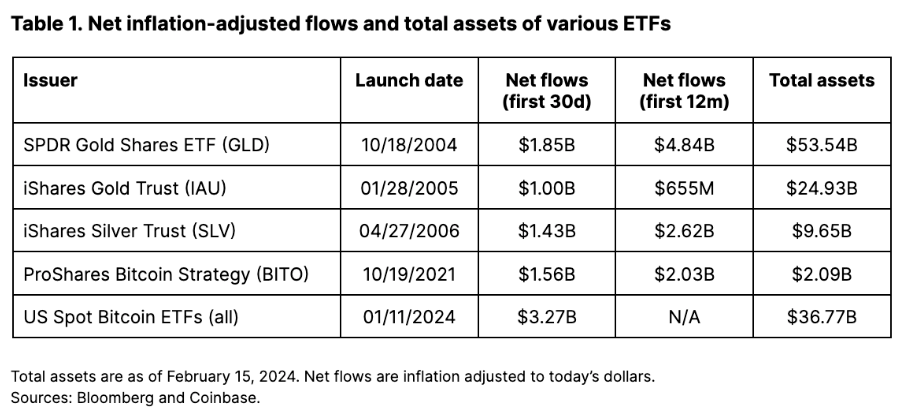

According to a report from Coinbase, the largest US cryptocurrency exchange, the amount of inflows in the first month of approval rose to $3.3 billion (500 billion yen). As a result, the market capitalization of the crypto asset market has reached the $2 trillion level for the first time since March 2022. The current inflow level is equivalent to more than 10 times the amount of BTC that Bitcoin miners can produce.

Furthermore, compared to gold ETFs in 2004, the inflows of State Street's SPDR Gold Shares ETF (GLD) were significantly higher. “It was the most successful.”

ETF comparison (Source: Coinbase)

Among the approximately 5,500 ETFs created to date, BlackRock's iShares Bitcoin Trust (IBIT) and Fidelity's Wise Origin Bitcoin Fund (FBTC) have inflows in the top 0.1%. ”.

However, although the flow of portfolio rebalancing has begun to calm down, such as the large-scale selling of the Grayscale investment trust Bitcoin Trust (GBTC) due to its conversion to an ETF, technical selling pressure factors remain.

One of these is debt restructuring related to repayment to creditors of Genesis, which went bankrupt in 2022.

On the 14th, Genesis Global was ordered by the U.S. Bankruptcy Court in New York to acquire 35.9 million shares ($1.66 billion) of Bitcoin Trust (GBTC) and 8.7 million shares ($209 million) of Ethereum Trust (ETHE). It has been learned that the company has received approval to sell its assets to repay creditors.

As a result of this ruling, the possibility of “selling all stocks and distributing cash'' or “converting GBTC or ETHE into purchasing physical crypto assets (virtual currency) on behalf of creditors'' has emerged. There is. In this regard, Coinbase's analysis shows that the latter is more likely.

connection:What is Bitcoin halving?Outlook for 2024 based on past market price fluctuations

Related: Points to note about virtual currency IEOs Domestic and international examples and how to participate

Under these circumstances, El Manjura, an analyst at ARK Invest led by Cathie Wood, points out, “Despite the soaring price of Bitcoin, Google search volume is at an all-time low.'' did.

The background is a significant increase in the influx of institutional investors due to the approval of the listing of Bitcoin ETFs (exchange traded funds), and as the market matures, the demand for basic information search by individual investors has decreased compared to the past bull market. Examples include things you do.

Mr. Elmanjura described the market as “the dawn of a new era,'' and expressed hope that the market will be headed for a sustainable growth path led by institutional investors, rather than the speculative demand of individual investors.

connection:Bitcoin vs. Yen hits new high; even in the options market, there is limited room for a downside price | Contributed by a bitbank analyst

altcoin market

In the altcoin market, a sharp rise in Worldcoin (WLD) was also noticeable. Although there is no direct relationship, it seems that OpenAI's announcement of high-precision video generation AI “Sora” has raised speculation. Launch date has not been determined.

If you give commands using Sora's text prompts, you can watch movie trailers featuring the adventures of astronauts, animated works, and powerful live-action footage of giant extinct mammoths looming in a snowy field. A wide variety of use cases are envisioned, including the ability to reproduce

Prompt: “Several giant wooly mammoths approach treading through a snowy meadow, their long wooly fur lightly blows in the wind as they walk, snow covered trees and dramatic snow capped mountains in the distance, mid afternoon light with wispy clouds and a sun high in the distance… pic.twitter.com/Um5CWI18nS

— OpenAI (@OpenAI) February 15, 2024

connection:World Coin (WLD) skyrockets, speculation raised by OpenAI's announcement of video generation AI “Sora”

Worldcoin (WLD), founded by Sam Altman, CEO of Open AI, the developer of ChatGPT, has raised $115 million in a Series C funding round.

Meanwhile, countries such as France, India and Brazil have been forced to discontinue iris scanning after facing a backlash over privacy concerns over the collection of biometric data for universal digital ID solutions and WLD basic income distribution. There is a reason why it is no longer available.

Related: Explaining the advantages of staking and accumulation services and the advantages of virtual currency exchange “SBI VC Trade”

We have introduced the “Heat Map” function to the CoinPost app for investors!

In addition to important news about virtual currencies, you can also see at a glance exchange information such as the dollar yen and price movements of crypto asset-related stocks in the stock market such as Coinbase.

■Click here to download the iOS and Android versions

https://t.co/9g8XugH5JJ pic.twitter.com/bpSk57VDrU

— CoinPost (virtual currency media) (@coin_post) December 21, 2023

Click here for a list of past market reports

The post Ethereum continues to grow significantly, approaching the $3,000 level, Bitcoin also remains firm appeared first on Our Bitcoin News.

1 year ago

110

1 year ago

110

English (US) ·

English (US) ·