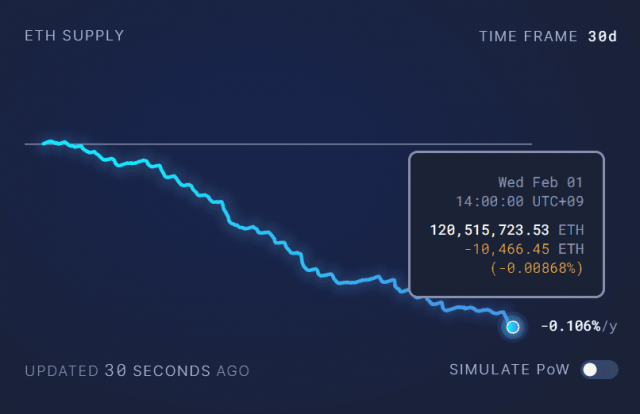

Net loss of ETH in January

Through January 2023, the supply of crypto assets (virtual currency) Ethereum (ETH) has decreased by 10,466 ETH (2 billion yen). The number of ETH burns is increasing based on the increase in network usage, and it is outstripping the new issuance due to staking rewards.

Source: Ultrasound.Money

Burning is the act of reducing the supply of virtual currency that has already been issued and circulated in the market. Raise the rarity value of the token to affect the supply and demand relationship, and it is expected that the price will rise.

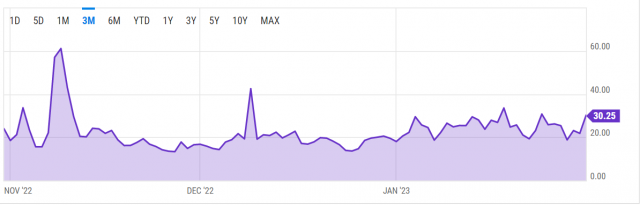

Ethereum has a mechanism to burn part of the transaction fee (base fee). Due to the increase in ETH gas prices in January (20Gwei or less → 20Gwei or more), the burn rate, which fluctuates according to gas demand, has also increased.

Source: Ycharts

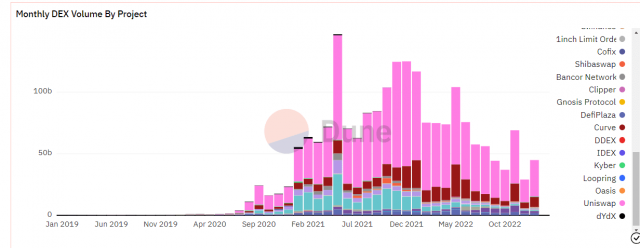

Decentralized exchange Uniswap was the application that burned the most ETH in January. Three Uniswap products have burned a total of 8,300 ETH over the past 30 days, accounting for 13% of the total ETH burn (63626.43 ETH) during the same period.

In fact, Uniswap’s monthly trading volume reached $2.96 billion in January, up 66% month-on-month.

Source: Dune

OpenSea, the largest NFT electronic market, accounted for 8.6% of the total burn volume with 5493.09 ETH. In addition, the use of the stablecoin “Tether (USDT)” and the number of simple token transfers on Ethereum are increasing, with around 3,000 ETH being burned each.

Relation:Ethereum to Launch Public Testnet with Staking Withdrawal Feature

Shanghai update planned

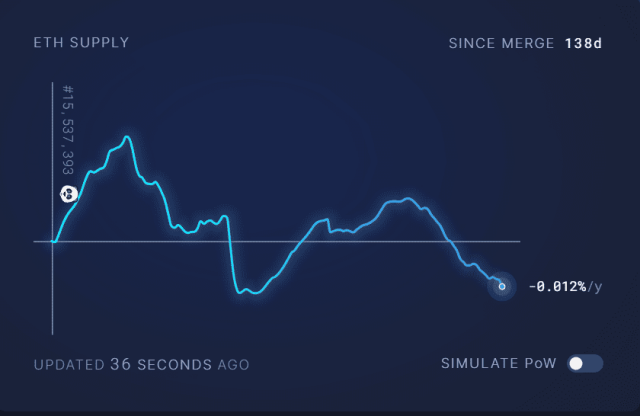

Ethereum has transitioned to Proof of Stake (PoS) after implementing a major upgrade “The Merge” in September 2022. The mining reward (13,000 ETH/day) that was generated before has become 0 (zero), and the amount of new ETH issued per day is only the staking reward (1,789 ETH at the time of writing).

Source: Ultrasound.Money

The inflation rate, which can be calculated by dividing the annualized number of new issuance by the existing issuance (120,515,722 ETH), has changed from about 3.5% before the merge to -0.012% (at the time of writing).

Many Ethereum supporters, including Dan Morehead, CEO of crypto fund giant Pantera Capital, are eyeing the potential for ETH to transition into a deflationary asset.

Relation:“Potential shift to deflationary assets” after Ethereum merge, US fund Pantera points out

For reference, Bitcoin, which halves every four years and is often described as an inflation hedge, has an annual inflation rate of 1.72%.

In addition, Ethereum plans to implement the first upgrade after the merge, “Shanghai”, in March-April 2023. At the time of writing, 16.2 million ETH (equivalent to approximately 3.18 trillion yen) locked up in the staking contract and staking rewards will be available for withdrawal for the first time.

It has also been pointed out that while Shanghai will drive new ETH staking growth in the long term, it will also cause some short-term selling pressure.

According to Ethereum’s largest liquid staking company Lido, it is estimated that at least 200,000 ETH will be withdrawn in the first week after the hard fork.

Relation:Lido ETH withdrawal method to be voted for Shanghai

The post Ethereum cryptocurrency sees net drop in supply in January appeared first on Our Bitcoin News.

2 years ago

116

2 years ago

116

English (US) ·

English (US) ·