The post Ethereum (ETH) Set to Hit $3,000, Insights from On-Chain Data appeared first on Coinpedia Fintech News

Ethereum (ETH), the world’s second-biggest cryptocurrency by market cap appears to be super bullish and could hit the $3,000 level soon. Despite the majority of top cryptocurrencies, including Bitcoin (BTC), Solana (SOL), and many others struggling to gain momentum, ETH has gained more than 4% of its value.

Ethereum Price Momentum

At press time, ETH is trading near the $2,680 level and has experienced a price surge of over 4.25% in the past 24 hours. During the same period, its trading volume has skyrocketed by 65%, indicating higher participation from traders, potentially due to the ongoing price momentum.

Ethereum Technical Analysis and Upcoming Levels

According to expert technical analysis, ETH appears bullish and is now heading toward the $3,000 resistance level. After breaking the descending trendline, the sentiment has completely changed, and ETH has surged more than 15%.

Source: Trading View

Source: Trading ViewHowever, in the past two days, ETH was in a consolidation phase between the $2,530 and $2,600 levels. On September 23, 2024, it broke out of that zone and has been experiencing an upside rally.

Based on the historical price momentum, there is a strong possibility that the ETH price could reach the $2,900 level and even higher if the sentiment remains positive. As of now, it is trading below the 200 Exponential Moving Average (EMA) on a daily time frame, indicating a downtrend.

ETH’s Bullish On-chain Metrics

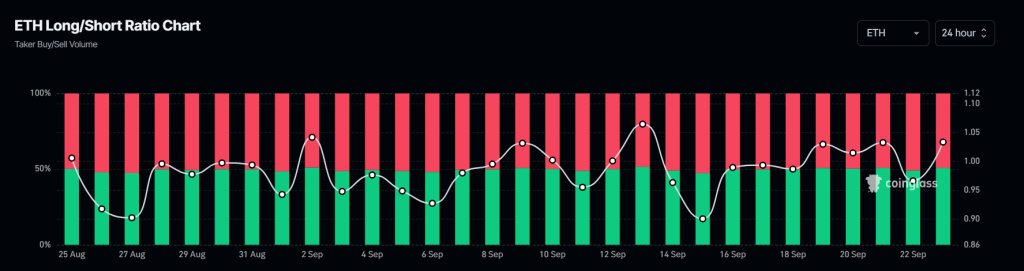

This bullish outlook is further supported by on-chain metrics that indicate market sentiment. According to the on-chain analytic firm Coinglass, ETH’s Long/short ratio currently stands at 1.033, indicating bullish market sentiment.

Source: Coinglass

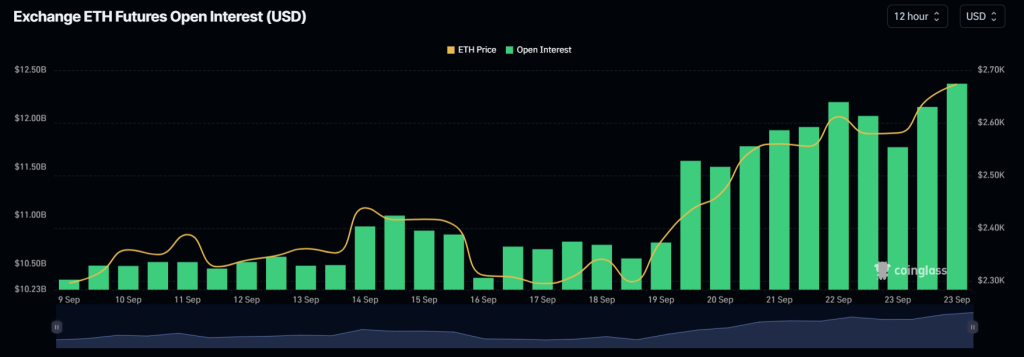

Source: CoinglassAdditionally, its future open interest has increased by 4.8% in the past 24 hours and has been steadily rising since September 9, 2024.

Source: Coinglass

Source: CoinglassThis rising future open interest suggests that bulls are building more long positions. Currently, 50.82% of top traders hold long positions, while 49.18% hold short positions.

11 months ago

62

11 months ago

62

English (US) ·

English (US) ·